- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (FSLR): Evaluating Valuation After Q3 Revenue Jump and Lowered Full-Year Guidance

Reviewed by Simply Wall St

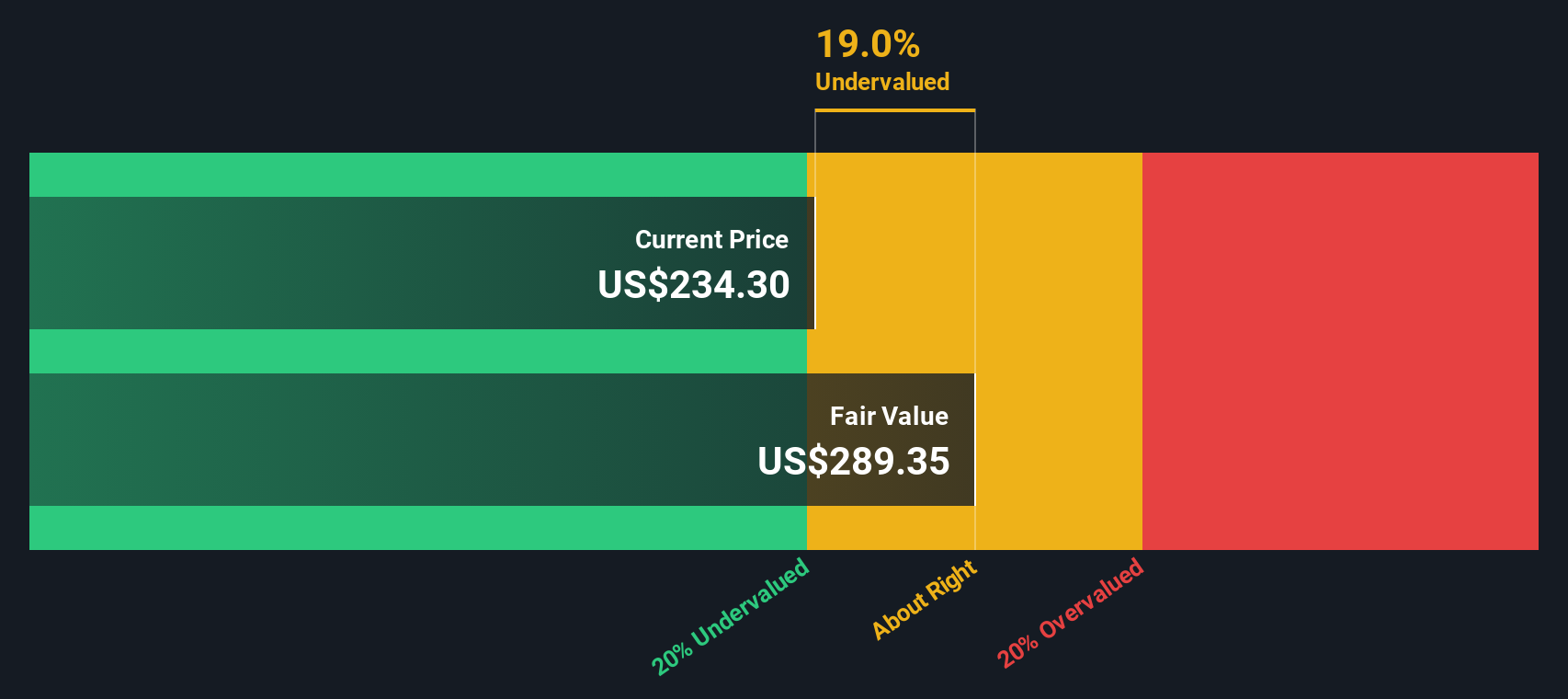

First Solar (FSLR) shares sparked fresh discussion after the company posted a sharp jump in year-over-year revenue and profits for the third quarter. However, the company tempered its full-year outlook following recent contract terminations and ongoing supply chain challenges.

See our latest analysis for First Solar.

Despite lowered full-year guidance and headline-making insider sales, First Solar’s shares have been on a tear lately, with a 20.7% share price return over the last month and an eye-catching 47.6% in the past 90 days. Longer term, momentum remains strong, as its total shareholder return has soared nearly 41% over the past year and nearly 240% over five years. This shows investors still see plenty of growth ahead, even as risks evolve.

If First Solar’s surge has you curious about what other companies might be poised for strong moves, now’s a great moment to discover fast growing stocks with high insider ownership

With First Solar delivering eye-catching returns and continuing to post strong growth, yet facing near-term headwinds and trading close to analyst targets, the big question is whether this is a genuine buying opportunity, or if future growth is already reflected in the price.

Most Popular Narrative: 5.2% Overvalued

First Solar’s share price recently climbed above the narrative fair value estimate of $259.11, with the last close at $272.64. The small premium hints at growing optimism, but the current narrative suggests investors might already be pricing in much of the good news. Below, discover one key driver behind this view.

Recent U.S. policy changes, specifically, strengthened incentives and tighter restrictions against foreign entities of concern (such as China) under the new reconciliation legislation, are boosting First Solar's competitive moat. This is supporting robust demand for domestically produced modules and enabling the company to capture higher long-term contracted pricing, directly improving forward revenue visibility and gross margins.

Want to see how surging policy support and a manufacturing boom shape this pricing power? This narrative’s fair value hinges on ambitious growth, margin gains, and a bold profit outlook. The key numbers might surprise even longtime FSLR watchers. Click in for the full valuation story.

Result: Fair Value of $259.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainty and shifting demand from major global buyers could quickly change the long-term growth story for First Solar.

Find out about the key risks to this First Solar narrative.

Another View: Our DCF Model Says Undervalued

While the market and analysts see First Solar as slightly overvalued based on price targets and recent momentum, our SWS DCF model estimates fair value at $480.90, which is over 75% above current prices. If this holds true, it could mean the real opportunity is still ahead. But which view will play out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Solar Narrative

If you have a different perspective or want to dig into the numbers yourself, building your own take takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Solar.

Looking for more investment ideas?

Don’t let hidden opportunities slip away. Staying ahead starts with the right tools. Use the Simply Wall Street Screener and uncover stocks that could supercharge your portfolio.

- Unlock income potential by checking out these 16 dividend stocks with yields > 3% with attractive yields and compelling long-term prospects.

- Capitalize on innovation and gain exposure to tech’s next wave through these 24 AI penny stocks poised for rapid growth.

- Access tomorrow’s market leaders at a discount with these 863 undervalued stocks based on cash flows already catching savvy investors’ attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives