- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Photronics (PLAB): Reassessing Valuation After Strong Buy Upgrade, Q3 Beat, Buybacks and Cash-Rich Balance Sheet

Reviewed by Simply Wall St

Photronics (PLAB) just delivered a clean one two for investors: a Strong Buy consensus from Wall Street alongside better than expected third quarter earnings, backed by steady buybacks and a cash rich balance sheet.

See our latest analysis for Photronics.

The upbeat third quarter and Strong Buy call have started to nudge sentiment, with the stock’s recent 7 day share price return of 5.41% hinting at rebuilding momentum despite a softer 1 year total shareholder return.

If this kind of quiet turn in sentiment interests you, it might be worth seeing which other chip related names are showing similar patterns in high growth tech and AI stocks.

With earnings beating expectations, a Strong Buy tag in place, and the shares still trading at a steep discount to analyst targets, is Photronics quietly undervalued or are markets already baking in its next leg of growth?

Most Popular Narrative: 26.8% Undervalued

With Photronics last closing at $24.15 against a narrative fair value of $33, the story leans toward meaningful upside if assumptions hold.

Ongoing and planned technological upgrades in Asia (extension to 6nm and 8nm nodes) enable Photronics to participate in next-generation chip production for edge AI, automotive, and communications, creating new high-value growth streams and potential revenue share gains as industry complexity increases. The company's diversified global manufacturing footprint and strong customer relationships (especially in fast-growing Asian regions and U.S. government/defense markets) provide insulation from regional cyclicality and increase the resilience and breadth of revenue streams over the next several years.

Curious how modest revenue growth, margin expansion, and a higher future earnings multiple can still justify that gap to fair value? The narrative leans on disciplined capital deployment, shrinking share count, and a valuation framework that treats Photronics more like a durable compounder rather than a cyclical short term trade.

Result: Fair Value of $33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained heavy capex and unpredictable chip demand, especially in Asia, could pressure margins and derail the expected earnings and valuation uplift.

Find out about the key risks to this Photronics narrative.

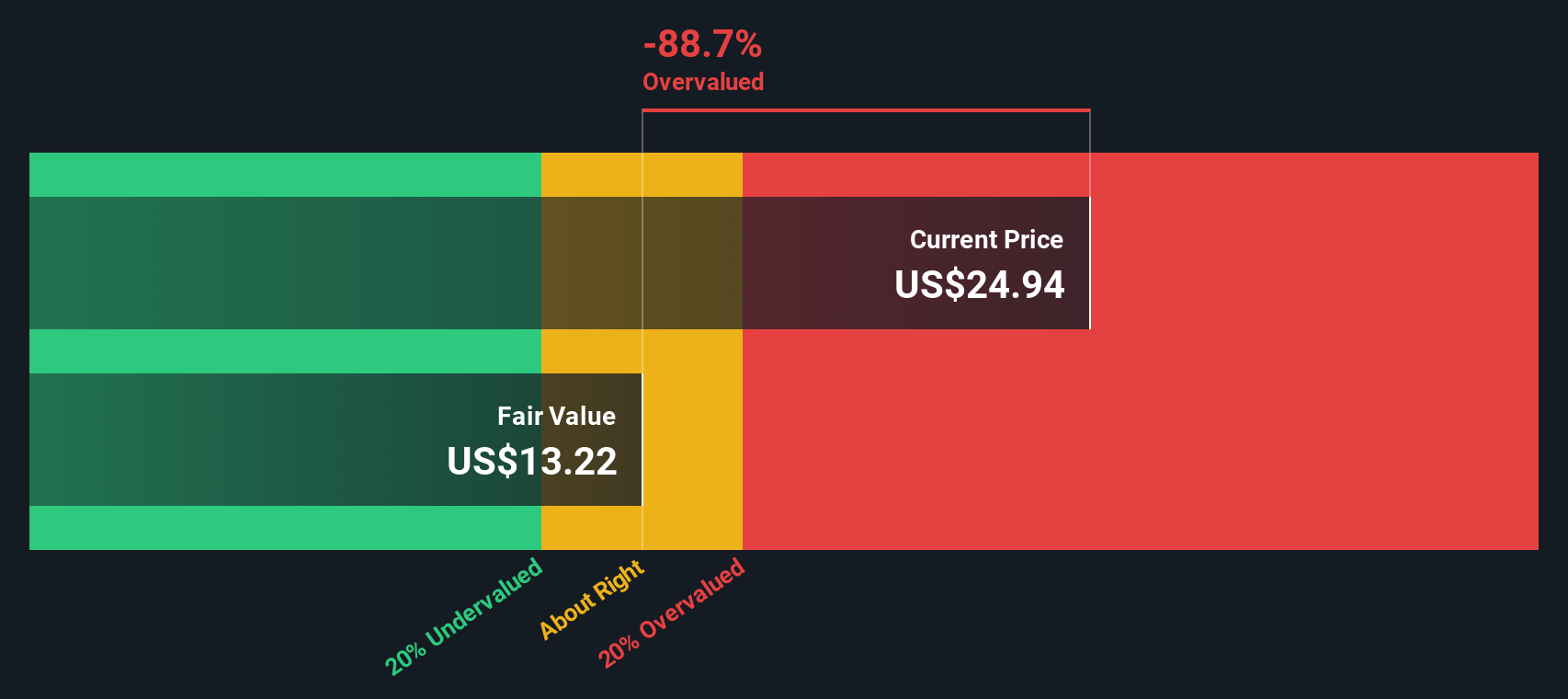

Another View: DCF Flags Overvaluation

While analysts see Photronics as about 26.8% undervalued on a narrative fair value of $33, our DCF model points the other way and suggests fair value closer to $12.69, well below the current $24.15 share price. Which lens better fits a cyclical, capex heavy chip supplier?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity with fresh, data backed stock ideas from our powerful Simply Wall St screener tools.

- Catch early stage momentum by scanning these 3576 penny stocks with strong financials that already show real financial strength instead of just hype.

- Position yourself for secular growth by targeting these 26 AI penny stocks at the center of automation, data intelligence, and next generation software.

- Strengthen your portfolio core by focusing on these 15 dividend stocks with yields > 3% that can supplement returns with reliable income over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026