- United States

- /

- Semiconductors

- /

- NYSE:DQ

How Investors May Respond To Daqo New Energy (DQ) Navigating a Downturn With Strong Cash and No Debt

Reviewed by Sasha Jovanovic

- In recent days, Daqo New Energy reported the ability to maintain operations with US$2.06 billion in cash reserves and no debt, even as polysilicon prices remain below cash cost and the industry faces a downturn.

- This financial resilience, combined with advances in N-type polysilicon technology and majority ownership of Xinjiang Daqo New Energy, supports the company's capacity to endure market pressure and potentially benefit from industry consolidation.

- With this in mind, we'll examine how Daqo New Energy's strong balance sheet could impact its investment narrative and future prospects.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Daqo New Energy Investment Narrative Recap

To consider Daqo New Energy as a potential investment, investors need to have confidence in a cyclical recovery of the solar industry and the company’s ability to withstand current headwinds. The latest report of US$2.06 billion in cash reserves and no debt is reassuring, yet it does not fundamentally alter the main short-term catalyst: regulatory efforts in China to stabilize polysilicon prices. The biggest risk remains prolonged industry overcapacity with continued losses, which this news only partially offsets.

Among recent announcements, Daqo’s authorization of up to US$100 million in share repurchases is most relevant for this discussion. This program, primarily funded from the company’s substantial cash position, highlights management’s response to the ongoing downturn and aligns with the catalyst of improved industry profitability, should regulatory action prove effective. Investors watching for signs of market stabilization will see this as a move with direct implications for shareholder value.

However, it’s critical to remember that if industry overcapacity persists and losses continue…

Read the full narrative on Daqo New Energy (it's free!)

Daqo New Energy's outlook anticipates $2.4 billion in revenue and $226.9 million in earnings by 2028. This is based on a 58.5% annual revenue growth rate and a $616.1 million increase in earnings from the current level of -$389.2 million.

Uncover how Daqo New Energy's forecasts yield a $26.58 fair value, in line with its current price.

Exploring Other Perspectives

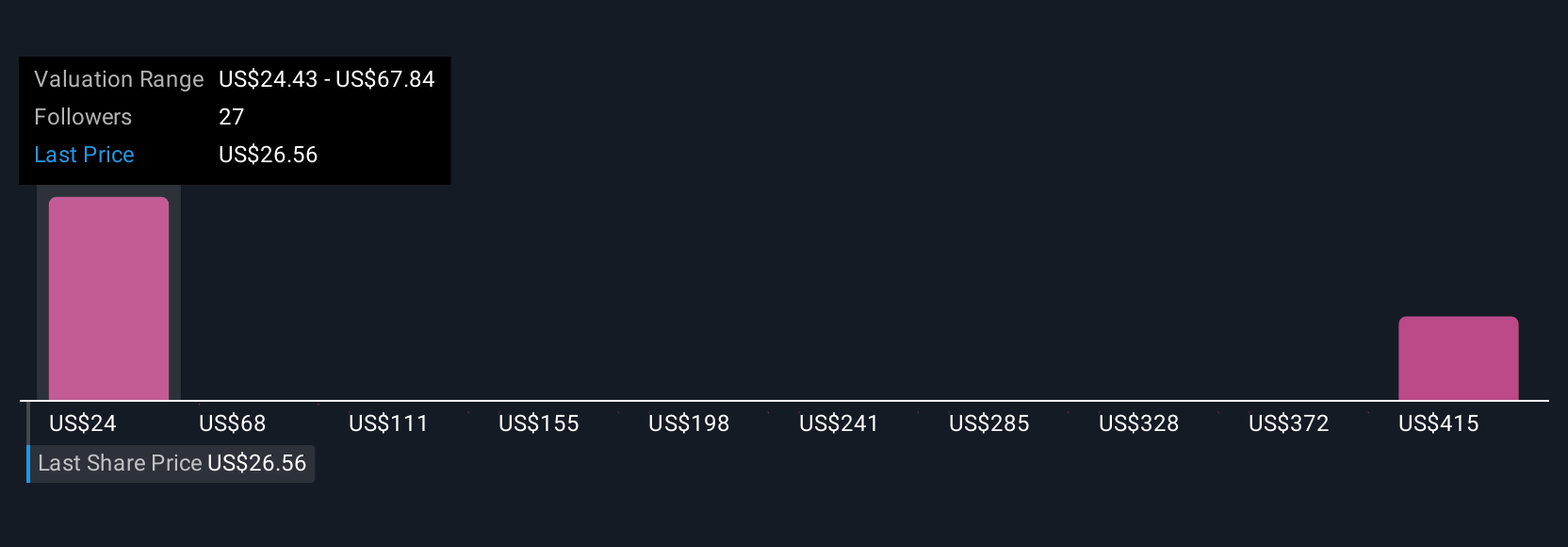

Fair value opinions from four members of the Simply Wall St Community range widely, from US$26.58 to US$466.80 per share. Many participants are factoring in regulatory pressure as a key turning point for Daqo’s recovery, so it’s essential to weigh different insights before making a judgment.

Explore 4 other fair value estimates on Daqo New Energy - why the stock might be a potential multi-bagger!

Build Your Own Daqo New Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daqo New Energy research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Daqo New Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daqo New Energy's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DQ

Daqo New Energy

Manufactures and sells polysilicon to photovoltaic product manufacturers in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives