- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

Navitas Semiconductor (NVTS): Assessing Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

Navitas Semiconductor (NVTS) has seen its stock movement generate some interest after a period of dramatic swings over the past month. Investors are watching closely as the share price tries to find a consistent direction in light of shifting market sentiment.

See our latest analysis for Navitas Semiconductor.

After a year of impressive momentum, with a staggering 122.92% year-to-date share price return and a 318.28% total shareholder return over the past 12 months, Navitas Semiconductor’s recent 46.93% dip in the last 30 days has investors rethinking both risk and potential. That swift reversal is a reminder of how quickly market sentiment can shift, despite earlier optimism around the stock’s growth story.

If you’re weighing your next opportunity in the sector, why not explore See the full list for free.?

With shares now trading 6 percent below analyst price targets after a remarkable run, investors may be wondering whether Navitas Semiconductor is undervalued at these levels or if the market has already priced in its future growth prospects, leaving limited upside.

Most Popular Narrative: 3.4% Undervalued

Navitas Semiconductor’s most widely followed narrative assigns a slightly higher fair value to the stock than its recent close, suggesting modest underappreciation by the market. This setup prompts investors to consider what could drive shares higher from here.

The expansion of Navitas' EV pipeline and design wins, including strategic partnerships with major automakers, is set to enhance revenue growth in the automotive sector as these projects enter production by 2026.

What bold assumptions power this narrative’s valuation? Analysts are forecasting a growth surge and expect profit metrics to shift in dramatic fashion over the next few years. Want to see what makes these projections stand apart from the rest? Don’t miss the full narrative to discover the numbers that underpin this conclusion.

Result: Fair Value of $8.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing revenue softness in key markets and reduced gross margins could slow Navitas Semiconductor's growth and challenge assumptions about its future profitability.

Find out about the key risks to this Navitas Semiconductor narrative.

Another View: Peer and Sector Multiples

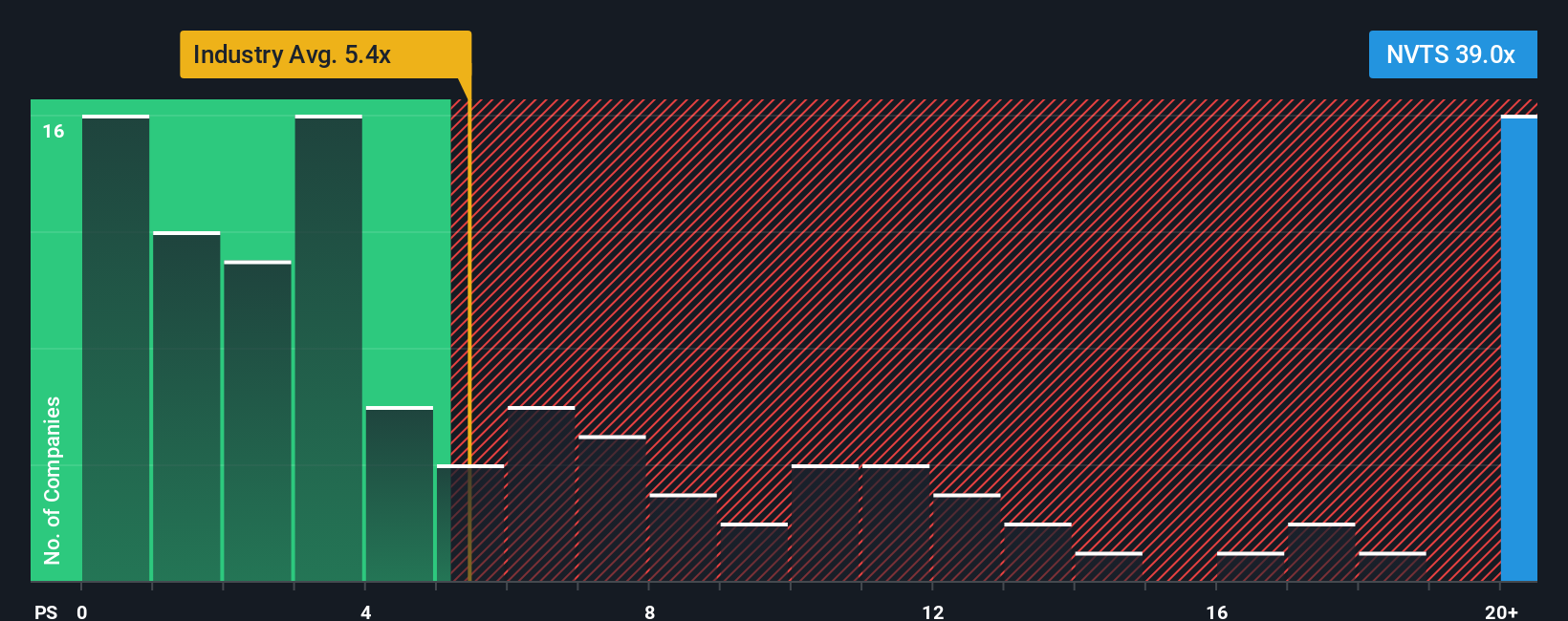

Looking at Navitas Semiconductor’s price-to-sales ratio of 31.4 times, the stock trades much higher than both the industry average of 4.7 times and peer average of 2.5 times. Even compared to the fair ratio of 12.1 times, this signals that investors are paying a steep premium for growth expectations. Could sentiment shift if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Navitas Semiconductor Narrative

Of course, if you see things differently or would rather dig into the details yourself, you can build your own perspective in just a few minutes, Do it your way.

A great starting point for your Navitas Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for a single story. Seize new opportunities now with screeners that match your goals and investing style. Don’t let these powerful ideas pass you by because the next winner could be waiting.

- Target consistent income with reliability and growth by checking out these 18 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3%.

- Unlock the potential of companies leading breakthroughs in healthcare by using these 31 healthcare AI stocks to spot the major players shaping tomorrow’s medical innovation.

- Ride the cutting edge of finance and technology when you browse these 81 cryptocurrency and blockchain stocks for stocks innovating across cryptocurrencies and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026