- United States

- /

- Software

- /

- NasdaqGS:TEAM

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but it is up 31% over the past year with earnings expected to grow by 15% per annum over the next few years. In this context of robust growth expectations, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential to capitalize on favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Adobe (NasdaqGS:ADBE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adobe Inc., along with its subsidiaries, is a global diversified software company with a market capitalization of $226.12 billion.

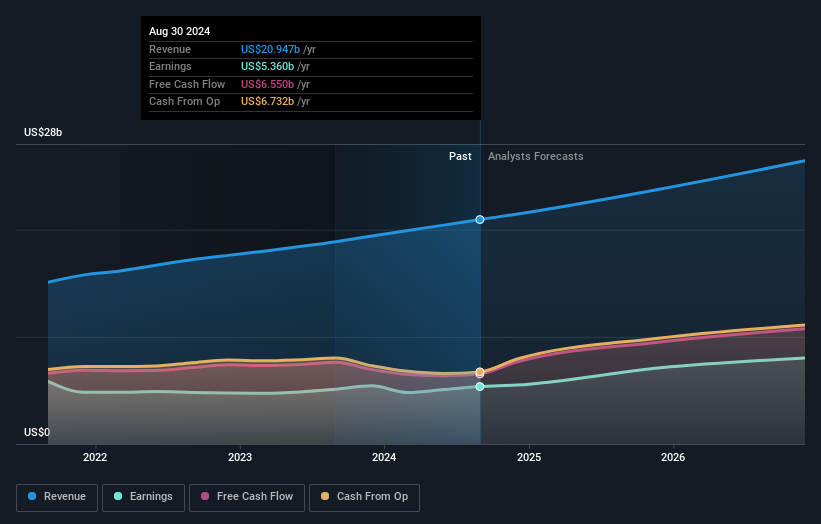

Operations: Adobe generates revenue primarily from its Digital Media segment, which accounts for $15.44 billion, and the Digital Experience segment, contributing $5.24 billion. The Publishing and Advertising segment adds an additional $276 million to its revenue streams.

Adobe's strategic emphasis on enhancing its software ecosystem through R&D is evident with a significant allocation of resources, underscoring its commitment to innovation. In the fiscal year 2024, Adobe dedicated 16.3% of its revenue to R&D expenses, reflecting a robust strategy to stay ahead in the competitive tech landscape. This investment has facilitated developments like Frame.io and Adobe GenStudio for Performance Marketing, which are pivotal in streamlining video production and marketing workflows respectively. These innovations not only enhance Adobe's product offerings but also solidify its position by responding effectively to the evolving demands of digital content creation and distribution.

- Click to explore a detailed breakdown of our findings in Adobe's health report.

Review our historical performance report to gain insights into Adobe's's past performance.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

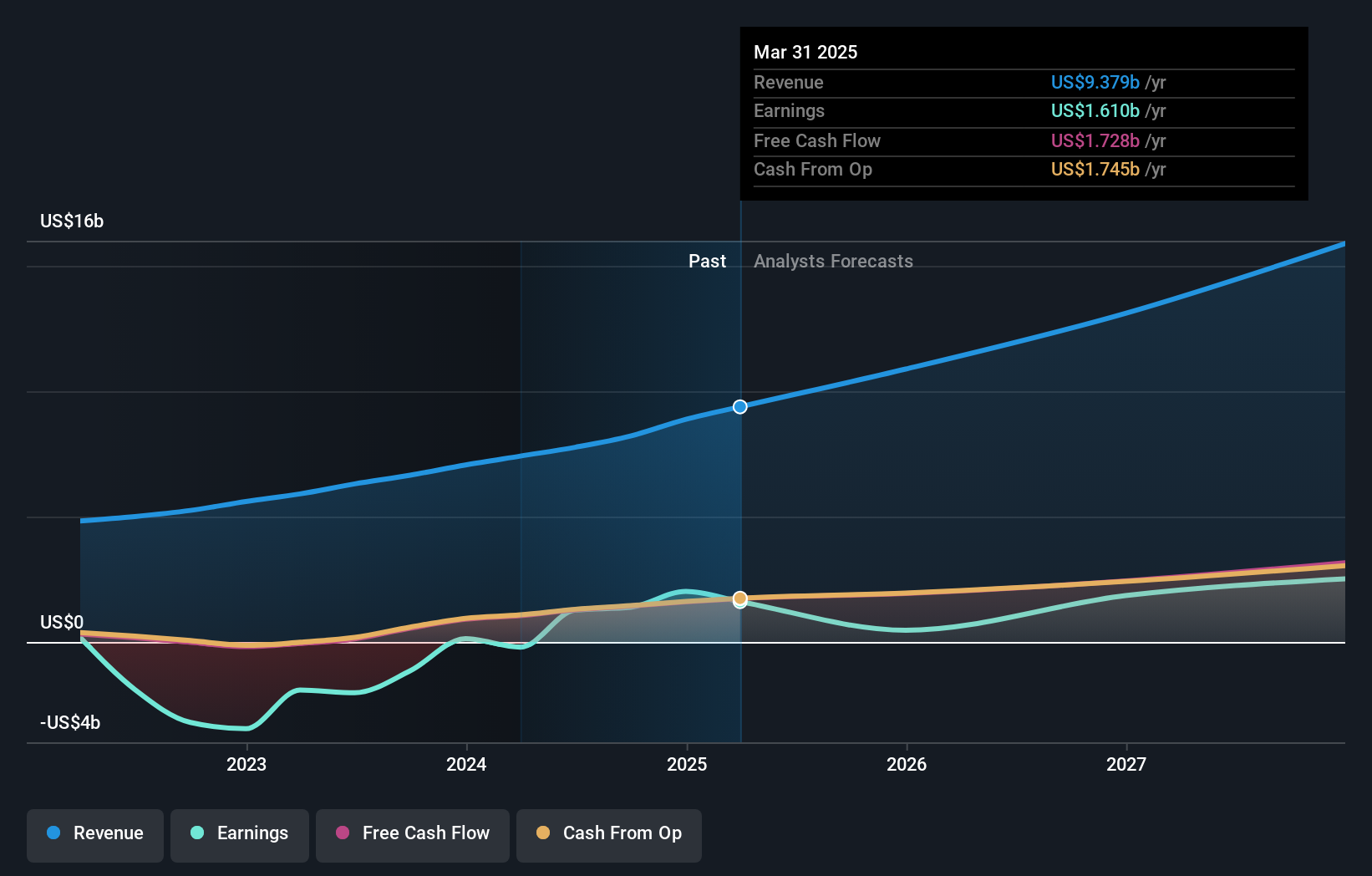

Overview: Atlassian Corporation is a global company that designs, develops, licenses, and maintains a range of software products with a market capitalization of approximately $68.35 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $4.57 billion.

Atlassian's strategic positioning in the tech sector is underscored by its robust R&D investments, which are pivotal for fostering innovation and maintaining competitiveness. In 2024, the company allocated a significant 15.2% of its revenue to R&D activities, emphasizing its commitment to developing cutting-edge solutions. Despite a challenging quarter with a net loss widening to $123.77 million from $31.88 million year-over-year, Atlassian continues to invest in growth avenues like cloud migrations and software development enhancements. The recent appointment of Brian Duffy as Chief Revenue Officer heralds a strategic push towards revenue acceleration through expert leadership in sales transformation, setting the stage for potential profitability and sustained growth in an increasingly cloud-centric market.

Shopify (NYSE:SHOP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shopify Inc. is a commerce company that offers a comprehensive commerce platform and services across multiple regions globally, with a market cap of $145.41 billion.

Operations: Shopify generates revenue primarily from its Internet Software & Services segment, amounting to $8.21 billion. The company operates across various regions including North America, Europe, the Middle East, Africa, Asia Pacific, Australia, China, and Latin America.

Shopify's strategic maneuvers in the tech landscape are evident through its robust R&D spending and recent client integrations, positioning it well within the high-growth tech sector. In 2024, Shopify dedicated 18.3% of its revenue to R&D, underscoring its commitment to innovation—critical for staying competitive in rapidly evolving markets. This investment coincides with a significant earnings report showing a net income surge to $828 million from $718 million year-over-year and an expected revenue growth rate in the mid-to-high twenties percentage range for Q4 2024. The company's recent integration with StackAdapt enhances its ecommerce capabilities, allowing merchants to optimize their marketing strategies effectively. These strategic decisions not only reflect Shopify's agile response to market demands but also bolster its position for sustained future growth amidst shifting digital commerce trends.

- Unlock comprehensive insights into our analysis of Shopify stock in this health report.

Assess Shopify's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Navigate through the entire inventory of 248 US High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.