- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

Is Analyst Interest in SiTime (SITM) Signaling a Shift in Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- Loop Capital recently initiated coverage of SiTime Corporation, citing the company's advancements in precision timing solutions and highlighting the anticipated strength of its Communications-Enterprise-Datacenter segment.

- This analyst attention points to the increasing importance of SiTime's technology for system manufacturers facing intricate market and design demands.

- We'll now consider how this analyst initiation, which underscores SiTime's position in precision timing for data centers, might influence its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

SiTime Investment Narrative Recap

To invest in SiTime, you need to believe in the ongoing expansion of advanced data centers and the crucial role of precision timing solutions in these platforms. While Loop Capital's recent coverage highlights momentum in SiTime's Communications-Enterprise-Datacenter (CED) segment, this analyst attention does not materially alter the company's main catalyst, demand for timing technology supporting AI data centers, or its significant risk: customer concentration in hyperscale and enterprise markets, which could expose revenue to sudden shifts. The recent launch of the Titan Platform, a MEMS resonator line expanding SiTime's addressable market by as much as US$1 billion annually, is tightly linked to the potential for outsized growth in the CED business cited by Loop Capital. This product introduction aligns with investors' focus on the company’s ability to increase content per design win and capture share in next-generation data center infrastructure. However, investors should not overlook the flipside of growing exposure to the AI data center cycle, particularly if...

Read the full narrative on SiTime (it's free!)

SiTime's narrative projects $600.4 million revenue and $15.9 million earnings by 2028. This requires 32.9% yearly revenue growth and a $98.1 million earnings increase from -$82.2 million today.

Uncover how SiTime's forecasts yield a $346.43 fair value, a 16% upside to its current price.

Exploring Other Perspectives

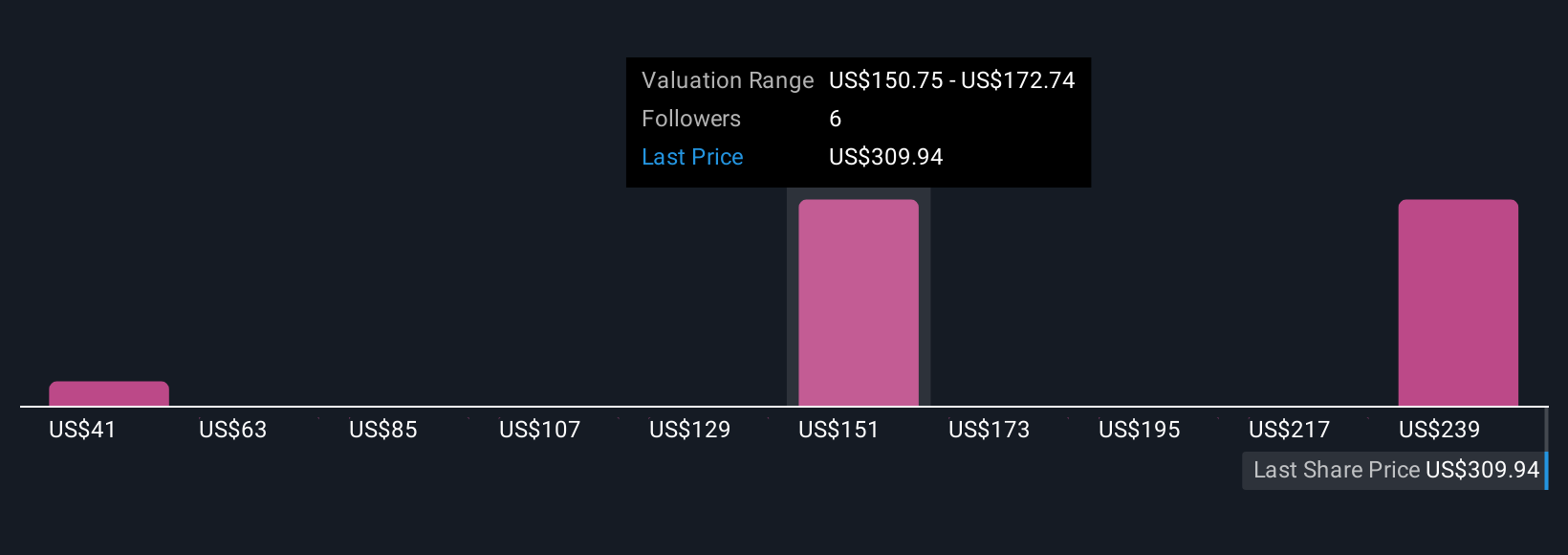

Simply Wall St Community valuations span from US$40.78 to US$346.43 based on three submitted estimates. While views on fair value differ widely, SiTime’s dependence on a small group of hyperscale customers highlights just how volatile the company’s revenue could be if even one major platform shifts priorities.

Explore 3 other fair value estimates on SiTime - why the stock might be worth as much as 16% more than the current price!

Build Your Own SiTime Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiTime research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free SiTime research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiTime's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026