- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova (NVMI) Is Down 8.7% After Record Q3 Results and Raised Guidance – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Nova Ltd. reported record third-quarter results with revenue of US$224.61 million and net income of US$61.42 million, alongside management issuing elevated fourth-quarter revenue guidance of US$215 million to US$225 million and diluted GAAP EPS of US$1.77 to US$1.95.

- The company highlighted exceptionally strong sales in advanced logic and memory segments, driving both its highest-ever quarterly sales and surpassing analysts’ expectations for the upcoming quarter.

- We'll explore how Nova's guidance for continued revenue strength could shape its medium-term investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nova Investment Narrative Recap

Belief in Nova as an investment centers on continued growth in semiconductor complexity, which keeps fueling demand for its advanced metrology solutions. The latest record Q3 earnings and optimistic Q4 guidance reinforce confidence in near-term business momentum and support revenue growth as the main short-term catalyst. However, customer concentration remains a key risk, and while the recent results are positive, they do not materially lessen exposure to this challenge if a major client were to delay spending.

Among the most relevant recent developments is Nova's October announcement that its ELIPSON solution achieved "Tool of Record" status with a leading global foundry for advanced GAA manufacturing. This milestone builds on the stronger revenue and margin outlook by supporting adoption of Nova’s new products in next-generation semiconductor processes, which is critical for the company to sustain growth drivers highlighted in the Q3 earnings report.

But in contrast to these growth milestones, investors should also keep in mind the risk that any material delay or scaling back of capital expenditures by one of Nova’s few largest customers...

Read the full narrative on Nova (it's free!)

Nova's outlook anticipates $1.1 billion in revenue and $293.1 million in earnings by 2028. This reflects a 9.8% annual revenue growth rate and a $58.2 million increase in earnings from the current $234.9 million.

Uncover how Nova's forecasts yield a $321.67 fair value, in line with its current price.

Exploring Other Perspectives

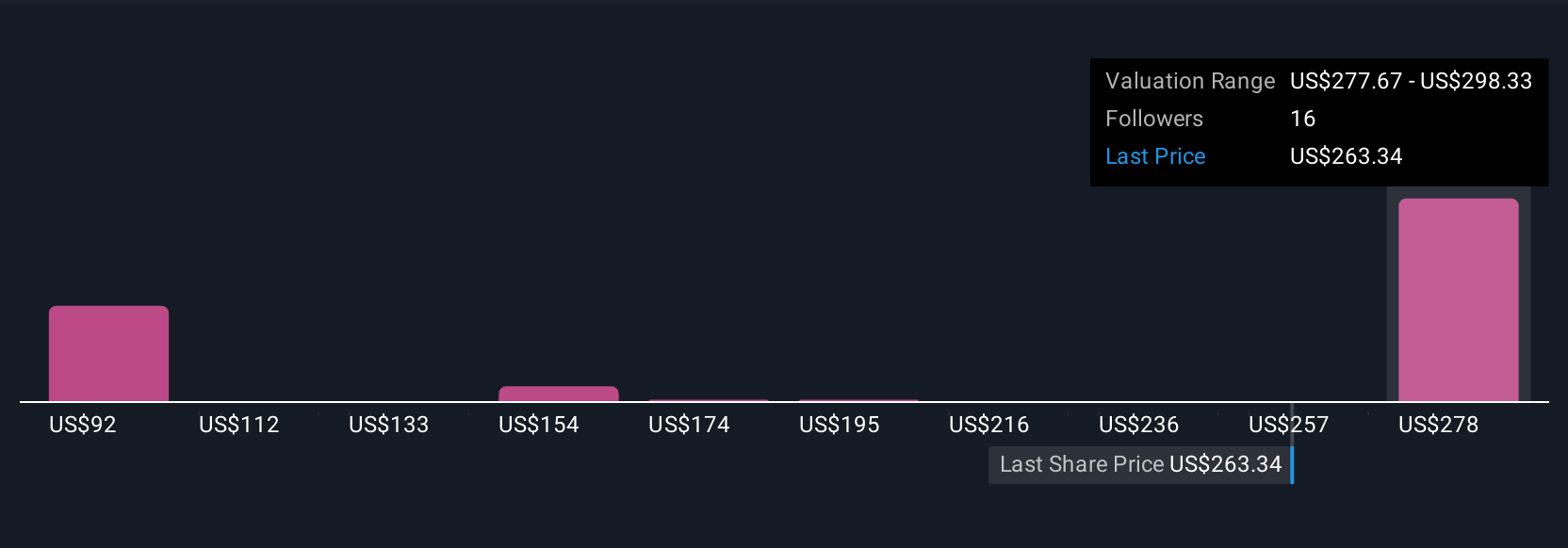

Simply Wall St Community members assigned fair value estimates for Nova ranging from US$86.95 to US$321.67, incorporating five separate perspectives. With product adoption accelerating, your outlook on customer concentration risk could influence whether you align with higher or lower valuations.

Explore 5 other fair value estimates on Nova - why the stock might be worth as much as $321.67!

Build Your Own Nova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nova research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nova's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives