- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

3 Stocks That Could Be Undervalued By As Much As 29.5%

Reviewed by Simply Wall St

As the Nasdaq and S&P 500 reach record highs, investors are closely watching the Federal Reserve's upcoming interest rate decision, which could influence market dynamics. In this environment of heightened anticipation and economic shifts, identifying undervalued stocks becomes crucial for those looking to capitalize on potential opportunities in the U.S. market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.00 | $13.79 | 49.2% |

| Pinnacle Financial Partners (PNFP) | $95.36 | $186.59 | 48.9% |

| Phibro Animal Health (PAHC) | $39.53 | $77.67 | 49.1% |

| Peapack-Gladstone Financial (PGC) | $29.20 | $56.54 | 48.4% |

| Northwest Bancshares (NWBI) | $12.43 | $24.41 | 49.1% |

| Investar Holding (ISTR) | $22.80 | $44.89 | 49.2% |

| Horizon Bancorp (HBNC) | $16.25 | $31.81 | 48.9% |

| Glaukos (GKOS) | $80.64 | $161.26 | 50% |

| Exact Sciences (EXAS) | $53.43 | $103.39 | 48.3% |

| AGNC Investment (AGNC) | $10.19 | $20.18 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

First Solar (FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic (PV) solar energy solutions across the United States, France, India, Chile, and other international markets with a market cap of approximately $21.63 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of CdTe solar modules, generating approximately $4.34 billion.

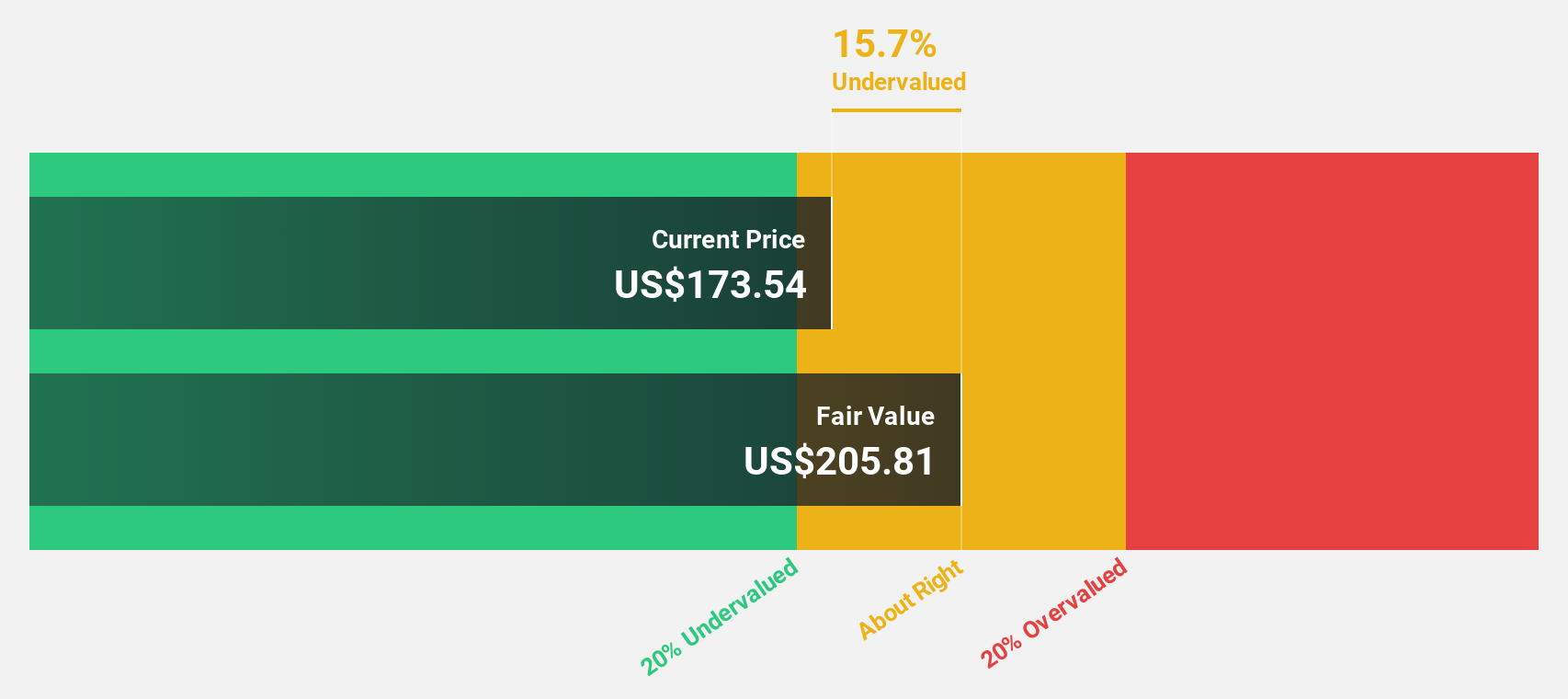

Estimated Discount To Fair Value: 29.5%

First Solar appears undervalued based on discounted cash flow analysis, trading at US$207, significantly below its estimated fair value of US$293.44. Recent agreements with 5N Plus and UbiQD enhance its supply chain and technological capabilities, supporting growth as it scales U.S. manufacturing to reach 14 GW capacity by 2026. Despite modest recent earnings growth, future profits are expected to grow significantly at 24.1% annually, outpacing the broader market's forecasted rate.

- Our growth report here indicates First Solar may be poised for an improving outlook.

- Take a closer look at First Solar's balance sheet health here in our report.

Coupang (CPNG)

Overview: Coupang, Inc. operates a retail business through mobile applications and internet websites in South Korea and internationally, with a market cap of approximately $59.09 billion.

Operations: Coupang's revenue is primarily derived from its Product Commerce segment, which generated $27.98 billion, and its Developing Offerings segment, which contributed $4.29 billion.

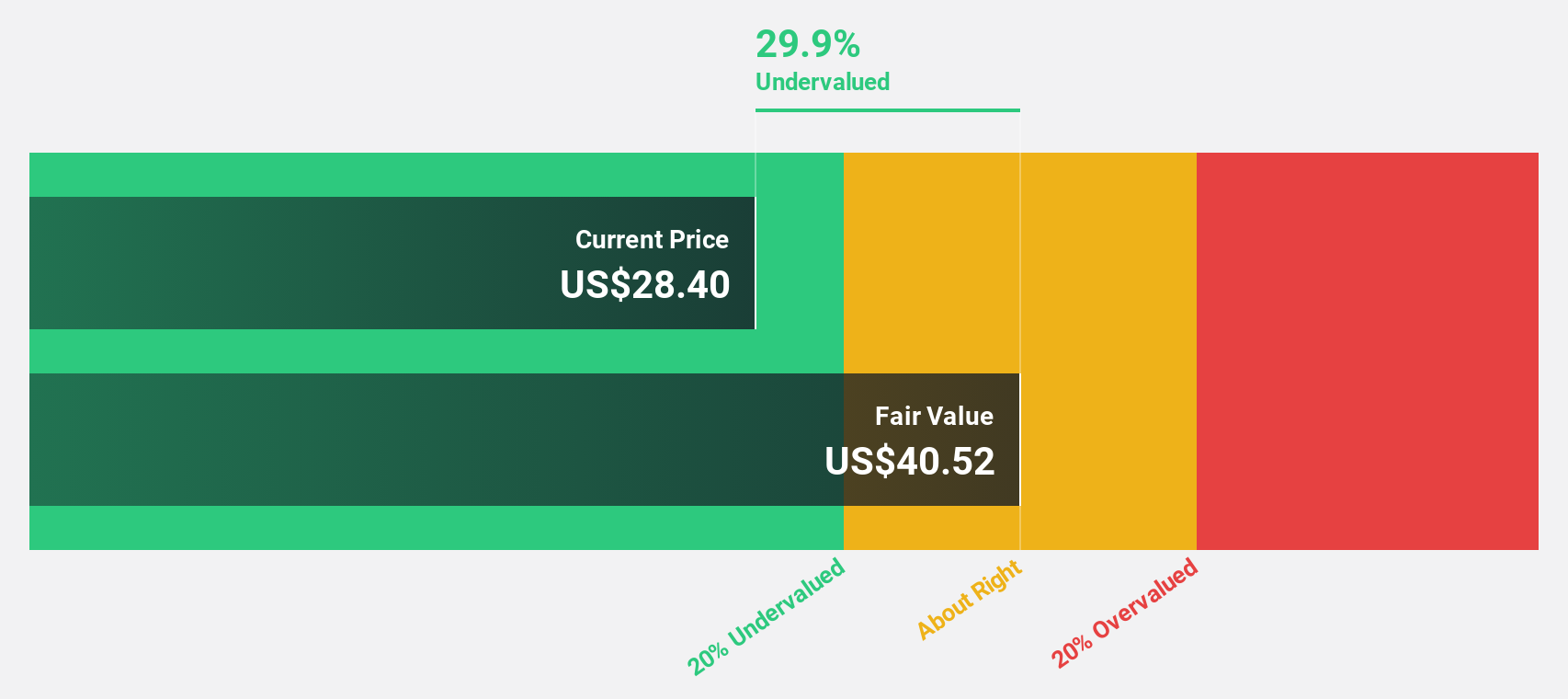

Estimated Discount To Fair Value: 28.5%

Coupang is trading at US$33.50, significantly below its estimated fair value of US$46.84, highlighting its potential undervaluation based on cash flows. The company reported strong Q2 2025 results with revenue of US$8.52 billion and a net income turnaround to US$32 million from a loss last year. Despite insider selling, Coupang's earnings are forecasted to grow substantially at 41.9% annually, surpassing the broader market's growth expectations.

