- United States

- /

- Semiconductors

- /

- NYSE:TSM

A Closer Look at TSMC (NYSE:TSM) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Taiwan Semiconductor Manufacturing.

Zooming out, Taiwan Semiconductor Manufacturing has not only gained ground recently, but has also delivered a powerful 42% year-to-date share price return and a stellar 44% total shareholder return over the past year. This reflects continued confidence in its growth outlook, even as short-term volatility appears. Momentum is clearly building for the stock amid sustained global demand for advanced chips.

If the strength in TSM’s rally has you watching the broader sector, it could be the perfect time to discover other high-growth tech and AI stocks with our See the full list for free..

With Taiwan Semiconductor shares on the rise and long-term gains hard to ignore, investors are now weighing if the stock is still undervalued or if the remarkable run means future growth is fully priced in.

Most Popular Narrative: 7.6% Undervalued

According to oscargarcia, the fair value for Taiwan Semiconductor Manufacturing sits notably above the last close price, reflecting optimism about sustained growth and profitability. The stage is set for further gains; however, the narrative suggests that much of the future promise may already be built into the stock.

The market likely has already baked in a large part of this AI narrative. Execution risks (in new investments, margin dilution, regulatory or geopolitical exposures) are real. The sustainability of premium multiples depends on sustained growth and margin discipline over multiple quarters.

Want to know what justifies this bullish view? The narrative teases a formula of rapid earnings expansion, high margins, and confidence in TSMC’s leadership. Wonder which bold financial assumptions drive the valuation? The full breakdown reveals exactly how these projections shape the fair value.

Result: Fair Value of $310 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential catalysts such as rising geopolitical tensions and margin pressure from costly overseas expansions could quickly test the strength of this bullish narrative.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another View: Stepping Back from the Numbers

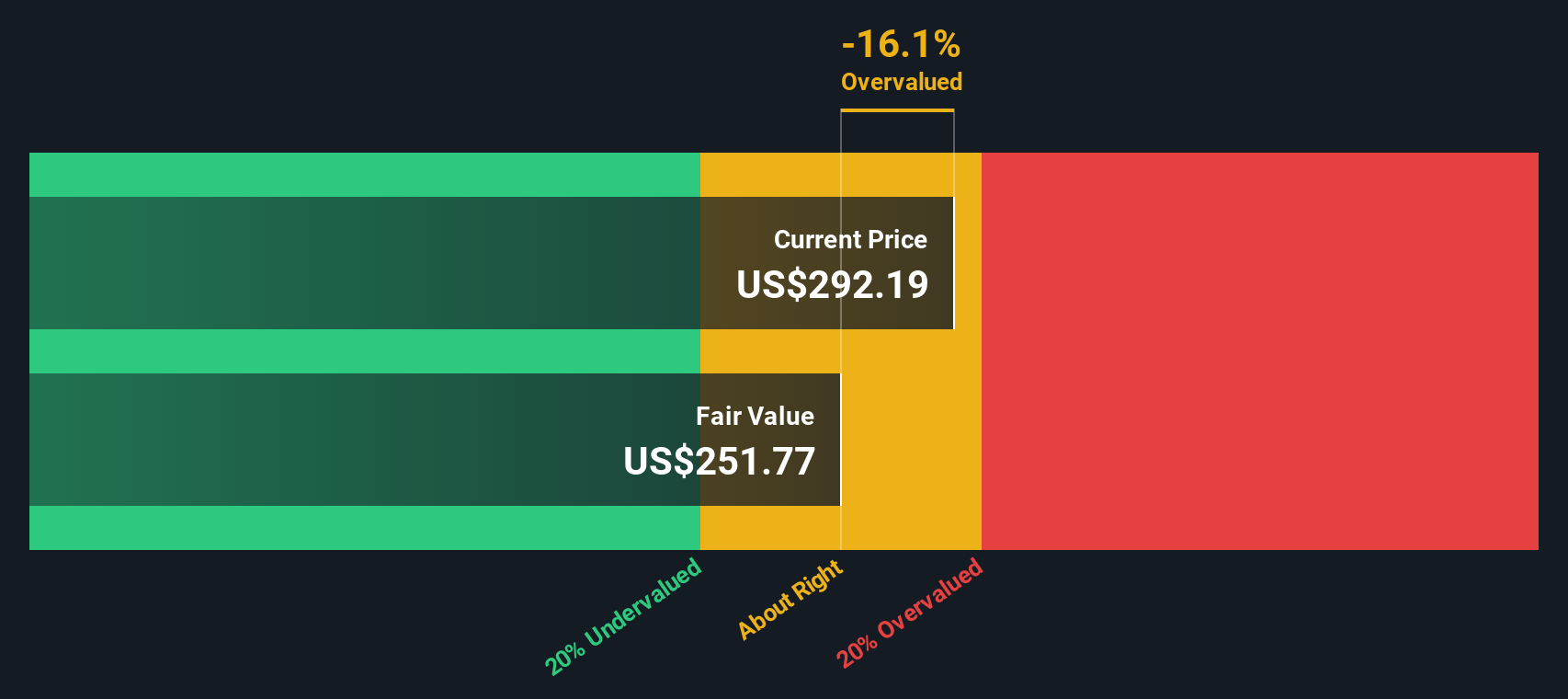

While many see upside in Taiwan Semiconductor Manufacturing’s current price compared to analyst targets, the SWS DCF model takes a more conservative stance and estimates fair value below the present share price. This approach suggests the stock may actually be overvalued in fundamental terms and raises a critical question for investors: is the growth story already fully reflected, or is there still more room to run?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiwan Semiconductor Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

Prefer to challenge the mainstream outlook or dig even deeper? You can personally test the data and craft your own story in just a few minutes with our Do it your way.

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to catch tomorrow’s winners and avoid missing valuable opportunities, streamline your research by tapping into unique stock themes curated for different investor goals.

- Start building passive income with these 16 dividend stocks with yields > 3% offering yields above 3% and strong track records.

- Seize breakthroughs in artificial intelligence by reviewing these 25 AI penny stocks positioned at the forefront of the next digital wave.

- Spot potential bargains by targeting value with these 876 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives