- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (INTC) Valuation: Is the Recent Stock Rally Supported by Fundamentals?

Reviewed by Kshitija Bhandaru

Intel (INTC) stock has been on the move recently, prompting investors to take a closer look at performance trends and potential drivers behind the action. The past month’s sharp gain stands out, especially considering broader market dynamics.

See our latest analysis for Intel.

This latest move caps off an already strong run for Intel. Its recent 30-day share price return topped 45.79%, with a year-to-date gain of 82.20%. Momentum has clearly accelerated after a muted start, although long-term total shareholder returns still reflect some catch-up in progress.

If Intel's renewed momentum has you searching for the next breakout, you might want to discover See the full list for free.

But with shares soaring, investors are left to wonder, is Intel still undervalued at these levels, or has the recent rally already priced in the company’s future growth prospects? Could there still be a buying opportunity?

Most Popular Narrative: 42% Overvalued

Intel’s last closing price of $36.84 stands well above the narrative’s estimated fair value of $25.95. The sharp premium sets up a debate over whether the recent rally may have pulled too far ahead of analyst forecasts.

Analysts are assuming Intel's revenue will grow by 3.1% annually over the next 3 years. Analysts assume that profit margins will increase from -38.6% today to 8.9% in 3 years time.

What is driving such a bold difference between where the market prices Intel and where the narrative puts its value? The answer comes down to a set of ambitious margin gains and a future profit forecast that could transform perceptions if met. Curious about the exact financial leaps powering that price gap? Only a deeper read will reveal the surprising numbers and the logic behind this target.

Result: Fair Value of $25.95 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent manufacturing challenges and ongoing execution risks could quickly undermine the optimistic outlook that many analysts have set for Intel.

Find out about the key risks to this Intel narrative.

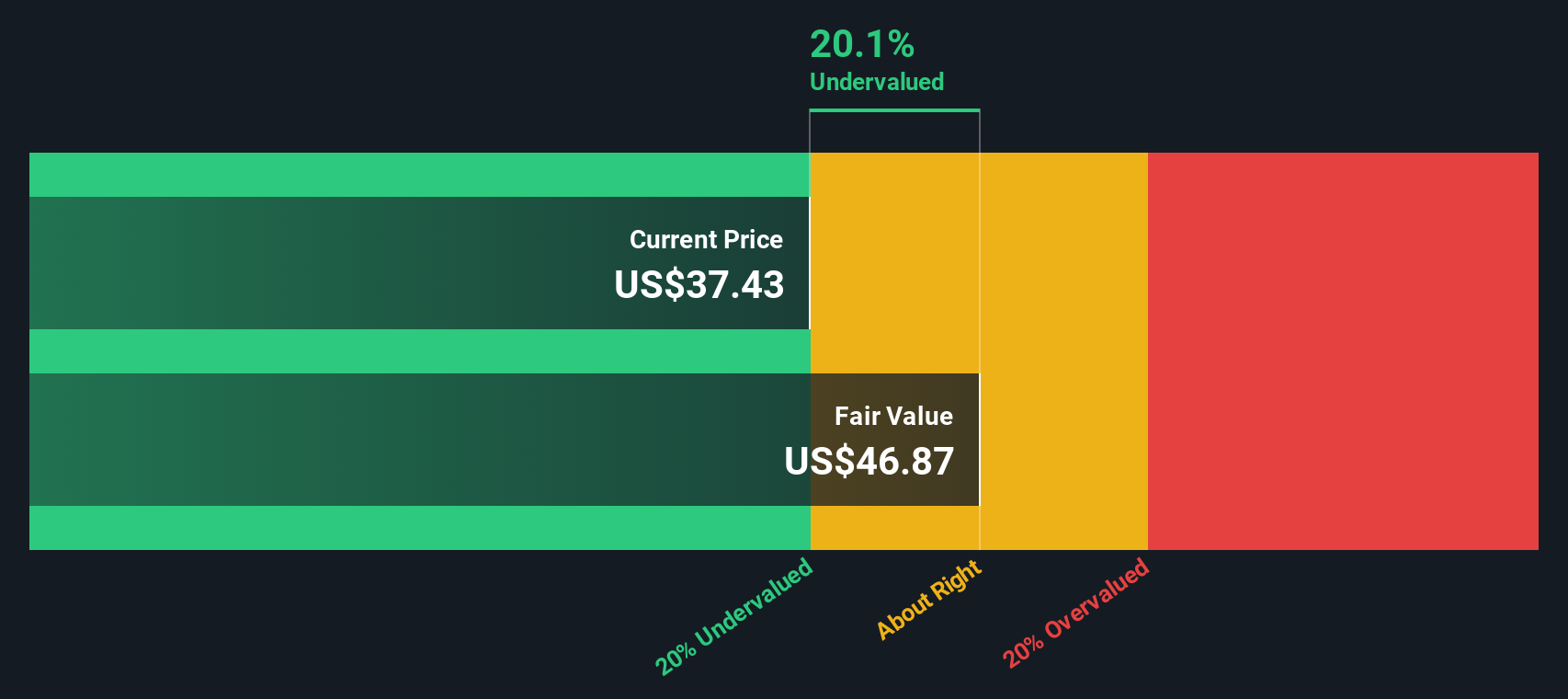

Another View: Valued Differently by Our Cash Flow Model

While the market sees Intel as overvalued based on analyst forecasts, our SWS DCF model offers a very different perspective. According to the latest cash flow analysis, Intel may actually be trading below what future cash flows suggest as intrinsic value. However, does this indicate hidden potential or simply reflect mismatched timelines?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Intel Narrative

For those who prefer digging into the numbers firsthand or see a different angle in Intel’s story, you can craft your own take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intel.

Looking for more investment ideas?

Give yourself a real edge by checking out untapped opportunities and fresh trends. Don’t miss your chance to find winning stocks before the crowd does.

- Secure steady income and glimpse tomorrow’s strong performers by scanning these 20 dividend stocks with yields > 3% with yields over 3% and robust fundamentals that most overlook.

- Accelerate your search for future innovation by targeting these 24 AI penny stocks companies that are pushing artificial intelligence into new industries and reshaping entire markets.

- Capitalize on powerful growth themes in tech by uncovering these 26 quantum computing stocks with breakthrough advancements and the potential to lead the next big wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026