- United States

- /

- Software

- /

- NasdaqCM:AEYE

AudioEye (AEYE) Trades Below Fair Value, Revenue Outlook Tops Market Narratives

Reviewed by Simply Wall St

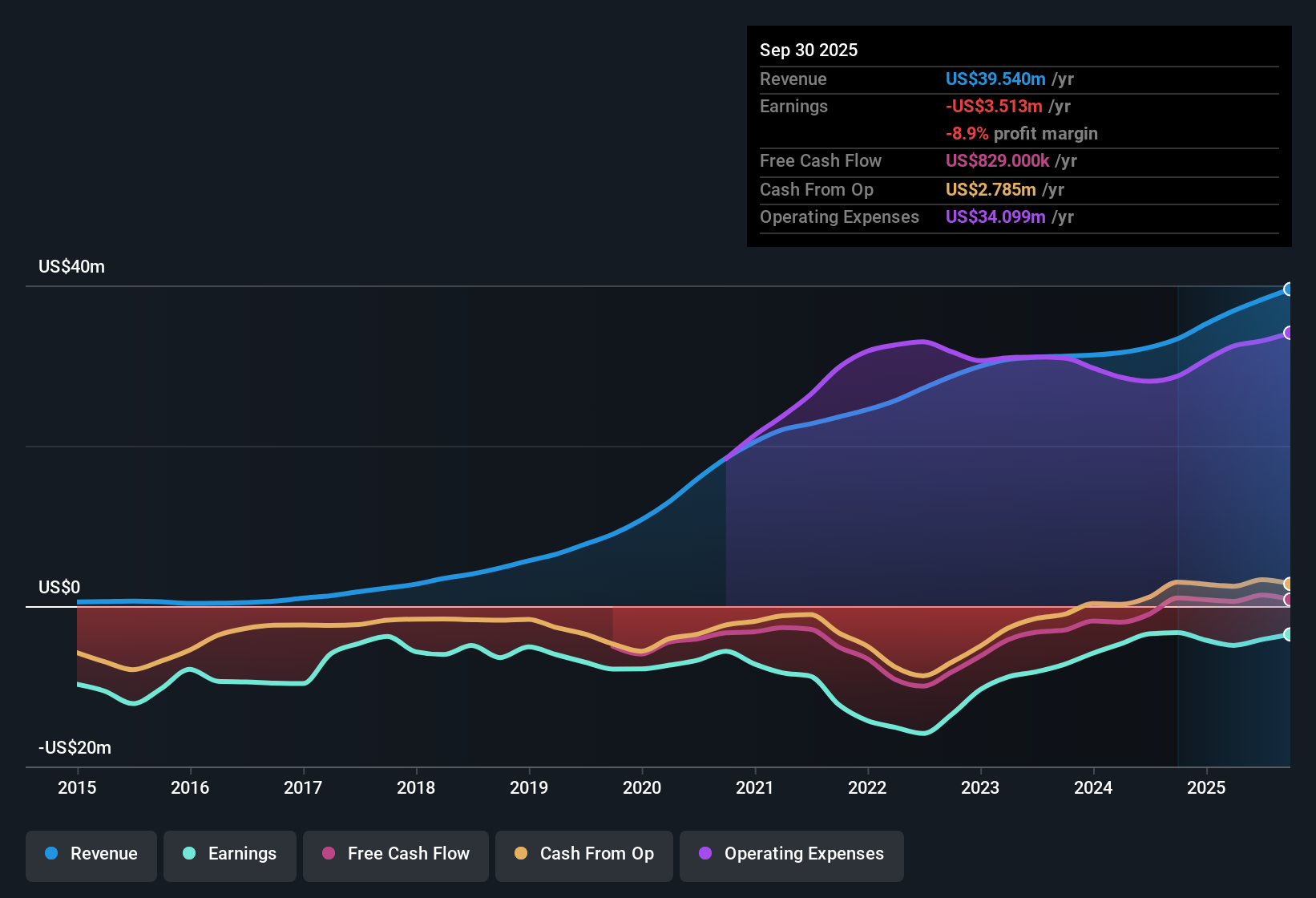

AudioEye (AEYE) remains unprofitable but has steadily narrowed its losses over the last five years at an annual rate of 18.4%. Revenue is now forecast to grow 11.5% per year, topping the US market average of 10.5%, even as net profit margins are yet to turn positive. Investors weighing the numbers will note that the company is valued at a 4.7x Price-to-Sales ratio and currently trades at $14.43, below the estimated fair value of $16.72. This keeps the spotlight on its growth prospects and valuation discount.

See our full analysis for AudioEye.Next up, we will look at how these results hold up when compared to the prevailing market narratives and what that could mean for AudioEye’s outlook.

See what the community is saying about AudioEye

Regulation Drives Revenue Forecasts

- With annual revenue growth projected at 11.5%, AudioEye is set to outpace the US market average as regulatory catalysts build momentum in both the EU and US.

- Analysts' consensus view anticipates that the enforcement of the European Accessibility Act and upcoming DOJ rules in the US will spark a multi-year surge in demand, increasing both revenue and margin durability for AudioEye and supporting more predictable, high-quality earnings.

- The company reports that its EU sales pipeline tripled quarter-over-quarter, signaling an acceleration in enterprise adoption as regulatory deadlines approach.

- This narrative also highlights the strategy of phasing out lower-margin consulting and audit services. Consolidating customers onto the automated platform is expected to boost adjusted EPS and free cash flow as integration completes by 2026.

- To see how these regulatory shifts and platform transitions shape market sentiment and sector positioning, read the full consensus narrative for AudioEye below. 📊 Read the full AudioEye Consensus Narrative.

Profitability Still Out of Reach

- Despite steady loss reduction with an 18.4% annual decline over five years, analysts do not expect AudioEye to become profitable within the next three years, keeping net profit margins in negative territory.

- Consensus narrative points out that heavy reliance on regulatory changes and successful platform upgrades pose risks to margin expansion and earnings visibility.

- The forecast improvement in profit margin from -10.9% to the US software industry average of 13.1% by 2028 is ambitious, especially with ongoing customer churn during legacy service phaseouts.

- Analysts underline that if governments delay, weaken, or inconsistently enforce new regulations, AudioEye may see customer adoption slow and revenue growth lag expectations, increasing near-term risk.

Peer Discount and Price Target Gap

- At a 4.7x Price-to-Sales ratio, AudioEye trades at a discount to both the US software industry average (5.1x) and its peers (5.0x), and currently sits below the DCF fair value of $16.72 and the consensus analyst target of $22.20, a 53.9% upside.

- Analysts' consensus view contends that for AudioEye to justify the $22.20 price target, investors must believe in the company's ability to achieve $55.6 million in revenue, $7.3 million in earnings, and a PE ratio of 50.9x by 2028.

- This valuation gap underscores the importance of regulatory tailwinds and successful technology scaling, while also flagging that dilution could increase as shares outstanding are expected to grow by 1.88% per year over the next three years.

- The share price of $14.43 gives value-focused investors room for upside, but only if ambitious margin and revenue forecasts are met fully and on schedule.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AudioEye on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the figures your way? Share your perspective and shape an original narrative. It takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AudioEye.

See What Else Is Out There

AudioEye's ambitious margin targets, ongoing losses, and uncertainty around regulation mean that stable, predictable growth remains elusive for now.

If you want more consistency, focus on companies with reliable performance using stable growth stocks screener (2074 results) that have steadily grown revenue and earnings regardless of industry shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AEYE

AudioEye

Provides Internet content publication and distribution software and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States and Europe.

Excellent balance sheet and good value.

Market Insights

Community Narratives