- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

SiTime (SITM) Is Up 22.6% After Q3 Revenue Surge and Strong AI-Driven Demand

Reviewed by Sasha Jovanovic

- SiTime Corporation released its third quarter 2025 results, reporting US$83.57 million in revenue, a 45% increase over the prior year, as strong demand for its Precision Timing solutions across high-growth sectors contributed to improved margins and reduced net losses.

- A key insight is that rapid adoption in AI, communications, and data center markets, paired with increased operational efficiency and positive analyst sentiment around new product expansion, has underscored SiTime's competitive positioning and long-term growth potential.

- We'll examine how the strong performance in AI and data center demand influences SiTime's investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SiTime Investment Narrative Recap

To be a SiTime shareholder, you need to believe that accelerating AI and data center demand will drive sustained adoption of the company's Precision Timing solutions, powering outsized revenue growth and improved margins, even if the business remains unprofitable near term. The third-quarter results affirm this narrative as SiTime exceeded revenue and margin expectations, but do not meaningfully lessen the ongoing risk associated with customer concentration in the communications, enterprise, and data center segment.

The September launch of SiTime's Titan Platform, which expanded its addressable market by US$400 million, is especially relevant here. This move directly addresses customer appetite for advanced timing across new AI and data center architectures, underscoring why increased adoption in these sectors remains the central catalyst for SiTime.

Yet, before getting too comfortable, keep in mind that any significant slowdown or shift among a concentrated customer base…

Read the full narrative on SiTime (it's free!)

SiTime's narrative projects $600.4 million revenue and $15.9 million earnings by 2028. This requires 32.9% yearly revenue growth and a $98.1 million earnings increase from the current earnings of -$82.2 million.

Uncover how SiTime's forecasts yield a $285.00 fair value, a 16% downside to its current price.

Exploring Other Perspectives

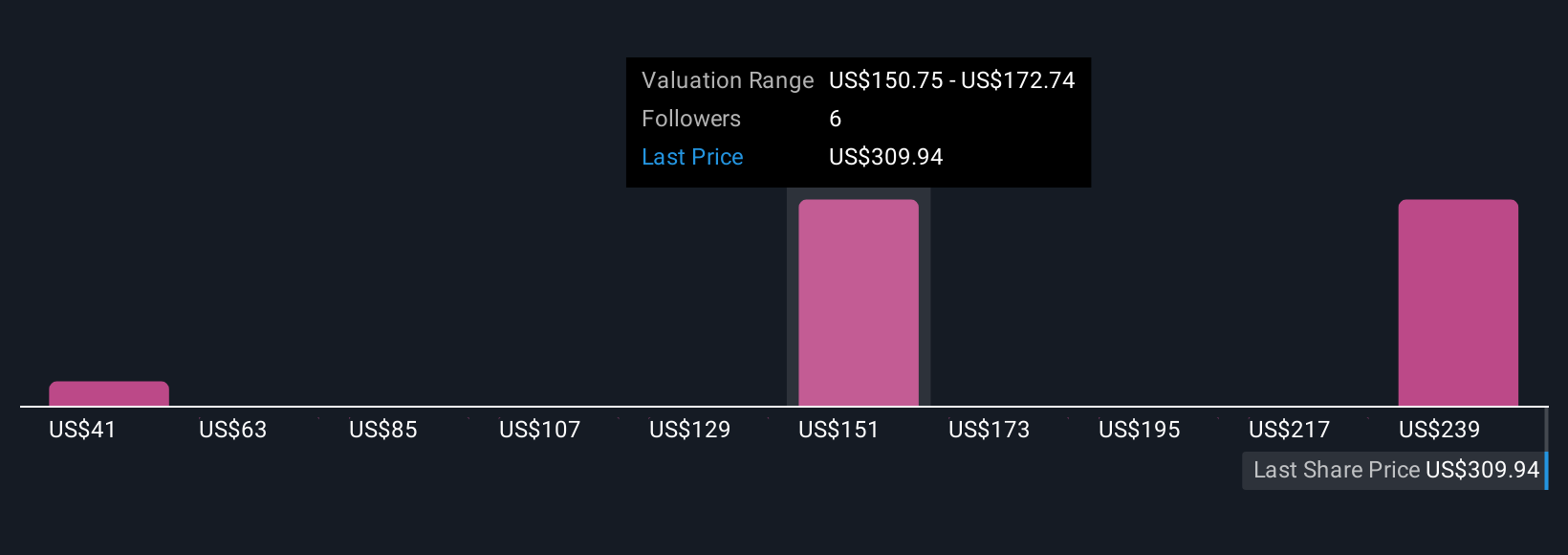

Three members of the Simply Wall St Community shared fair value estimates for SiTime, ranging from US$40.78 to US$285. With the company's rapid CED revenue gains shaping analyst outlooks, make sure to compare these diverse perspectives and consider how evolving sector dependencies could affect future performance.

Explore 3 other fair value estimates on SiTime - why the stock might be worth less than half the current price!

Build Your Own SiTime Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiTime research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SiTime research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiTime's overall financial health at a glance.

No Opportunity In SiTime?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives