- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

A Look at Intel's (INTC) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

Intel (INTC) shares moved slightly higher today as investors took stock of recent performance trends and ongoing developments within the semiconductor industry. The company’s stock has seen modest gains over the past week, bringing renewed attention from market watchers.

See our latest analysis for Intel.

Intel’s share price has experienced a strong surge lately, driven by renewed optimism about its competitive positioning, with a 10.19% gain just today and a remarkable 100.59% year-to-date share price return. While the total shareholder return over the past year sits at 68.65%, momentum appears to be building as investors focus on Intel’s turnaround signs and industry developments.

If semiconductor momentum has you thinking big, the next logical step is to discover the most exciting tech and AI stocks using our curated list: See the full list for free.

With Intel’s shares climbing so rapidly, the key question now is whether its strong gains signal further upside or if investors have already priced in the company’s recovery and future growth potential. Is there still room to buy?

Most Popular Narrative: 8.8% Overvalued

With Intel closing at $40.56 and the most widely followed narrative calculating a fair value at $37.27, today's price stands meaningfully above what future earnings projections suggest. This sets up a compelling debate about whether the rebound is justified by anticipated improvements or if optimism is running ahead of fundamentals.

Intel is focusing on flattening its organizational structure to enhance agility, make swifter decisions, and foster innovation, which could lead to improved product development and competitive advantage, positively impacting future revenue and earnings growth.

What’s behind these numbers? The future of Intel’s valuation hangs on faster earnings growth, expanding margins, and a price multiple that reflects confidence in a major business turnaround. Want to see which bold projections drive the price target? It’s all in the narrative. Dive deeper to uncover the surprising assumptions backing this outlook.

Result: Fair Value of $37.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as organizational complexity and slow adaptation to AI could still undermine Intel’s growth prospects if these issues are not effectively addressed.

Find out about the key risks to this Intel narrative.

Another View: Market Ratios Suggest Value

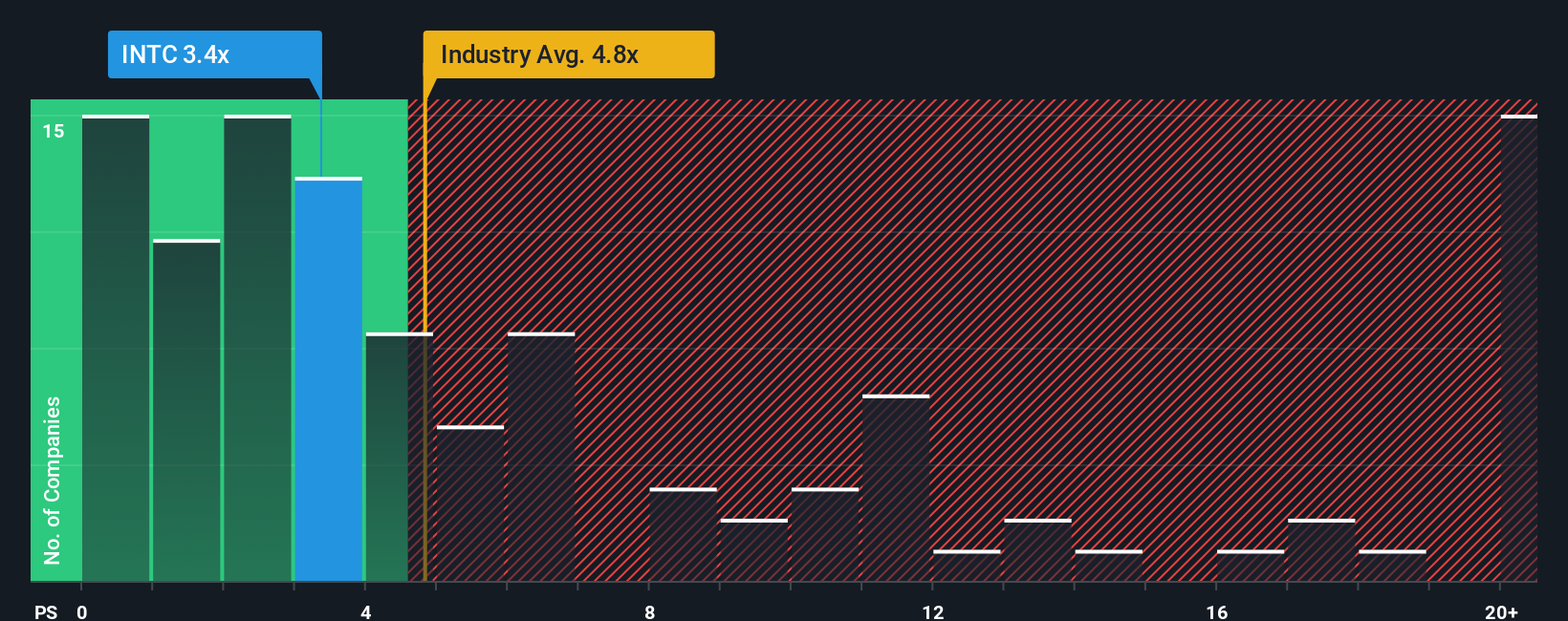

While Intel looks overvalued relative to its projected fair value, another angle tells a different story. Measured against industry peers, Intel’s price-to-sales ratio is 3.6x, which is lower than both the U.S. semiconductor average (4.8x) and the peer average (14.3x). This signals that, despite market skepticism, current trading levels could actually represent an opportunity if sentiment shifts toward these benchmarks. Could the market be missing a hidden source of value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intel Narrative

If you have a different interpretation of Intel’s outlook or want to delve into the data firsthand, you can craft your own unique perspective in just minutes. Do it your way.

A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to find high-potential opportunities beyond Intel. Your next big winner could be right around the corner on Simply Wall Street.

- Get ahead of market shifts by targeting income powerhouses through these 15 dividend stocks with yields > 3% which offers yields above 3% and sustainable growth.

- Spot undervalued gems that the market may be overlooking when you search these 914 undervalued stocks based on cash flows based on robust cash flows and fundamental strength.

- Stay at the forefront of innovation by checking out these 30 healthcare AI stocks companies transforming the healthcare sector with next-generation artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026