- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

How Marvell’s AI Chip Advancements Are Shaping Its Value After an 8.7% Stock Jump

Reviewed by Bailey Pemberton

- Curious whether Marvell Technology is a bargain or just riding the hype? Let’s take a closer look at what is unfolding beneath the stock price.

- The stock jumped 8.7% over the last week, showing short-term enthusiasm, but is still down 19.8% year-to-date and 5.6% over the past twelve months.

- Recent headlines have centered around Marvell’s advances in data center and AI chip solutions, drawing renewed investor attention and speculation about its long-term role in fast-changing tech markets. Momentum has been boosted by industry collaborations and market optimism about the expanding footprint of AI hardware.

- On a value score of 1 out of 6, the stock leaves most valuation checks unmet so far, but classic metrics are just one piece of the puzzle. Next, we will look at how analysts approach valuation and explore a more insightful way to judge whether MRVL is truly undervalued.

Marvell Technology scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Marvell Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's fair value by projecting its future cash flows and discounting them back to today. This approach helps investors determine whether a stock's current price reflects these future earnings potential.

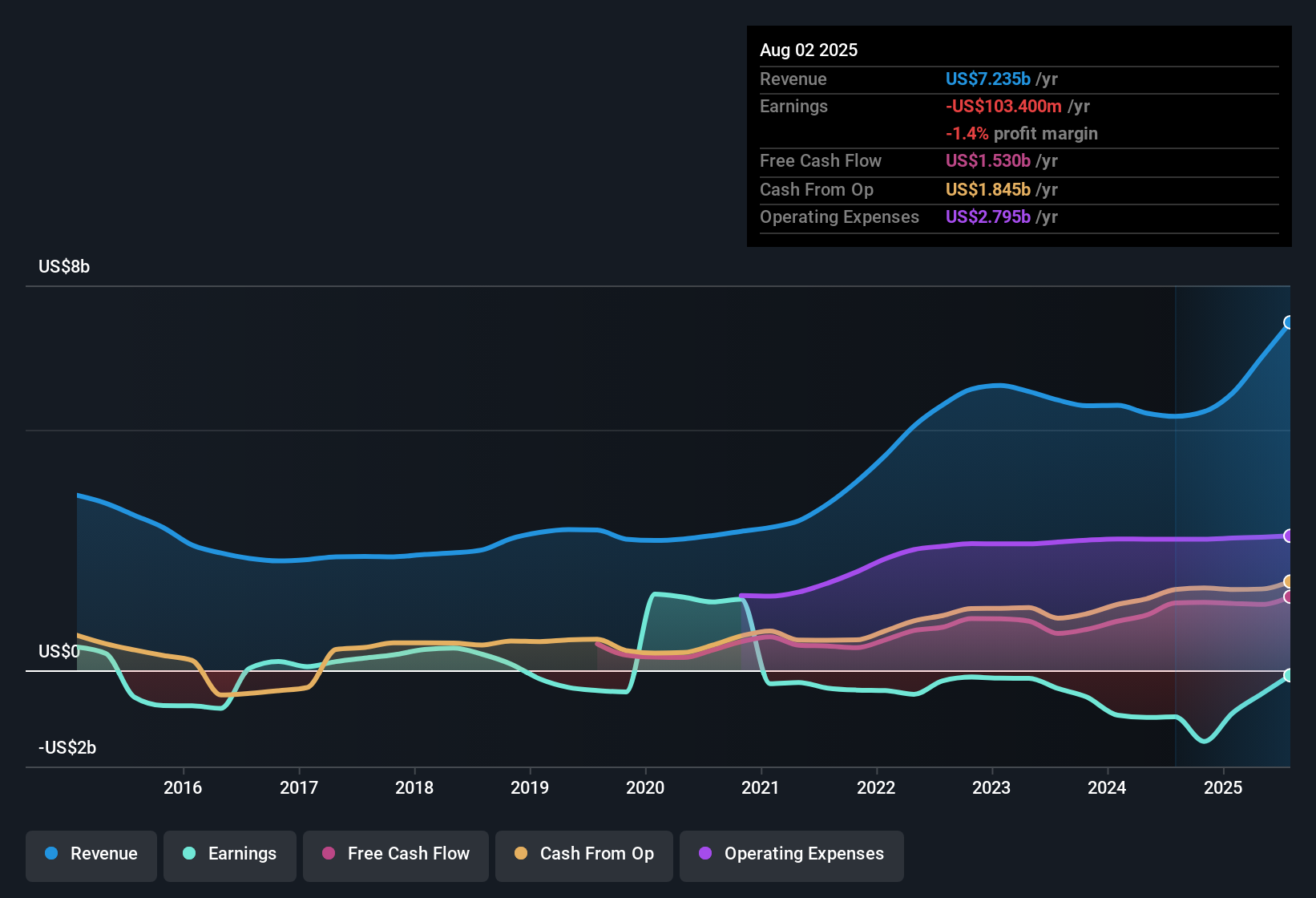

For Marvell Technology, the latest reported Free Cash Flow stands at $1.48 Billion. Analysts forecast steady growth, estimating Free Cash Flow reaching $4.23 Billion by 2030. The first five years of these projections are based on analyst consensus, with subsequent years extrapolated by Simply Wall St's methodology.

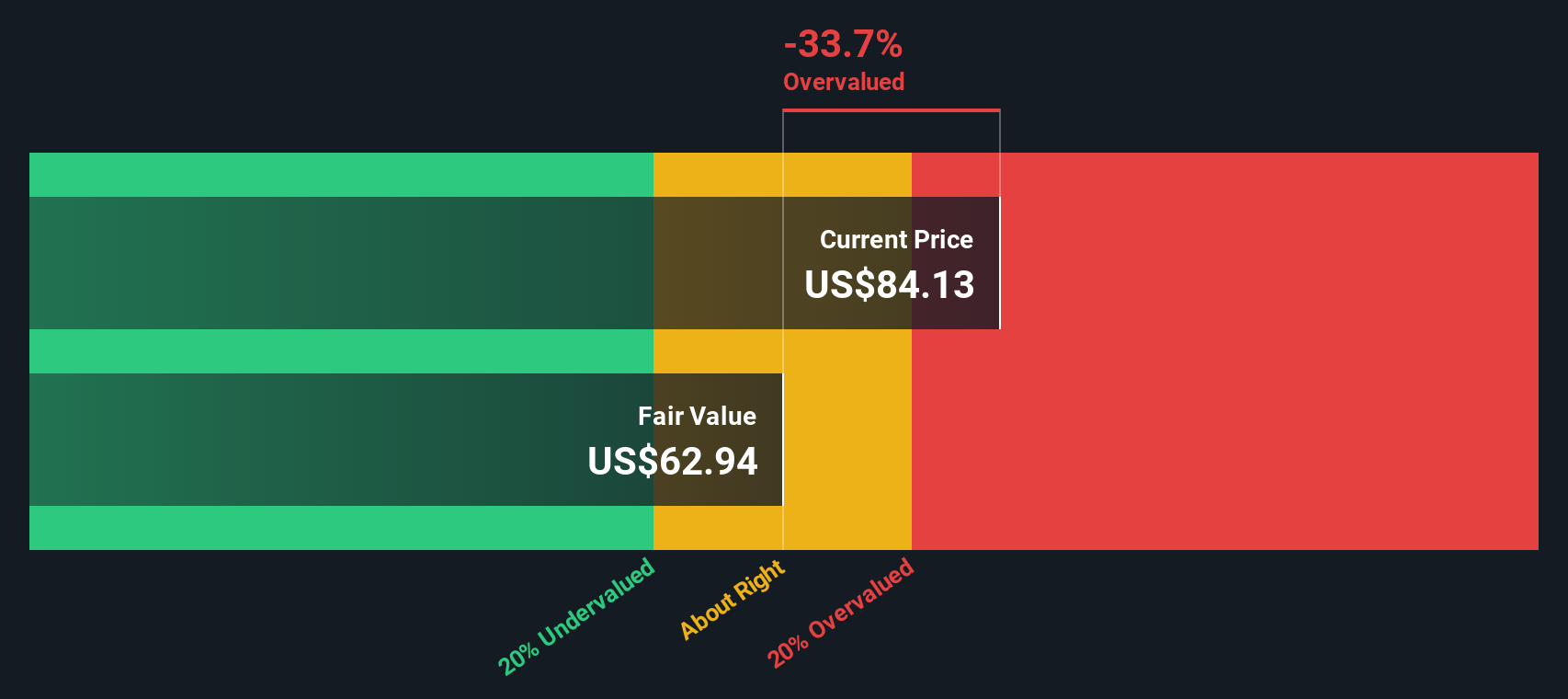

Bringing all these future cash flows back to present value, the DCF model assigns Marvell an intrinsic value of $63.27 per share. Compared to the current stock price, this means Marvell is around 44.0% overvalued at this time.

In summary, the DCF model indicates that, despite strong cash flow prospects, the stock price is running well ahead of what long-term cash generation supports today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marvell Technology may be overvalued by 44.0%. Discover 923 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Marvell Technology Price vs Sales

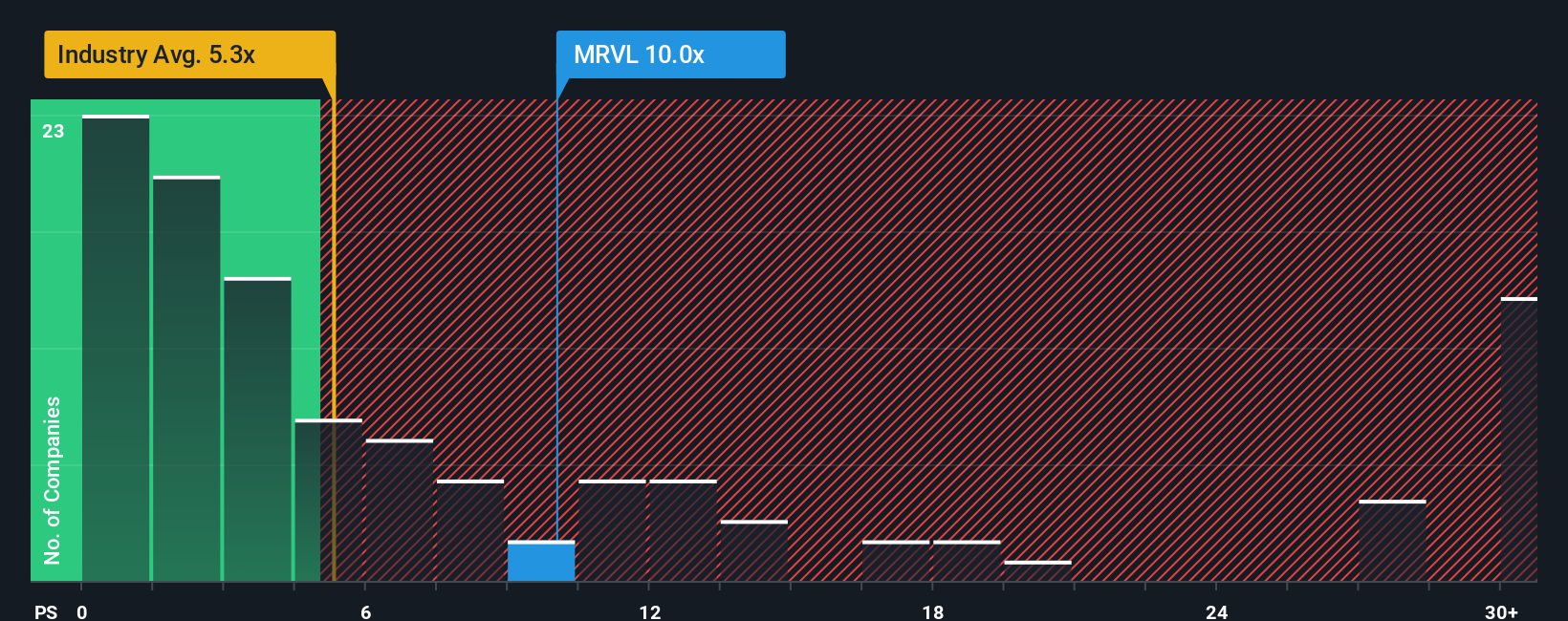

The Price-to-Sales (P/S) ratio is especially helpful for evaluating companies like Marvell Technology, which are experiencing rapid growth but may not have consistent profits or whose earnings can be impacted by large investments in research and development. By focusing on sales rather than earnings, the P/S ratio lets investors compare companies even if they are not yet highly profitable. This makes it a valuable tool for growth-oriented semiconductor firms.

Growth expectations and risk profile play a major role in what constitutes a fair P/S ratio. Fast-growing companies in high-potential sectors can justify higher multiples. Greater uncertainty or slower growth typically leads to lower ratios being considered reasonable.

Marvell Technology currently trades at a P/S ratio of 10.86x, which is more than double the semiconductor industry average of 4.82x, but still below its peer group average of 16.30x. Simply Wall St’s proprietary “Fair Ratio” model, which holistically weighs Marvell’s growth prospects, industry dynamics, profit margins, market cap, and risk factors, calculates a fair P/S ratio of 10.61x for the company.

Unlike a simple comparison to peers or the wider industry, the Fair Ratio reflects the company’s unique growth drivers and risks, providing a more balanced assessment of value. Since Marvell’s current P/S ratio and its Fair Ratio are closely aligned, the market appears to be pricing the stock appropriately based on these factors.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marvell Technology Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way to connect your perspective about a company’s future—your story—directly to its projected financial outcomes, such as fair value, future revenue, earnings, and margins. Instead of relying solely on ratios or analyst targets, Narratives let you outline the business scenario you believe is most likely. This approach links Marvell Technology’s specific opportunities, risks, and milestones to a dynamic financial forecast and a resulting valuation.

Narratives are easy to use and available to everyone on Simply Wall St’s Community page, where millions of investors create and follow them. They equip you to act with conviction, as you can compare your assumed fair value with the current share price and see at a glance if a stock fits your criteria to buy or sell.

Unlike static models, Narratives update automatically when new earnings, news, or industry developments emerge, ensuring your view stays relevant. For example, some investors may see Marvell’s potential to reach $122 per share based on accelerating AI adoption and new design wins. Others might set a much more cautious target closer to $58, reflecting concerns about customer concentration and market volatility.

Do you think there's more to the story for Marvell Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026