- United States

- /

- Semiconductors

- /

- NasdaqGS:UCTT

Ultra Clean Holdings (UCTT): Assessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Event driven move in Ultra Clean Holdings stock

Ultra Clean Holdings (UCTT) has been quietly grinding higher over the past week, even as its year to date performance stays in the red. That gap is exactly what makes the stock interesting now.

See our latest analysis for Ultra Clean Holdings.

That recent uptick caps a solid 90 day share price return of 7.1 percent, but with the year to date share price return still down sharply and one year total shareholder return off more than 30 percent, this looks more like early rebuilding of momentum rather than a full trend change.

If Ultra Clean’s move has you thinking about where else capital equipment demand could surprise, it might be worth scanning high growth tech and AI stocks for other potential beneficiaries.

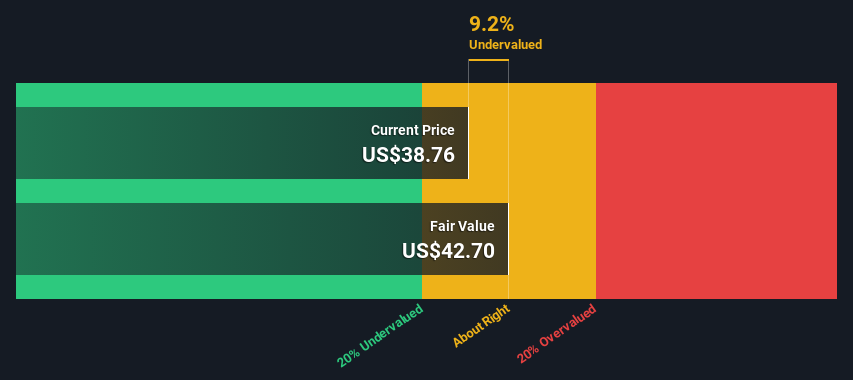

With revenue still growing but profits under pressure and the share price well below analyst targets, the real question now is whether Ultra Clean is quietly undervalued or if the market is already discounting any future recovery.

Most Popular Narrative: 25% Undervalued

With Ultra Clean Holdings closing at $26.24 against a narrative fair value of $35, the story leans heavily on a sharp earnings recovery and higher future multiples.

Analysts assume that profit margins will increase from -7.1% today to 2.4% in 3 years time.

Analysts expect earnings to reach $64.6 million (and earnings per share of $1.4) by about September 2028, up from $-153.0 million today.

Curious what justifies that big swing from deep losses to meaningful profits, and a richer earnings multiple than many chip makers, all under a double digit discount rate pathway?

Result: Fair Value of $35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged wafer fab equipment weakness, or a setback with a major customer, could quickly undermine the assumed earnings recovery and higher valuation multiple.

Find out about the key risks to this Ultra Clean Holdings narrative.

Another View: Cash Flows Point the Other Way

While the narrative fair value and analyst targets argue Ultra Clean is about 25 percent undervalued, our DCF model presents a cooler picture, with fair value closer to $18.17 and the stock trading above that. Is the market overpaying for a rebound that may take longer to arrive?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ultra Clean Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ultra Clean Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Ultra Clean Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in an edge by scanning fresh stock ideas on Simply Wall St’s screener so promising opportunities never slip past you again.

- Capture mispriced opportunities early by reviewing these 902 undervalued stocks based on cash flows that pair strong fundamentals with attractive entry points.

- Target cutting edge growth potential through these 26 AI penny stocks shaping the next wave of intelligent automation and data driven services.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that offer resilient payouts and room for long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UCTT

Ultra Clean Holdings

Develops and supplies critical subsystems, components and parts, and ultra-high purity cleaning and analytical services for the semiconductor industry in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026