- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (APP): Assessing Valuation After Strong Q3 Results and Upbeat Guidance

Reviewed by Simply Wall St

AppLovin (APP) turned heads with its third-quarter earnings report, as revenue and net income jumped sharply compared to last year. The company also set an upbeat revenue target for the next quarter, drawing fresh attention from investors.

See our latest analysis for AppLovin.

AppLovin has been catching more eyes on Wall Street lately, not just because of standout quarterly results and its ongoing share repurchase program but also thanks to remarkable stock momentum. After a sharp rally in recent months, the company boasts a one-year total shareholder return of 152.04% and has delivered a staggering 3,716.71% over three years, far outpacing most peers. With an 81.80% year-to-date share price return, it is clear that sentiment has shifted decisively toward growth potential and renewed confidence as management executes on expansion and profitability goals.

If AppLovin’s surge has you wondering what else is out there, it’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

Yet with shares soaring so quickly and a bullish outlook already baked in, the real question is whether AppLovin remains undervalued after its impressive run, or if the market has already priced in its future growth potential.

Most Popular Narrative: 4.4% Undervalued

AppLovin's latest fair value estimate in the most popular narrative comes in higher than the last closing price, suggesting an attractive setup as the stock shows strong momentum.

Expanded rollout of the self-service AXON ads manager and Shopify integration is expected to open AppLovin's platform to a massive new base of small and mid-sized advertisers globally. This could dramatically increase advertiser count and drive sustained uplift in topline revenue.

Want to see what’s fueling that high price tag? The blueprint focuses on a sharp acceleration in profits, improved margins, and significant gains in global reach. Explore the full prediction to discover which bold financial moves and wildcards support the case for the current valuation.

Result: Fair Value of $649.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory hurdles or faltering growth beyond gaming could quickly challenge the optimistic outlook and adjust market expectations for AppLovin's next phase.

Find out about the key risks to this AppLovin narrative.

Another View: Market Valuation Looks Expensive

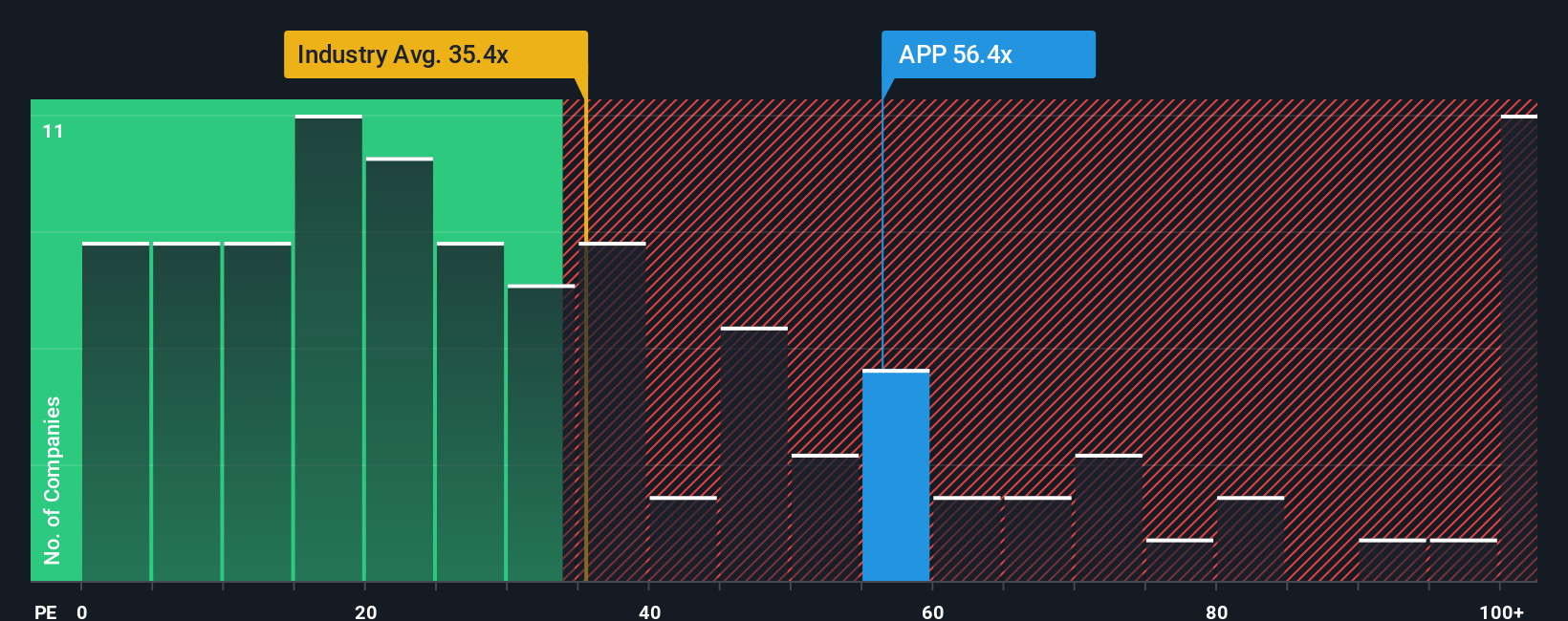

While the fair value narrative points to AppLovin being undervalued, the company’s current price-to-earnings ratio paints a different picture. At 72.2x earnings, AppLovin trades far above the US Software average of 33.5x, its peers at 46.1x, and even the fair ratio of 58.7x. This premium suggests investors are paying up for rapid growth, but it also raises the stakes if the company fails to deliver. Does this gap signal risk or opportunity on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

Your viewpoint might differ, and if you like digging into the numbers yourself, you can easily create your own take in just a few minutes. Do it your way

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your search to just one big winner. Right now, some of the most exciting opportunities are only a click away, waiting for savvy investors like you.

- Boost your yield potential by targeting steady earners with these 17 dividend stocks with yields > 3%, offering reliable dividends above 3%.

- Ride the artificial intelligence wave by tapping into breakthroughs with these 25 AI penny stocks, reshaping everything from finance to healthcare.

- Capitalize on deep value opportunities revealed by these 859 undervalued stocks based on cash flows and stay a step ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives