- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Penguin Solutions (PENG): Assessing Valuation as AI Initiatives and SK Telecom Partnership Draw Industry Focus

Reviewed by Simply Wall St

Penguin Solutions (PENG) has announced its participation at the upcoming Supercomputing 25 conference in St. Louis. The company plans to demonstrate scalable AI infrastructure solutions and highlight its collaboration with SK Telecom on a significant South Korean AI initiative.

See our latest analysis for Penguin Solutions.

PENG’s latest moves in high-performance computing come as the company’s momentum remains solid, with a 21.3% total shareholder return over the past year and a healthy 41% gain for those who have held long term. While the share price has dipped 6.5% in the last week and 14% over the past quarter, recent initiatives in AI infrastructure suggest a company building for future growth rather than just riding last year’s rally.

If Penguin’s push into advanced AI got your attention, now is a great time to see what else is emerging in tech. Check out See the full list for free..

With shares currently trading at a discount to analyst targets, investors are left to consider whether Penguin Solutions is flying under the radar or if the market is already factoring in the company’s future growth potential.

Most Popular Narrative: 26.5% Undervalued

According to the most popular narrative among analysts, Penguin Solutions’ fair value now stands at $28.25 per share. This means the current price of $20.76 could represent an opportunity for investors who believe the company will meet high growth expectations. The recent adjustment in fair value is supported by both near-term optimism and bold long-term projections.

Strategic collaborations with major partners (such as SK Telecom and SK hynix) are enabling early access to next-generation semiconductor and memory technologies. This is accelerating product innovation, enhancing competitive differentiation, and likely contributing to future increases in revenue and gross margins.

Wondering what exactly drives this massive valuation gap? Get the inside scoop on the growth bets, margin resets, and technological inflection points powering the consensus price target. Only by exploring the full narrative can you uncover the crucial financial assumptions setting Penguin's fair value above the pack.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around the timing of large contracts and potential tariff pressures may quickly change the outlook for Penguin’s ambitious margin and growth targets.

Find out about the key risks to this Penguin Solutions narrative.

Another View: Valued by Multiples

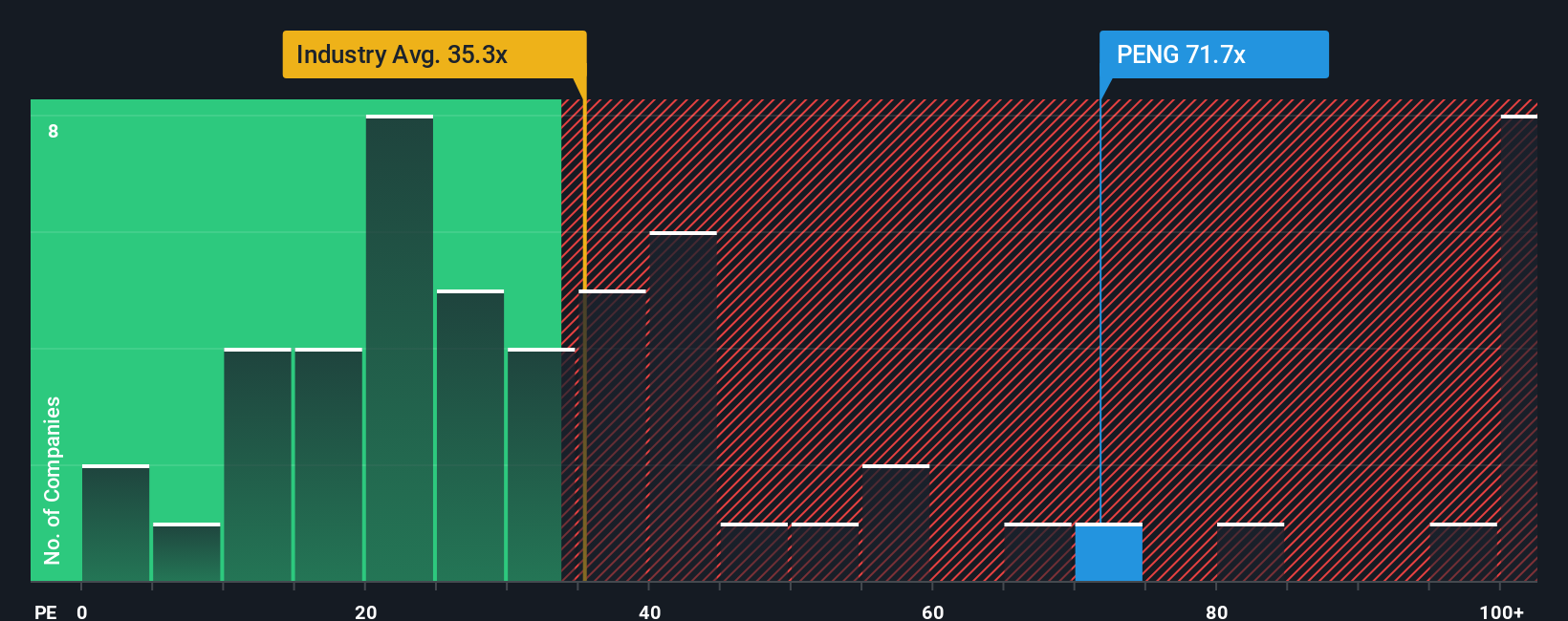

While analysts see Penguin Solutions as undervalued based on growth and fair value estimates, the company’s price-to-earnings ratio tells a less optimistic story. At 71x, it is double the US Semiconductor industry average of 35.6x and well above the peer average of 43.3x. This premium suggests the current price already reflects aggressive expectations, so is the upside really as large as it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penguin Solutions Narrative

If you think there’s more to the story or want to analyze the facts from your own perspective, you can build a narrative in just a few minutes. Do it your way.

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the moment and uncover fast-moving opportunities that other investors might miss. Use these powerful tools to fuel your next smart investing move. Why let valuable insights pass you by?

- Uncover high-growth potential by tracking these 25 AI penny stocks that are driving advances in artificial intelligence and revolutionizing the digital landscape.

- Pounce on value plays with these 864 undervalued stocks based on cash flows to find stocks that are flying under the radar and could be your next hidden gem.

- Maximize your passive income strategy using these 14 dividend stocks with yields > 3% to spot shares offering reliable yields above 3% and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives