- United States

- /

- Semiconductors

- /

- NasdaqGS:TSEM

Tower Semiconductor (NasdaqGS:TSEM): Assessing Valuation After $300m RF and Silicon Photonics Expansion Plan

Reviewed by Simply Wall St

Tower Semiconductor (NasdaqGS:TSEM) is back on traders’ radar after Q3 revenue ticked higher sequentially, and management doubled down with a fresh $300 million push into RF infrastructure and silicon photonics capacity.

See our latest analysis for Tower Semiconductor.

The latest capacity push comes on top of a powerful rerating, with a 30 day share price return of 32.17 percent and an 82.04 percent 90 day share price return feeding into a 130.97 percent 1 year total shareholder return. This suggests that momentum is clearly building rather than fading.

If Tower’s surge has you rethinking your semiconductor exposure, this could be a good moment to explore other high growth tech and AI stocks that might be catching similar tailwinds.

With the shares now near analyst targets after a triple digit one year return, the question is whether Tower’s accelerating growth and fresh capacity spend still leave upside on the table, or whether markets are already fully pricing it in.

Most Popular Narrative Narrative: 7.2% Undervalued

With Tower shares last closing at $115.07 against a most popular narrative fair value of $124, the storyline leans toward more upside if execution holds.

The rapid ramp up in silicon photonics shipments including expansion from transmit only to both transmit and receive functions, higher bandwidth modules (up to 1.6T with 3.2T on the roadmap), and adoption by Tier 1 customers positions Tower to further penetrate the growing optical transceiver market, supporting future revenue acceleration and increased average selling prices.

Curious how aggressive revenue growth, fatter margins, and a richer earnings multiple all combine into that fair value figure? The full narrative reveals the playbook.

Result: Fair Value of $124 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story could unravel if Tower’s heavy CapEx fails to fill capacity, or if key SiPho and SiGe customers pivot to rival foundries.

Find out about the key risks to this Tower Semiconductor narrative.

Another Lens On Valuation

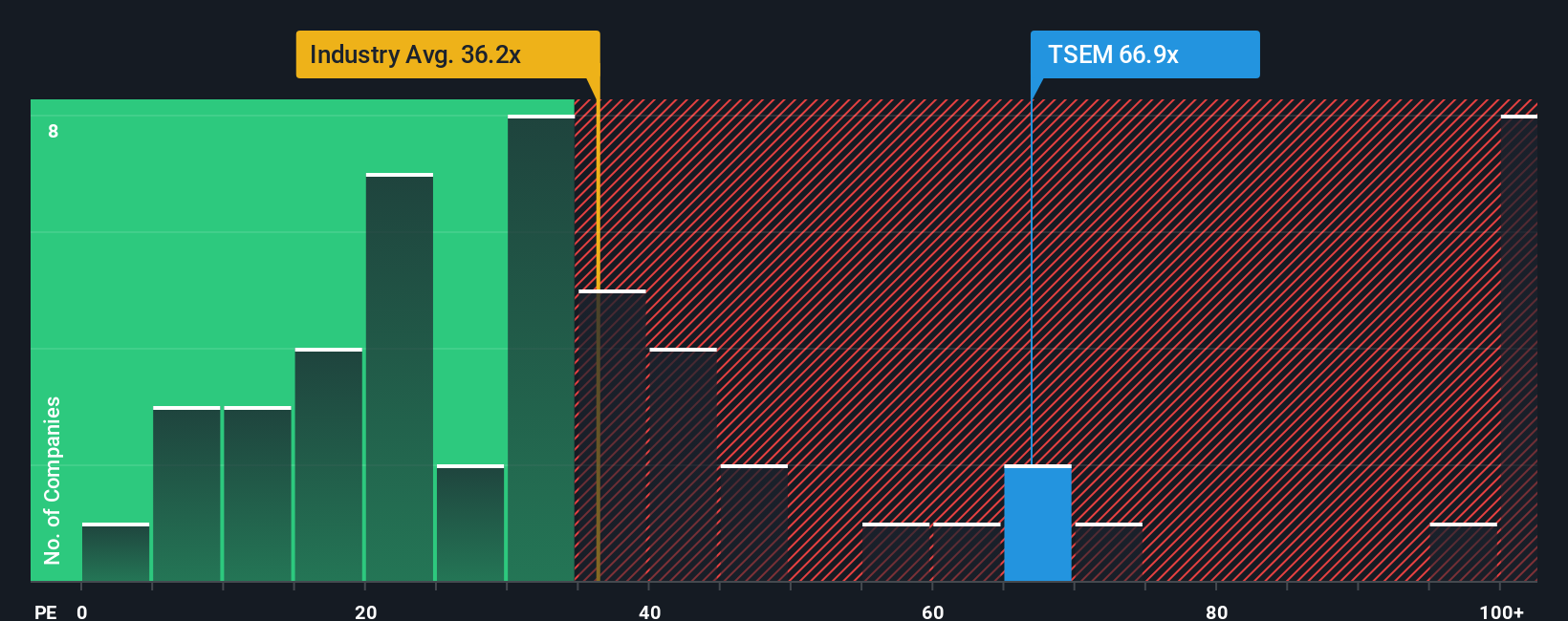

While the popular narrative pegs Tower as 7.2 percent undervalued, our fair ratio work using the price to earnings metric flashes a very different signal. At 66.1 times earnings versus a 37.6 times industry average and a 43.7 times peer average, Tower screens as richly priced.

Our fair ratio suggests the market could drift back toward about 45.5 times earnings over time. If that occurs, the current multiple would leave little room for execution hiccups. Is that a valuation premium you are comfortable paying for this growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tower Semiconductor Narrative

If you see the story differently or would rather stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tower Semiconductor.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall Street Screener to quickly surface targeted opportunities and keep your portfolio positioned where future growth is heading.

- Capture potential high growth at the smaller end of the market by scanning these 3574 penny stocks with strong financials that already show strong financial foundations.

- Capitalize on the surge in automation and machine learning by zeroing in on these 26 AI penny stocks poised to benefit most from the AI boom.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can support consistent payouts while still offering room for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tower Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSEM

Tower Semiconductor

An independent semiconductor foundry, provides technology, development, and process platforms for integrated circuits in the United States, Japan, rest of Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026