- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Releases Xeon 6 Processors and Unveils Advanced Ethernet Solutions

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) recently witnessed a 16.51% increase in its stock price over the last month, a performance worth noting given the broader market backdrop. During this period, the company announced the release of its cutting-edge Xeon 6 processors and advanced Ethernet solutions, showcasing significant enhancements in AI and data center capabilities. Collaborations with Wind River to support its new SoC for AI and media workloads further highlighted Intel's strategic focus on cloud and edge environments. Meanwhile, the broader tech market faced a decline, with major indices like the Nasdaq falling due to investor concerns, yet Intel's positive gains indicated market confidence in its latest innovations. Speculation around Silver Lake's interest in acquiring a stake in Intel's programmable chips unit added intrigue. Additionally, Intel's stock buyback update, despite previous challenging earnings reports, may have bolstered investor sentiment, contrasting with the overall decline observed in tech-heavy indices.

Click here to discover the nuances of Intel with our detailed analytical report.

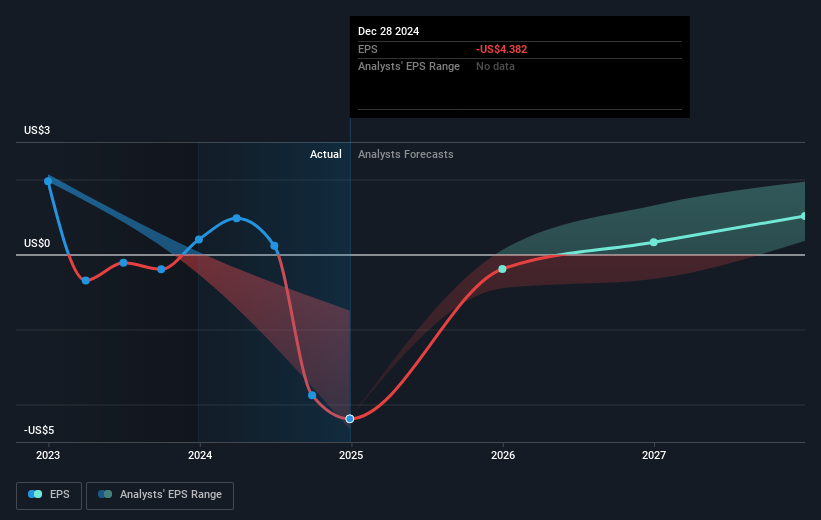

Over the past year, Intel's total shareholder return, including dividends, was a 42.96% decline, contrasting sharply with the US semiconductor industry's 31.3% gain and the broader US market's 17.8% increase. Key factors in this performance include the December 2024 retirement of Intel's CEO, triggering temporary leadership changes and possible market uncertainty. Furthermore, the company's decision in August 2024 to suspend its dividend in favor of enhancing liquidity likely impacted investor sentiment.

Another contributing factor to Intel's declining returns was the January 30, 2025, earnings announcement revealing a net loss of US$126 million and reduced revenue, spotlighting underlying market challenges. While the January 2025 debut of new processors like the Intel® Core™ Ultra 200V highlighted product advancement, persistent concerns might have overshadowed innovation gains. Speculation around February's potential acquisition of Intel’s programmable chips unit also added complexity to investor perceptions during this period.

- See how Intel measures up with our analysis of its intrinsic value versus market price.

- Gain insight into the risks facing Intel and how they might influence its performance—click here to read more.

- Shareholder in Intel? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives