- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

QuamCore Quantum Partnership Might Change The Case For Investing In SkyWater Technology (SKYT)

Reviewed by Sasha Jovanovic

- On November 6, 2025, QuamCore announced a multi-million-dollar collaboration with SkyWater Technology to co-develop Single Flux Quantum (SFQ) devices aimed at advancing scalable quantum computing, combining SkyWater’s U.S.-based manufacturing and proprietary superconducting processes with QuamCore’s SFQ-based control architecture.

- This partnership marks a foundational step for QuamCore’s goal of building a 1-million-qubit superconducting quantum computer and highlights SkyWater’s role as a manufacturing partner for emerging quantum platforms.

- We'll examine how SkyWater’s entry into quantum chip co-development with QuamCore could reshape the company's technology leadership narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

SkyWater Technology Investment Narrative Recap

To be a shareholder in SkyWater Technology, you need to believe in the company's ability to capitalize on U.S.-based chip manufacturing, secure partnerships in emerging sectors like quantum computing, and manage the integration of recent acquisitions while facing execution risks. The new QuamCore collaboration supports SkyWater's ambition to expand into high-growth technologies, but the most important short-term catalyst remains a successful ramp-up and margin recovery from the Fab 25 acquisition; the partnership is a promising signal, though on its own does not eliminate short-term margin and integration risks.

Among recent announcements, SkyWater’s Q3 2025 results stand out, showing strong revenue growth and profitability. Robust quarterly performance gives the company additional breathing room as it invests in future-focused initiatives like the QuamCore partnership, reinforcing investor focus on financial resilience through near-term operational pressures.

However, if revenue growth from Fab 25 or new tech platforms falls short, the risks from debt and margin compression could become far more pressing for investors to consider...

Read the full narrative on SkyWater Technology (it's free!)

SkyWater Technology's narrative projects $804.6 million in revenue and $113.6 million in earnings by 2028. This requires 40.6% yearly revenue growth and a $130.1 million earnings increase from the current earnings of -$16.5 million.

Uncover how SkyWater Technology's forecasts yield a $15.83 fair value, a 12% downside to its current price.

Exploring Other Perspectives

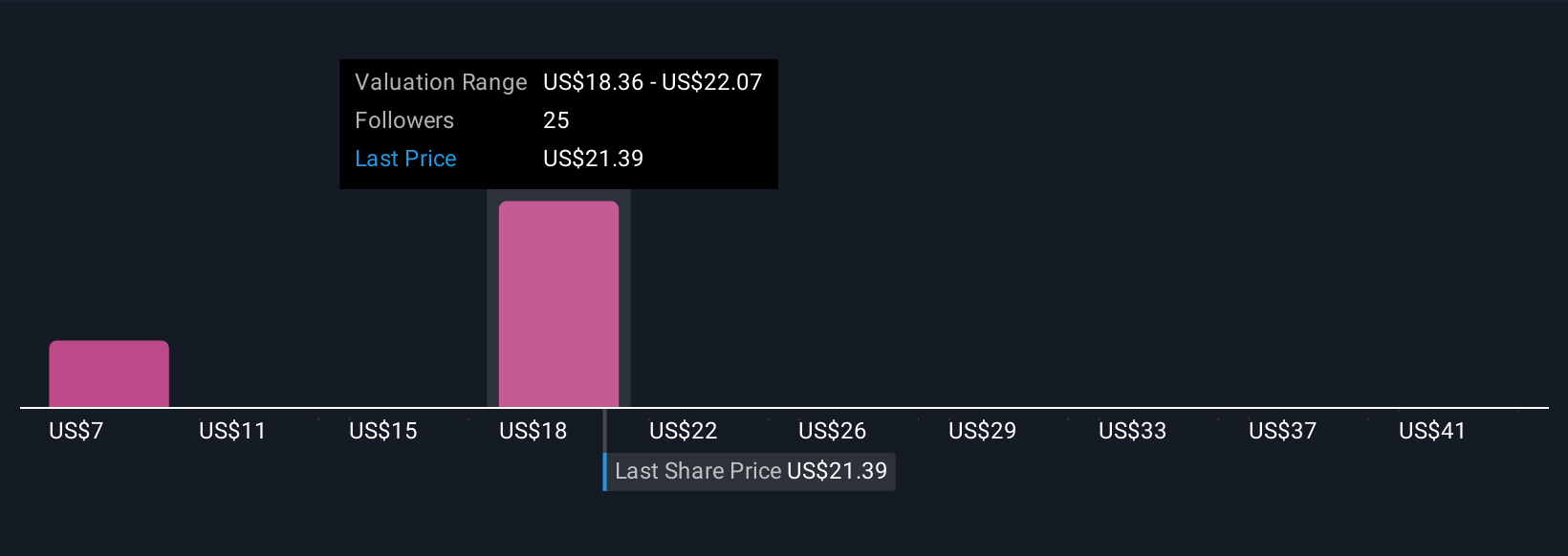

Fair value estimates from the Simply Wall St Community span US$15.83 to US$44.30, based on four independent projections. As investors explore these varied valuations, the company's pace of margin recovery and ability to integrate Fab 25 remain essential drivers shaping the outlook.

Explore 4 other fair value estimates on SkyWater Technology - why the stock might be worth over 2x more than the current price!

Build Your Own SkyWater Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWater Technology research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free SkyWater Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWater Technology's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives