- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (NasdaqGS:MCHP) Launches MPLAB XC Unified Compiler Licenses For Streamlined Development

Reviewed by Simply Wall St

Microchip Technology (NasdaqGS:MCHP) experienced a 9.09% increase in its share price over the past week, coinciding with the introduction of its MPLAB® XC Unified Compiler Licenses. This development may have resonated positively within investment circles, showcasing the company's commitment to streamlining software management for developers. Despite broader market challenges, including a 3% drop in the overall market and declines in major technology stocks such as Nvidia and Tesla, Microchip Technology's performance stood out. The recent downturn in tech-heavy indices like the Nasdaq further emphasized the company's resilience amidst widespread sell-offs. By focusing on user experience and operational efficiency, Microchip has managed to distinguish itself in a volatile market, aligning growth initiatives with current embedded development needs. This upward movement in its stock price contrasted with trends affecting other technology players, reflecting investor confidence in the company's ongoing efforts to enhance its product offerings and market position.

Dig deeper into the specifics of Microchip Technology here with our thorough analysis report.

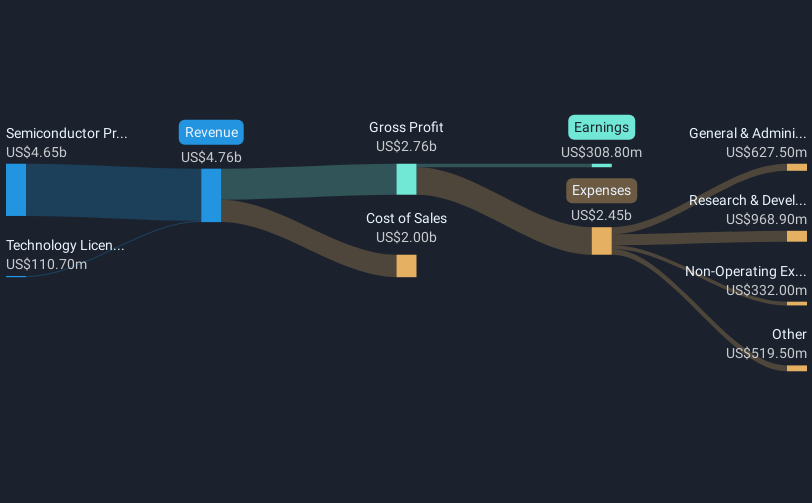

Microchip Technology's shares delivered a total return of 39.46% over the last five years. This period was marked by significant earnings growth, with annual increases of 21.8%, showcasing the company's ability to expand its profitability despite challenges. In recent years, however, performance hit setbacks, including adverse earnings growth by 86.9% over the past year, in contrast to a modest 1.6% decline in the broader semiconductor industry. During February 2025, the unveiling of innovative products like the MPLAB XC Unified Compiler Licenses underscored ongoing advancements, although earnings announcements revealed a challenging quarter with sales declining to $1.03 billion.

While Microchip's dividend yield remains moderately attractive at 2.99%, its sustainability has come into question given the expenses eclipsing earnings. This funding challenge is highlighted by the company’s high Price-To-Earnings ratio of 105.9x, which marks it as expensive when compared to the semiconductor industry average. Recent corporate developments, including advanced automotive imaging collaborations, reflect Microchip’s commitment to growth. However, the company underperformed the broader US semiconductor industry and market, which returned 31.3% and 17.8%, respectively, over the past year.

- Get the full picture of Microchip Technology's valuation metrics and investment prospects—click to explore.

- Understand the uncertainties surrounding Microchip Technology's market positioning with our detailed risk analysis report.

- Invested in Microchip Technology? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives