- United States

- /

- Semiconductors

- /

- NasdaqGS:QRVO

Qorvo (QRVO): Valuation Perspective Following Strong Q2 Results and Raised Outlook

Reviewed by Simply Wall St

Qorvo (QRVO) just released its second-quarter results, with both adjusted earnings and revenue coming in ahead of expectations. This was due to strong demand in its Advanced Cellular Group and High Performance Analog segments.

See our latest analysis for Qorvo.

The positive earnings surprise and upbeat guidance have given Qorvo’s share price some welcome momentum, with a 23.1% share price return year to date and a 24.4% total shareholder return over the past year. After some earlier volatility, recent gains suggest investors are warming up to the company’s growth prospects, particularly as restructuring efforts and improving demand take hold.

If Qorvo’s turnaround story has caught your attention, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

But after this strong run and improving fundamentals, is Qorvo still trading at an attractive valuation? Have investors already priced in the company’s turnaround? Is there a compelling buying opportunity, or is the market already expecting more growth ahead?

Most Popular Narrative: 15.6% Undervalued

With Qorvo’s last close at $85.89 and a fair value estimate from the most popular narrative at $101.74, the gap between price and perceived value is attracting attention. The market’s recent momentum could be just the beginning if current projections come to fruition.

Qorvo is set to benefit from accelerating adoption and content expansion tied to the rollout of 5G and future 6G networks. This is evidenced by strong design wins in flagship smartphones, Wi-Fi 7/8 deployments, and persistent efforts to increase RF content per device, directly supporting multi-year revenue growth and margin expansion.

The fair value argument hinges on big growth expectations, not just for revenue but for profits and margins too. Find out what core financial leaps are powering this bold call. Unpack the projection behind this fair value and see what makes this narrative so different from the market’s current view.

Result: Fair Value of $101.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a single major customer and challenges from regulatory uncertainty could quickly undermine the optimistic outlook for Qorvo’s turnaround story.

Find out about the key risks to this Qorvo narrative.

Another View: Multiples Tell a Different Story

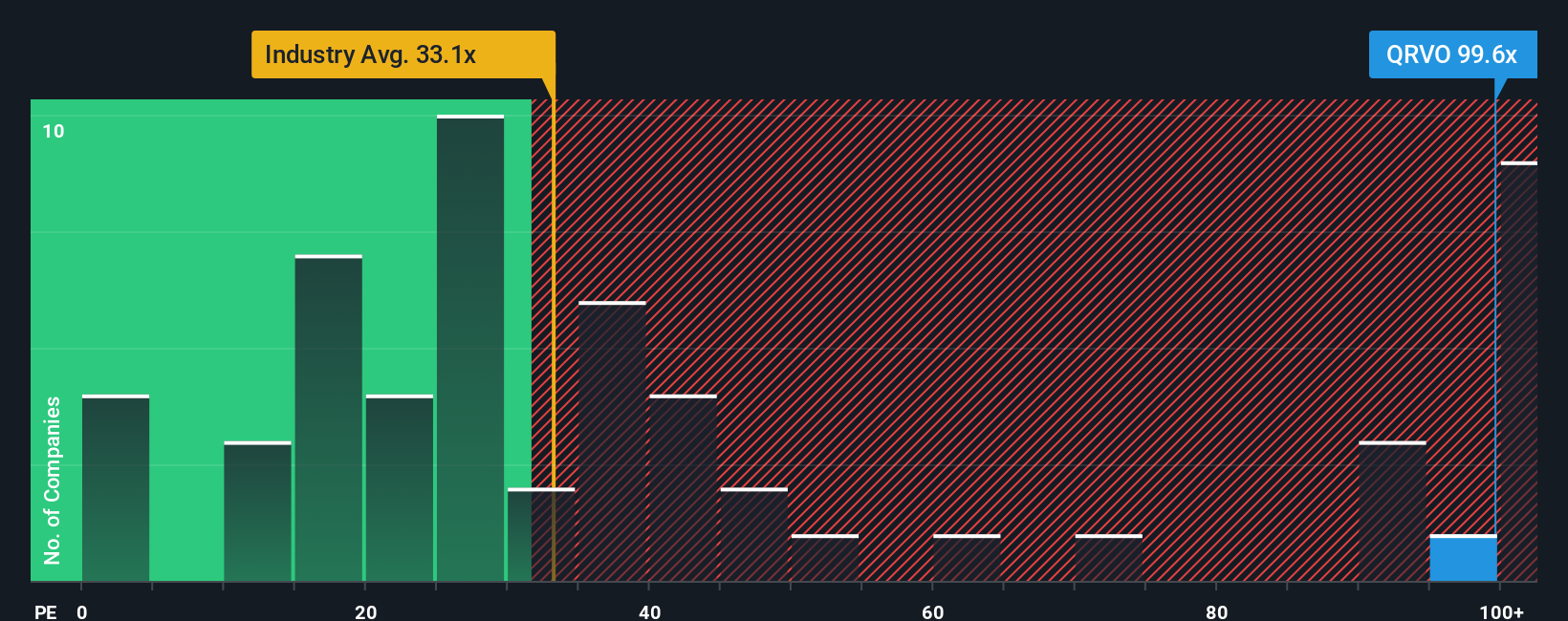

While fair value calculations highlight Qorvo’s upside, current pricing against earnings ratios presents a more expensive picture. Qorvo trades at 36.5x, which is higher than both its industry average of 35.8x and a fair ratio of 29.1x. Does this premium signal belief in future growth, or a risk of overpaying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qorvo Narrative

If you think there’s more to the story or want to dig deeper yourself, you can craft your own narrative for Qorvo in just a few minutes. Do it your way

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next smart move and stay ahead by searching beyond Qorvo. Some of the market’s most exciting opportunities are just a click away. Don’t let them slip past you!

- Target unstoppable momentum and catch early-stage growth with these 3572 penny stocks with strong financials poised for major upside potential.

- Secure consistent income and seek peace of mind with these 15 dividend stocks with yields > 3% offering reliable returns above 3% yield.

- Capitalize on the data revolution and ride the innovation wave with these 25 AI penny stocks transforming industries through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qorvo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QRVO

Qorvo

Engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.