- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Himax Technologies (NasdaqGS:HIMX): Evaluating Valuation After WiseEye-Powered Pro Eye Monitor Debut

Reviewed by Simply Wall St

Himax Technologies (NasdaqGS:HIMX) just put its WiseEye visual AI in the spotlight, teaming with subsidiary Liqxtal to debut the Pro Eye vision care monitor ahead of the 2025 Taiwan Healthcare+ Expo.

See our latest analysis for Himax Technologies.

The WiseEye announcement lands as the share price trades around $7.74, with a 1 year total shareholder return of 33.23% contrasting with a weaker 30 day share price return of minus 16.77%. This suggests longer term momentum remains intact even as near term enthusiasm cools.

If this kind of visual AI story has your attention, you might also want to scan other high growth tech and AI stocks that could be setting up for their next move.

With WiseEye gaining traction and shares still trading at a modest discount to analyst targets, the question now is whether Himax remains undervalued or if the market has already priced in its next leg of growth.

Most Popular Narrative: 9.3% Undervalued

With the narrative fair value sitting at roughly $8.54 against a last close of $7.74, the implied upside points to a moderate mispricing story.

The proliferation of IoT, smart home, and AI integrated devices is unlocking new addressable markets for Himax's WiseEye AI offerings and ultra low power vision processors. These products are already gaining adoption across leading global brands in notebooks, smart locks, and smart access devices, supporting recurring revenues and improved net margin profiles over time.

If you want to see the framework behind that upside view, including accelerating earnings, rising margins, and a compressed future multiple brought together in one roadmap, explore the full narrative.

Result: Fair Value of $8.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and ongoing demand volatility could pressure Himax's margins and cash flows and challenge the optimistic WiseEye and automotive growth narrative.

Find out about the key risks to this Himax Technologies narrative.

Another Lens on Value

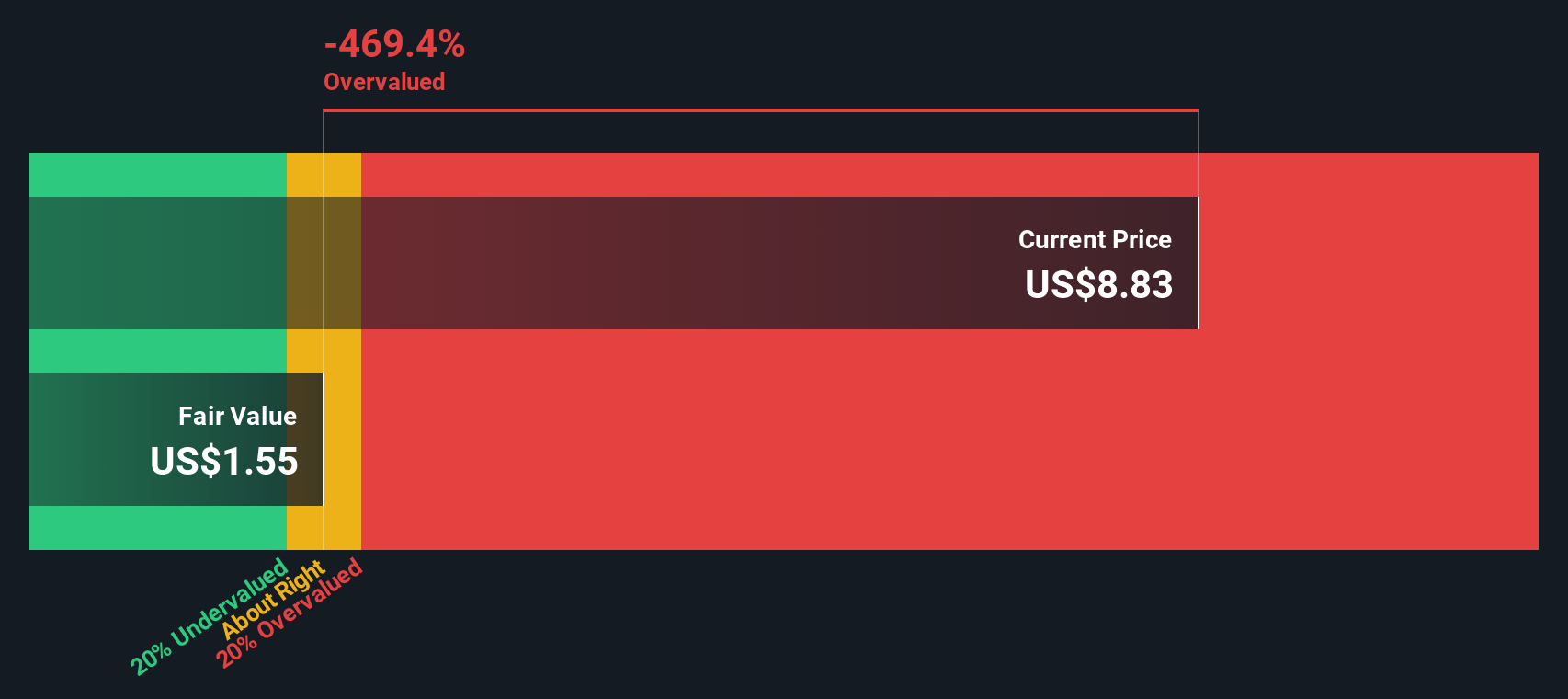

Our SWS DCF model paints a far stricter picture, suggesting fair value closer to $1.86. This implies that the current $7.74 price screens as materially overvalued on cash flows even as narratives flag upside. Is the market overestimating future growth, or are the DCF inputs too harsh?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Himax Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Himax Technologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Put your research momentum to work now and uncover new opportunities with hand picked ideas from the Simply Wall St screener before the market moves on without you.

- Target steady income potential by scanning these 14 dividend stocks with yields > 3% that can help anchor your portfolio through changing markets.

- Capitalize on innovation by reviewing these 25 AI penny stocks positioned at the front line of artificial intelligence growth.

- Sharpen your value hunting edge by focusing on these 927 undervalued stocks based on cash flows that our models flag as mispriced opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026