- United States

- /

- Semiconductors

- /

- NasdaqGS:LSCC

Lattice Semiconductor (LSCC) Is Down 13.0% After Profit Slide Despite Higher Q3 Revenue and Buybacks

Reviewed by Sasha Jovanovic

- Lattice Semiconductor Corporation recently reported its earnings for the third quarter of 2025, highlighting year-over-year revenue growth to US$133.35 million but a decline in net income and earnings per share, and also provided fourth quarter revenue guidance in the range of US$138 million to US$148 million.

- While the company completed a share buyback totaling 1,545,547 shares for US$85.85 million, profitability fell sharply compared to the previous year, despite an increase in sales during the third quarter.

- With Lattice issuing forward-looking revenue guidance, we'll explore how revised earnings expectations may shape its investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lattice Semiconductor Investment Narrative Recap

To be a shareholder in Lattice Semiconductor, you need confidence in its ability to capture long-term growth from the AI and edge computing boom, despite a heavy reliance on low-power FPGAs and competitive pressures. Recent earnings pointed to increased sales but a sharp profitability decline; while this may temper near-term enthusiasm, the forward guidance for a potential sales rebound supports the main catalyst, and the biggest risk remains revenue volatility from shifts in core end-market demand. The Q3 results don't materially change that balance.

One recent announcement closely tied to this outlook is the launch of the MachXO5-NX TDQ FPGA family, which targets secure, low-power applications demanded by AI, industrial, and automotive customers. This aligns with Lattice’s goal of driving future growth through a higher-value product mix, potentially cushioning the business against swings in legacy segment demand. Yet, amid product innovation there remains the lingering question for investors about...

Read the full narrative on Lattice Semiconductor (it's free!)

Lattice Semiconductor is forecast to achieve $764.9 million in revenue and $187.0 million in earnings by 2028. This outlook is based on analysts' assumptions of a 16.1% annual revenue growth rate and projects an increase in earnings of about $155.4 million from the current $31.6 million.

Uncover how Lattice Semiconductor's forecasts yield a $78.77 fair value, a 24% upside to its current price.

Exploring Other Perspectives

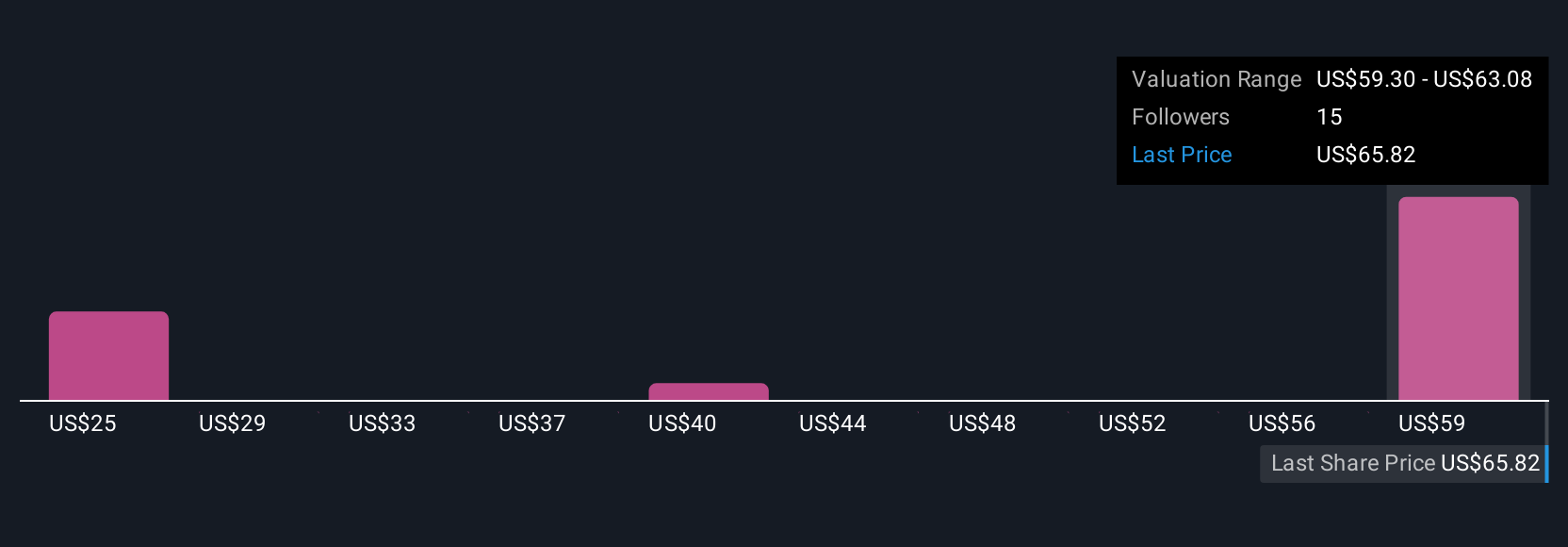

Simply Wall St Community members provided fair value estimates for Lattice Semiconductor ranging from US$26.97 to US$78.77, based on four individual forecasts. While opinions span both extremes, keep in mind the critical risk of revenue volatility as market preferences and competitive dynamics shift, be sure to consider various perspectives as you shape your own view.

Explore 4 other fair value estimates on Lattice Semiconductor - why the stock might be worth as much as 24% more than the current price!

Build Your Own Lattice Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lattice Semiconductor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lattice Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lattice Semiconductor's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSCC

Lattice Semiconductor

Develops and sells semiconductor, silicon-based and silicon-enabling, evaluation boards, and development hardware products in Asia, Europe, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives