- United States

- /

- Semiconductors

- /

- NYSE:ONTO

Onto Innovation (ONTO): Evaluating Valuation After Strong Q3 Results and Upbeat AI Packaging Outlook

Reviewed by Simply Wall St

Onto Innovation (ONTO) has caught investor attention after beating third-quarter revenue and EPS guidance, due in large part to its expanding reach in AI-powered advanced packaging and an encouraging outlook for future sales growth.

See our latest analysis for Onto Innovation.

After a bumpy start to the year, Onto Innovation’s 1-day share price return of 2.7% and 7% over the last week signal momentum is returning. A sharp 43% jump in the past 90 days stands out. Despite its 1-year total shareholder return of -14.8%, strong long-term performance, with a 93% total return over three years and more than 200% over five, shows the story is far from over and the market is beginning to factor in renewed growth prospects.

If you’re looking for other ways to spot companies with fast-improving outlooks, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying, but the price still below most analyst targets, the key question now is whether Onto Innovation is trading at a relative discount or if the market has already priced in its turnaround and future growth potential.

Most Popular Narrative: 6.4% Undervalued

Onto Innovation’s most popular narrative suggests a fair value higher than the latest close, supported by strengthened profit outlooks and upwardly revised key drivers. Investors are tuning in as these new catalysts catch the market’s attention.

The accelerating adoption of AI packaging and advanced 2.5D/3D logic architectures is driving a major step up in demand for Onto Innovation's next-generation Dragonfly systems. Strong customer pull and new applications are expanding both revenue and potential gross margin through higher ASPs and increased market share within leading-edge chip production.

Wondering what drives this upbeat price target? The narrative hinges on bold expectations around future earnings growth, fatter profit margins, and a forward multiple usually reserved for industry leaders. Want to know what ambitious financial leaps underline this valuation? Dive into the full story to see what shapes the consensus view.

Result: Fair Value of $157 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain uncertainties and integration challenges from recent acquisitions could quickly shift the outlook if these issues are not managed successfully.

Find out about the key risks to this Onto Innovation narrative.

Another View: Multiples Suggest a Richer Valuation

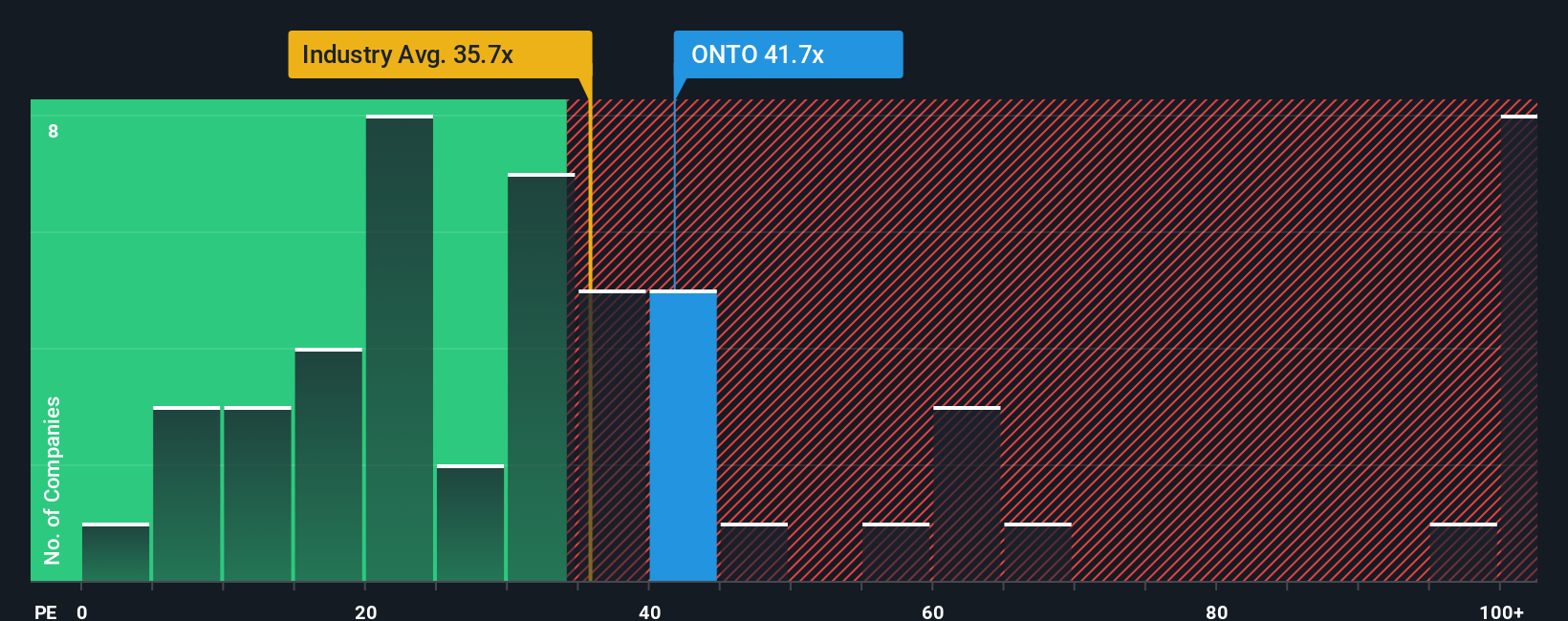

Looking at Onto Innovation through the lens of its price-to-earnings ratio, the picture shifts. The company trades at 41.7 times earnings, which is pricier than the US Semiconductor industry average of 36.1 but cheaper than direct peers at 52.2. The fair ratio sits close at 42.8, indicating the market could still move higher or lower. Are investors paying up for proven growth or overlooking potential valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Onto Innovation Narrative

If you’re curious to see how the numbers stack up for yourself or want to test your own thesis, it only takes a few minutes to create a personalized take. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Onto Innovation.

Looking for More Investing Opportunities?

Why stop at one winner? Explore more hand-picked stocks with breakthrough potential, keeping you a step ahead in today’s fast-changing markets.

- Get direct access to exceptional returns by targeting undervalued companies through these 922 undervalued stocks based on cash flows that may be trading below their true worth.

- Unlock high-yield possibilities and steady income by steering toward these 14 dividend stocks with yields > 3% with attractive yields above 3%.

- Catch the next AI boom early and spot innovative companies shaping tomorrow’s technology with these 25 AI penny stocks before the rest of the market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026