- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

FormFactor (FORM): Valuation in Focus After New Analyst Coverage Highlights AI and Memory Growth Drivers

Reviewed by Simply Wall St

FormFactor (FORM) is drawing new attention after a leading brokerage began covering the company. The coverage highlights FormFactor's growing presence in high-bandwidth memory and the AI chip market. Investors are watching for signs of continued margin improvement.

See our latest analysis for FormFactor.

The buzz around FormFactor goes beyond analyst coverage. Its 82% share price return over the past 90 days stands out even in a red-hot semiconductor sector. This momentum has built steadily on the back of attractive long-term fundamentals, with a 37% total shareholder return over one year and more than doubling shareholder value over the past three years. This reflects sustained growth appetite as the company sharpens its position in the AI supply chain.

Curious how other top technology companies are performing as AI demand accelerates? Now's an ideal time to explore See the full list for free.

With shares surging and fundamentals strengthening, investors must now weigh whether FormFactor’s impressive run leaves room for future upside or if the pace of growth is already reflected in the current price. Is there still a buying opportunity, or has the market priced in all the good news?

Most Popular Narrative: 5.3% Undervalued

FormFactor’s most widely followed valuation narrative puts fair value at $56.88, a modest premium to the last close. With analysts expecting margin expansion and solid growth in high-bandwidth memory, the stock’s latest gains come under the spotlight.

Accelerating adoption of generative AI, high-performance computing, and HBM DRAM in data centers is driving substantial increases in test complexity and intensity. FormFactor's differentiated probe cards and early leadership in HBM4 chiplet testing position the company to benefit from higher ASPs and revenue growth as these markets scale. (Impacts: Revenue, potential margin improvement)

Want to uncover the financial backbone of FormFactor’s current valuation? The key assumptions that drive this price target hinge on future profit margins and ambitious revenue projections. There is a calculation at play that defies conventional industry expectations. Dive into the full narrative and see what’s really moving this fair value estimate.

Result: Fair Value of $56.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that persistent margin pressure and reliance on a few major customers could quickly alter FormFactor’s positive trajectory.

Find out about the key risks to this FormFactor narrative.

Another View: Valuation Through the Lens of Market Ratios

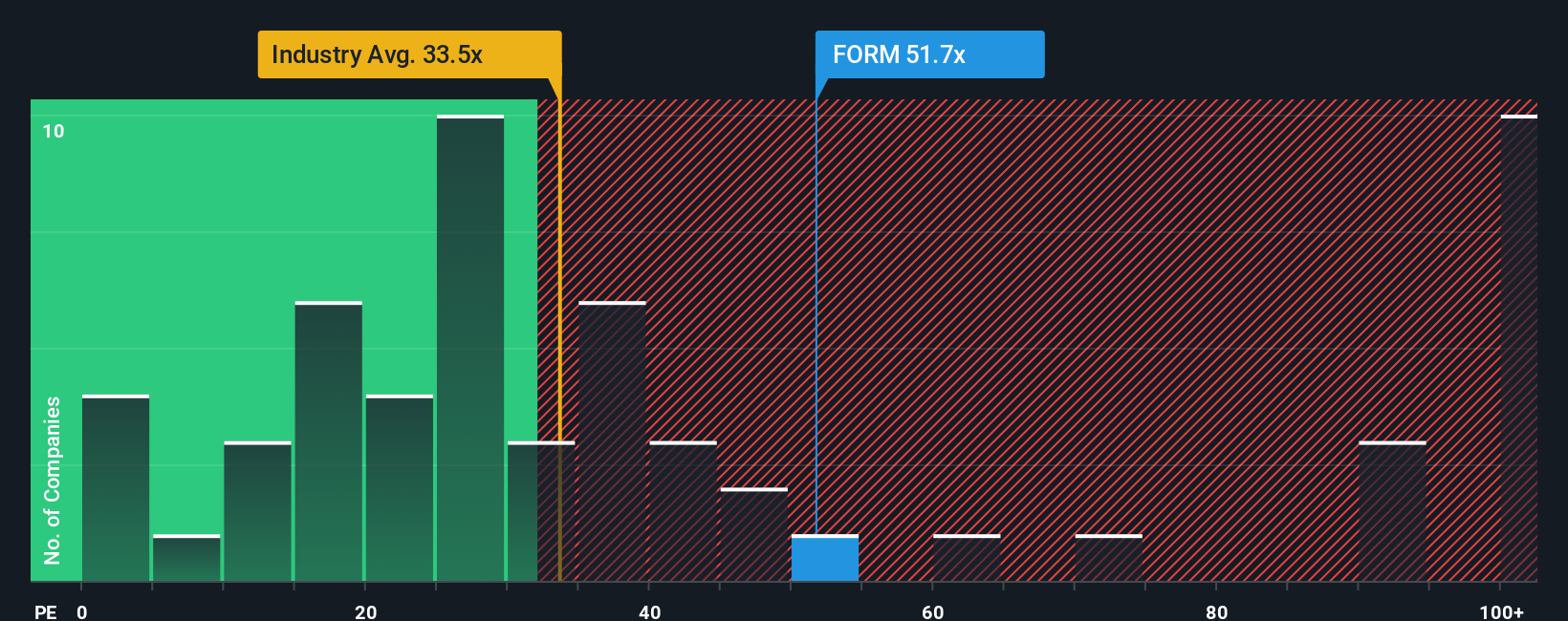

While analysts see FormFactor as modestly undervalued based on growth forecasts, its current price-to-earnings ratio stands at 102.2x. This is well above both the industry average of 35.6x and its peer average of 44.1x. It is also more than double the fair ratio of 41.5x. The gap suggests investors are paying a premium and signals valuation risk if expectations falter. Could this momentum keep justifying such a high multiple, or is the stock now outpacing its fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FormFactor Narrative

If you see the story differently or trust your own analysis, you can examine the numbers firsthand and craft your own take in just a few minutes. Do it your way

A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock the next wave of smart investing by acting now. Unique opportunities might pass you by if you stick to just one stock or sector.

- Capture rising payouts and reliable income sources by tapping into these 15 dividend stocks with yields > 3% that offer attractive yields over 3% matched with strong fundamentals.

- Experience the momentum of artificial intelligence by checking out the hottest these 25 AI penny stocks driving advancements and redefining industries right now.

- Spot undervalued market gems early and position yourself for potential upside by scanning through these 932 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success