- United States

- /

- Semiconductors

- /

- NYSE:TSM

Assessing TSMC (NYSE:TSM) Valuation as Shares Continue Steady Upward Momentum

Reviewed by Simply Wall St

Taiwan Semiconductor Manufacturing (NYSE:TSM) has caught plenty of investor attention lately, not because of a game-changing AI deal or product release, but simply because its stock continues to march higher. Moves like this naturally make shareholders and would-be buyers wonder if something is quietly brewing under the surface or if the company’s long-term growth story is just that compelling. Either way, this kind of upward momentum is tough to ignore, and it brings big questions for anyone considering what to do with TSM shares now.

So what’s driving this? In the past month alone, Taiwan Semiconductor Manufacturing has notched a gain of just over 2%, and the picture gets even brighter if you step back a bit: the stock is up 16% over the past 3 months and more than 53% over the past year. These moves haven’t come on the back of flashy news, but rather seem tied to steady revenue and net income growth, and a strong three- and five-year track record that would be the envy of many established tech giants. It is the kind of climb that hints at building momentum in investor sentiment, even as no single headline is doing the heavy lifting.

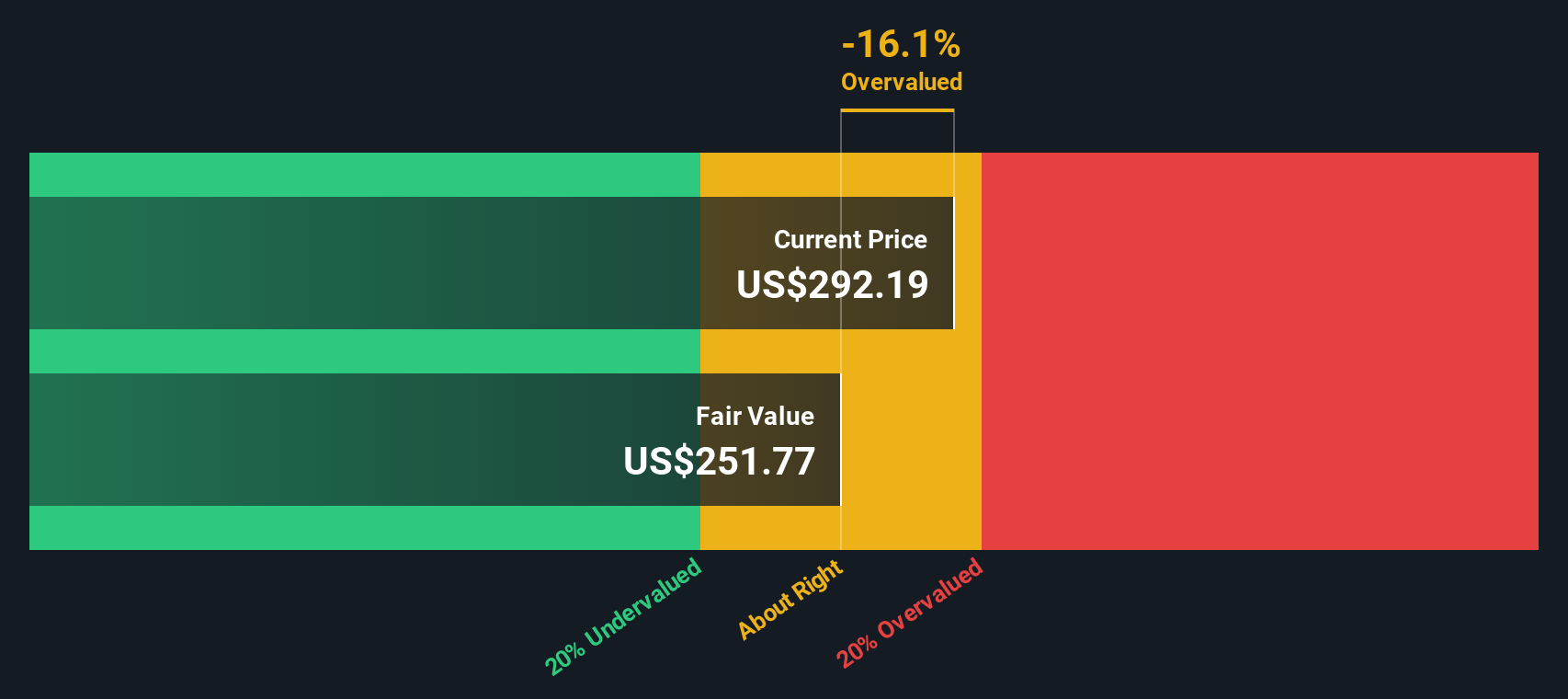

Given all this, the big question is whether Taiwan Semiconductor Manufacturing is now trading at a premium with all that growth already priced in, or if there is still room for investors to capture more upside from here.

Most Popular Narrative: 108.8% Overvalued

According to the most widely followed narrative, Taiwan Semiconductor Manufacturing may be significantly overvalued right now, as some believe future growth projections may already be reflected in the current share price.

The industry continues to grow, with an expected annual rate of 12.2% between 2023 and 2029, providing a favorable trend for companies operating in the sector. AI is engaged in a positive feedback loop with the chip industry. For a start, there is no AI without chips. However, AI enables chip design to become more efficient and intelligent. Machine learning algorithms analyze vast datasets to generate optimized chip architectures.

Wondering what makes this valuation so aggressive? The narrative relies on significant assumptions about future growth, margins, and where profits will land. Are these bold forecasts truly within reach, or are expectations set too high? Explore further to see what drives these notable calculations and why attention is focused on upcoming financial milestones.

Result: Fair Value of $118.4 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant geopolitical tensions or disruptions in advanced chip hardware supply could quickly alter TSMC’s growth outlook and challenge the current valuation narrative.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.Another View: A Different Take from the SWS DCF Model

While one approach says Taiwan Semiconductor Manufacturing looks richly priced, our DCF model offers a different perspective. This method suggests the shares might actually be undervalued relative to their calculated fair value. Is the market missing something, or are the assumptions in the models simply too far apart?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Taiwan Semiconductor Manufacturing to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you have a different perspective or like to dig into the numbers on your own, it’s easy to build your own take in just a few minutes. Do it your way

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You owe it to yourself to go beyond the usual stocks and uncover unique opportunities that could give your portfolio a serious edge. Don’t let these potential winners pass you by. Tap into handpicked ideas built around real strengths and future trends now.

- Find under-the-radar growth by targeting promising up-and-comers with strong balance sheets through our penny stocks with strong financials.

- Supercharge your search for tomorrow’s tech stars focused on artificial intelligence advancements by tapping into our AI penny stocks.

- Boost your passive income strategy by identifying quality companies offering reliable and attractive yields using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026