- United States

- /

- Semiconductors

- /

- NasdaqGS:TSEM

A Look at Tower Semiconductor's (NasdaqGS:TSEM) Valuation Following Its New AI-Focused Power Chip Launch

Reviewed by Simply Wall St

Tower Semiconductor (NasdaqGS:TSEM) just introduced the SW2001, a high-efficiency buck regulator developed with Switch Semiconductor. This new product targets fast-growing markets such as AI computing, server hardware, and telecom infrastructure, highlighting future revenue opportunities as demand for high-performance power solutions increases.

See our latest analysis for Tower Semiconductor.

Tower Semiconductor’s rollout of the SW2001 follows a remarkable surge in its share price, which has doubled year-to-date and delivered a 119.5% total shareholder return over the past year. Recent product milestones appear to be fueling bullish momentum, as investors consider the company’s expanding presence in high-performance chip markets.

If you’re looking for more ways to capitalize on momentum in tech and AI hardware, it’s an ideal time to explore See the full list for free.

With shares up more than 100% this year and analysts suggesting nearly 20% upside from current levels, investors may wonder whether Tower Semiconductor’s impressive growth story is already reflected in the price or if there is still a buying opportunity.

Most Popular Narrative: 16.6% Undervalued

Tower Semiconductor's most popular narrative sees significant upside, with a calculated fair value of $124, well above the last close price of $103.46. This signals optimism from analysts who model future earnings and margins to support a substantially higher valuation.

The rapid ramp-up in silicon photonics shipments, including expansion from transmit-only to both transmit and receive functions, higher bandwidth modules (up to 1.6T with 3.2T on the roadmap), and adoption by Tier 1 customers, positions Tower to further penetrate the growing optical transceiver market, supporting future revenue acceleration and increased average selling prices.

Crack the code behind Tower Semiconductor’s “undervalued” status. There is a set of ambitious growth bets, spanning margins, revenue, and future profit ratios, that shape this eye-catching target. Want to see the estimates that could propel the stock much higher and the assumptions analysts are banking on for the next few years? Dive in to see what’s behind the bold numbers.

Result: Fair Value of $124 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain. These include potential overinvestment in new capacity and the company’s heavy reliance on a handful of high-growth customers.

Find out about the key risks to this Tower Semiconductor narrative.

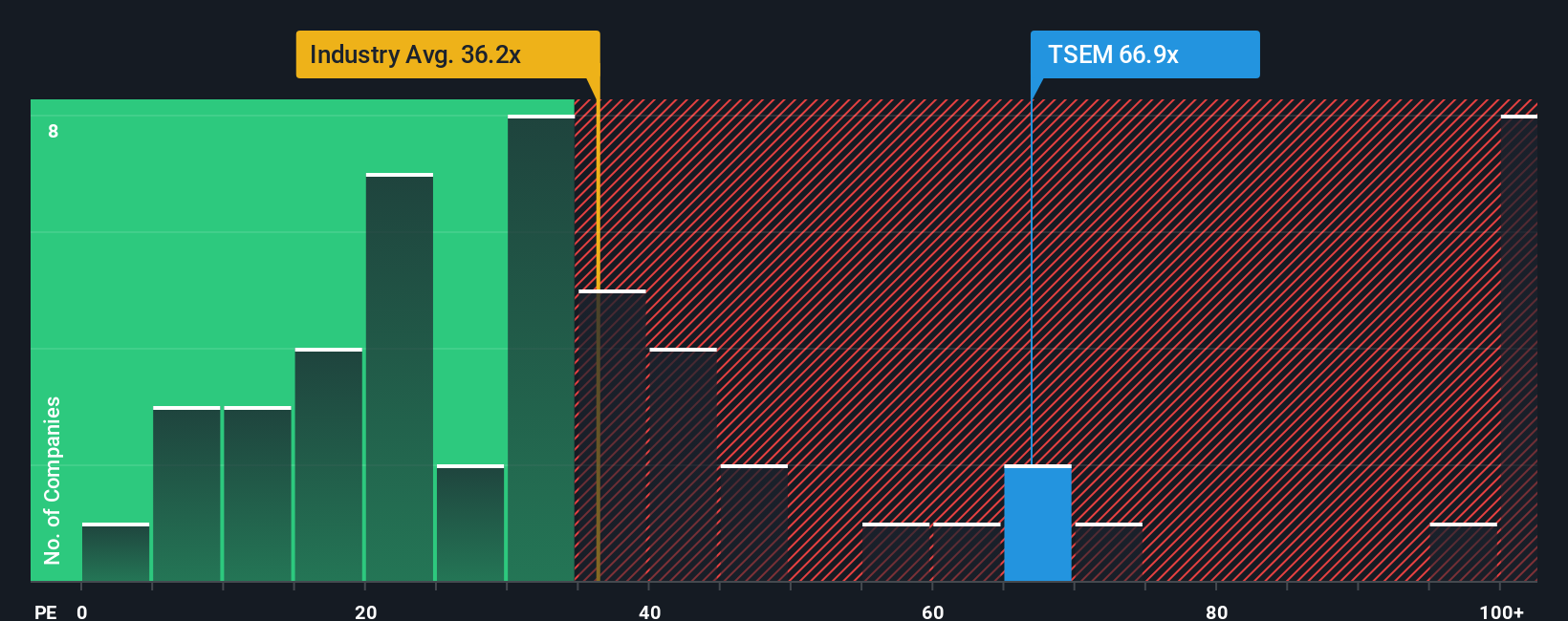

Another View: Multiples Show a Cautious Signal

While many see strong upside, a quick scan of common valuation multiples suggests Tower Semiconductor's shares trade at a hefty premium. Its price-to-earnings ratio stands at 59.4x, which is well above both the US semiconductor industry average of 35.8x and its peer group at 29.4x. Even compared to the fair ratio of 44.1x, the current pricing looks stretched, raising questions about valuation risk if growth expectations are not met. Is the optimism built into the price justified, or could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tower Semiconductor Narrative

If you want to challenge these views or dive deeper into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tower Semiconductor.

Looking for More Investment Ideas?

Seize the next opportunity by tapping into other corners of the market with our hand-picked stock screens, and don’t let standout investments pass you by.

- Accelerate your strategy by backing companies with a history of strong cash flows using these 923 undervalued stocks based on cash flows for hidden gems undervalued by the market.

- Capture high-yield potential by scanning these 15 dividend stocks with yields > 3% for impressive dividend performers offering attractive yields above 3%.

- Advance your portfolio with cutting-edge breakthroughs in artificial intelligence by targeting opportunities with these 25 AI penny stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tower Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSEM

Tower Semiconductor

An independent semiconductor foundry, provides technology, development, and process platforms for integrated circuits in the United States, Japan, rest of Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.