- According our earnings growth report, there's an indication that Coupang might be ready to expand.

- Navigate through the intricacies of Coupang with our comprehensive financial health report here.

HubSpot (HUBS)

Overview: HubSpot, Inc. offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific, with a market cap of approximately $25.90 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling approximately $2.85 billion.

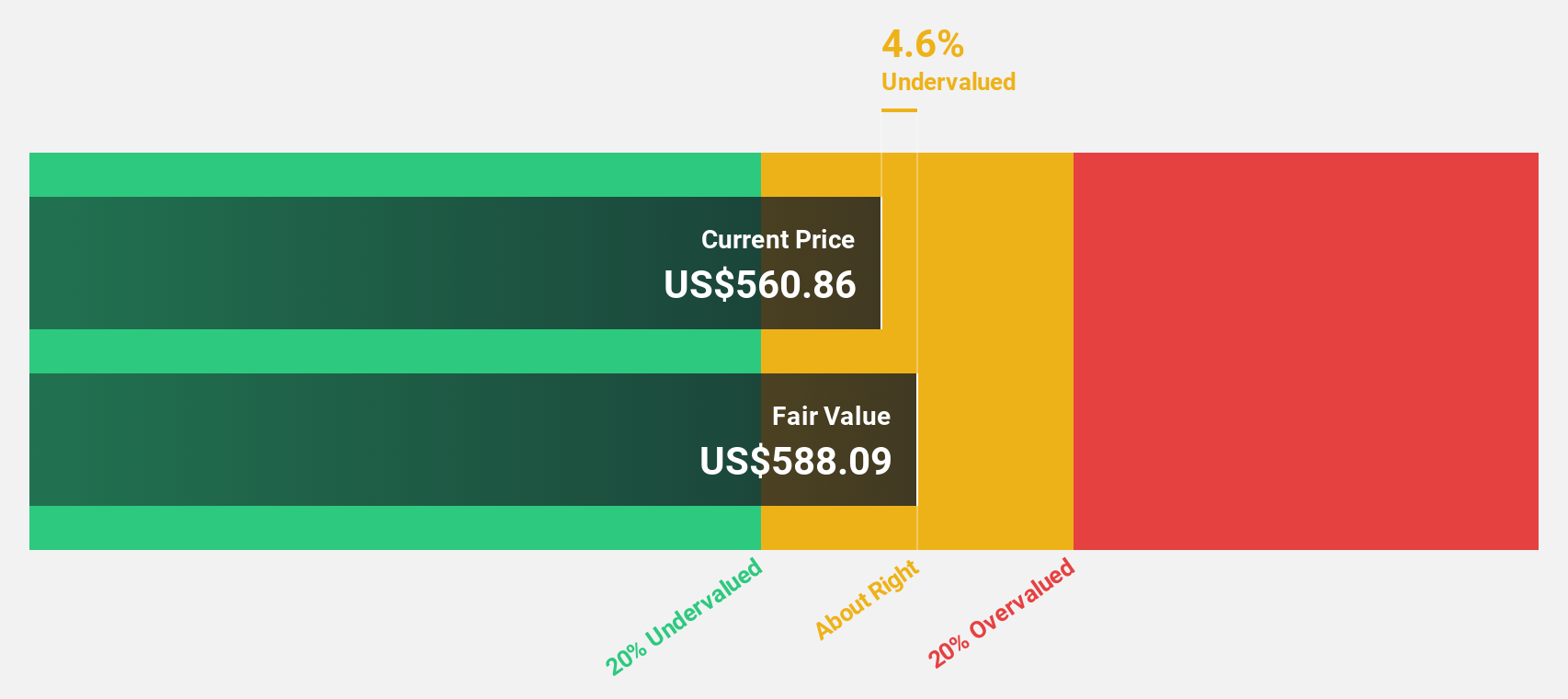

Estimated Discount To Fair Value: 11.2%

HubSpot is trading at US$508.14, slightly below its estimated fair value of US$572.25, suggesting it may be undervalued based on cash flows. Recent integrations with Talkdesk and CallRail enhance HubSpot's platform capabilities, potentially driving future growth. Despite a net loss in Q2 2025, revenue increased to US$760.87 million from the previous year, and earnings are forecasted to grow significantly annually over the next three years as profitability improves.

- Upon reviewing our latest growth report, HubSpot's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of HubSpot.

Seize The Opportunity

- Click here to access our complete index of 191 Undervalued US Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026