- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

SiTime (SITM): Exploring Valuation Following Loop Capital’s Bullish Initiation and Growth Forecasts

Reviewed by Simply Wall St

SiTime (SITM) entered the spotlight after Loop Capital initiated coverage and highlighted the company’s expanding role in precision timing. The firm expects SiTime’s Communications-Enterprise-Datacenter segment to continue its fast-paced growth into 2025.

See our latest analysis for SiTime.

SiTime’s latest appearance at the UBS Global Technology and AI Conference built on recent analyst optimism, with momentum in its Communications-Enterprise-Datacenter segment drawing market attention. Over the past year, SiTime delivered a 30.9% total shareholder return. The stock’s 28% gain year-to-date and strong three-year total return highlight growing investor confidence in its long-term growth story.

If all the buzz around SiTime’s expansion has you wondering what’s next in the tech space, now is a great opportunity to check out See the full list for free.

With analyst coverage heating up and shares climbing, investors now face a critical question: is SiTime undervalued given its growth prospects, or is the current market price already reflecting all that future potential?

Most Popular Narrative: 17.2% Undervalued

With SiTime’s most popular narrative setting a fair value well above the recent close, market expectations are clearly skewed toward further upside. The justification centers on demand amplification, higher-value products, and steep improvements in profit margins projected for the coming years.

Expansion of SiTime's content per device, particularly through customized clocks and clocking systems for AI, networking, and hyperscale platforms, enables increased dollar content per design win. This approach directly supports top-line growth and improves gross margins as these higher-ASP products become a greater share of sales.

Curious about the math behind this ambitious price target? The narrative hinges on aggressive growth rates and a margin profile shift few are expecting. The real surprise is that it all comes down to bold future forecasts that challenge the ordinary semiconductor playbook. Want the full rationale, the actual financial leaps, and just how high this next-gen tech could go? Unlock the entire narrative and see what’s driving this valuation call.

Result: Fair Value of $346.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued momentum is not guaranteed. Heavy reliance on data center demand and rapid innovation cycles could introduce earnings volatility and challenge margin growth.

Find out about the key risks to this SiTime narrative.

Another View: Multiples Tell a Cautionary Story

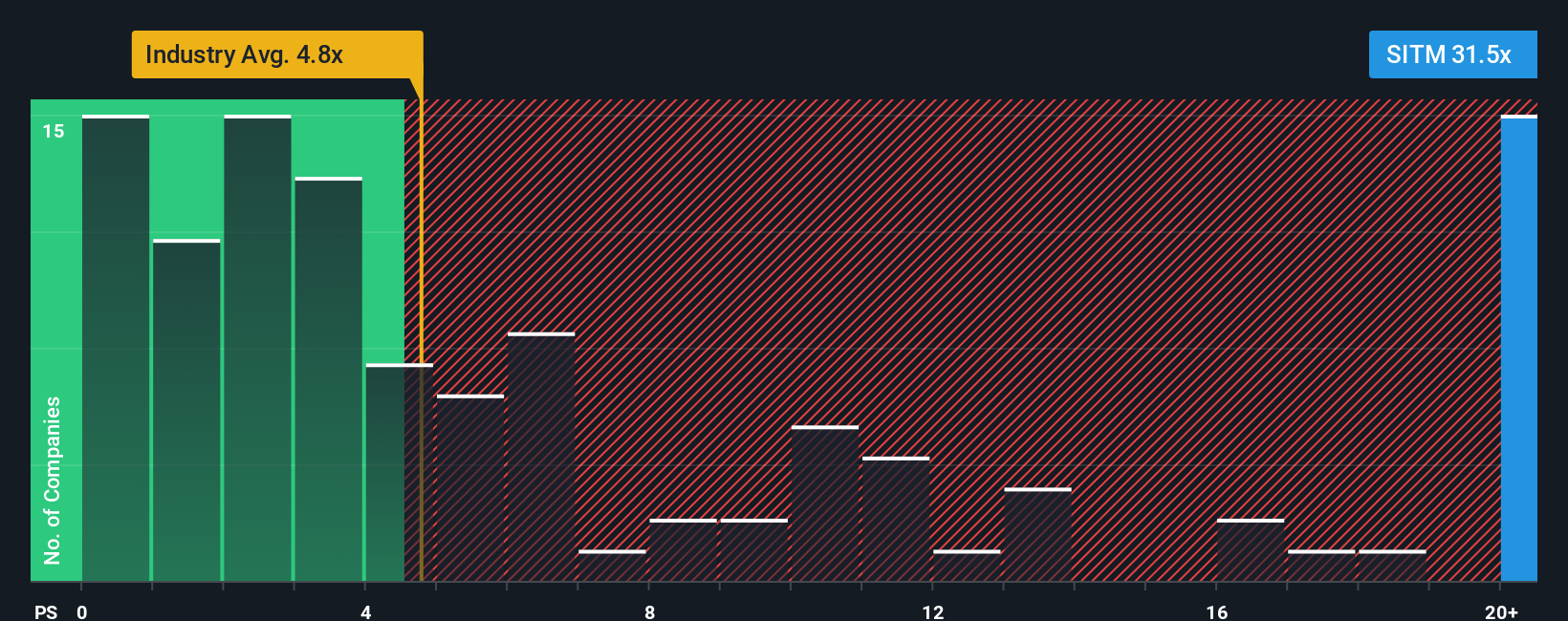

While SiTime’s narrative-driven valuation points to upside, the picture changes when looking at market multiples. SiTime’s price-to-sales ratio stands at 26.6x, far above its industry peers at 4.7x and even more elevated compared to a fair ratio of 11.4x. This sizeable gap suggests the stock is priced for perfection, leaving little room for error if growth falls short. Are the high expectations already fully baked in, or is there more headroom?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiTime Narrative

If these perspectives do not align with your own, consider diving into the data to craft your unique take. Building a personal view takes under three minutes. Do it your way

A great starting point for your SiTime research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop with just one company. Great opportunities await when you look beyond the obvious. Give your portfolio an edge by checking out these hand-picked stock themes on Simply Wall Street. Act now so you never miss a standout performer.

- Explore potential new opportunities and uncover strong financials with these 3565 penny stocks with strong financials primed for growth and untapped value.

- Benefit from the advances in artificial intelligence by tapping into these 25 AI penny stocks that are capitalizing on the latest tech innovation.

- Consider maximizing your income potential with these 14 dividend stocks with yields > 3% featuring attractive yields and resilient business models in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026