- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

A look at Monolithic Power Systems (MPWR)’s valuation after strong AI-driven growth and quarterly results beat expectations

Reviewed by Simply Wall St

Recent buzz around Monolithic Power Systems (MPWR) is tied to its latest quarterly beat and accelerating exposure to AI driven data centers, a combination that has pushed long term returns far ahead of the market.

See our latest analysis for Monolithic Power Systems.

The latest quarter simply reinforces a trend that has been building all year. The share price is now at $963.28, representing a robust year-to-date share price return of 62.11% and a five-year total shareholder return of 225.71%. This suggests momentum is still very much on the side of long term holders.

If MPWR’s run has you wondering what else could benefit from similar themes in AI and data, it is a good moment to explore high growth tech and AI stocks for other potential standouts.

With MPWR now trading just below analysts’ targets after a 60% plus surge this year, the key question is whether markets are already discounting its AI driven growth curve or if there is still a genuine buying opportunity ahead.

Most Popular Narrative: 18.4% Undervalued

With Monolithic Power Systems closing at $963.28 against a narrative fair value near $1,180, this framework implies meaningful upside if its assumptions hold.

The company's transformation from a chip-only semiconductor supplier to a full-service silicon-based solutions provider, and its focus on vertical, module-based, and system-level solutions, allow it to capture higher value, increase customer stickiness, and drive gross and operating margin expansion critical for long-term earnings growth. MPS has expanded its manufacturing and supply chain capacity to $4 billion in annual revenue, with significant diversification outside China, positioning it to gain share, secure supply for customers in a geopolitically sensitive environment, and take advantage of rising semiconductor content in end devices, all of which may support higher revenues and margins in future years.

Want to see the full math behind that upside call? The narrative leans on powerful revenue expansion, shifting margins, and a bold future earnings multiple. Curious?

Result: Fair Value of $1,180.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could crack if AI demand normalizes faster than expected or automotive content growth stalls, which could pressure revenue momentum and valuation.

Find out about the key risks to this Monolithic Power Systems narrative.

Another View, Market Compared

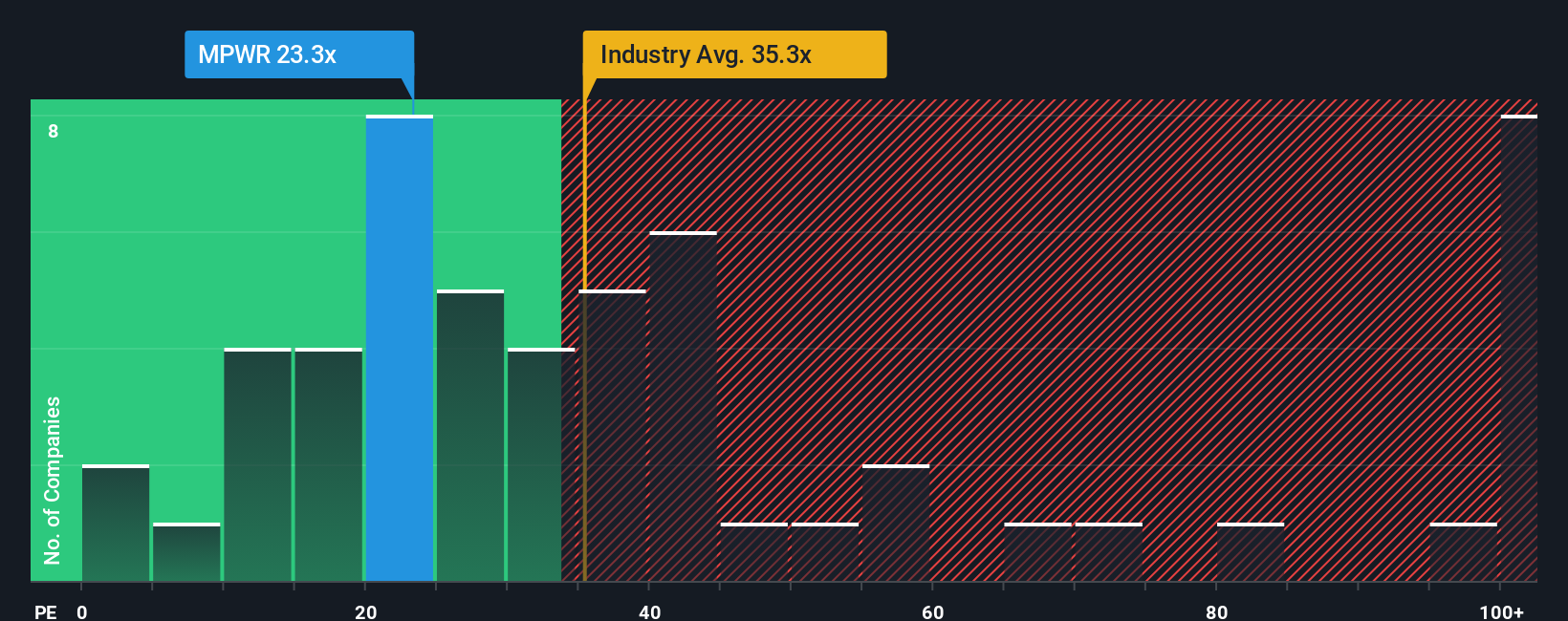

On earnings based valuation, the picture flips. MPWR trades on a 24.4x price to earnings ratio, cheaper than the US semiconductor industry at 38x and peers at 41.1x, but slightly higher than its 23.6x fair ratio estimate. This raises the question: is this a cushion or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Monolithic Power Systems Narrative

If this perspective does not quite fit your view, you can quickly dive into the numbers and craft a personalized outlook in minutes: Do it your way.

A great starting point for your Monolithic Power Systems research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next move by using the Simply Wall St Screener to uncover fresh, data driven opportunities beyond Monolithic Power Systems.

- Capture high growth potential early by scanning these 3576 penny stocks with strong financials where solid fundamentals meet compelling upside.

- Position your portfolio at the heart of the AI wave by targeting these 26 AI penny stocks shaping tomorrow’s most powerful platforms.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that combine reliable payouts with quality underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026