- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Is Enphase (ENPH) Quietly Turning Into a Full-Stack Home Energy Platform With Its New EV Charger?

Reviewed by Sasha Jovanovic

- Enphase Energy recently began U.S. production shipments of its next-generation IQ EV Charger 2 and rolled out PowerMatch battery optimization technology in Europe, enhancing integration across solar, storage, and EV charging.

- Together, these launches push Enphase further into whole-home and small-business energy management, potentially increasing the usefulness of each installed system and deepening customer lock-in across its platform.

- Next, we'll examine how the IQ EV Charger 2 rollout could reshape Enphase's investment narrative around integrated, software-rich energy systems.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Enphase Energy Investment Narrative Recap

To own Enphase today, you have to believe that integrated, software-heavy solar, storage, and EV charging will matter more than near term solar headwinds and policy risk. The IQ EV Charger 2 rollout and PowerMatch launch reinforce that ecosystem story, but they do not change the most important short term catalyst, which is a recovery in residential demand, or the biggest current risk around execution on rapid product launches.

Among recent announcements, the US$68 million safe harbor agreement for IQ9 microinverters stands out as most relevant, because it ties Enphase’s product pipeline directly to policy-linked demand and potential domestic content benefits. Together with the IQ EV Charger 2 and PowerMatch, it shows how future offerings like bidirectional charging and next generation inverters sit right at the intersection of electrification catalysts and Enphase’s execution risk.

But while the product roadmap looks promising, investors should be aware that rapid-fire launches plus elevated inventory could...

Read the full narrative on Enphase Energy (it's free!)

Enphase Energy's narrative projects $1.6 billion revenue and $232.0 million earnings by 2028. This requires 3.0% yearly revenue growth and about a $57 million earnings increase from $174.7 million today.

Uncover how Enphase Energy's forecasts yield a $38.85 fair value, a 24% upside to its current price.

Exploring Other Perspectives

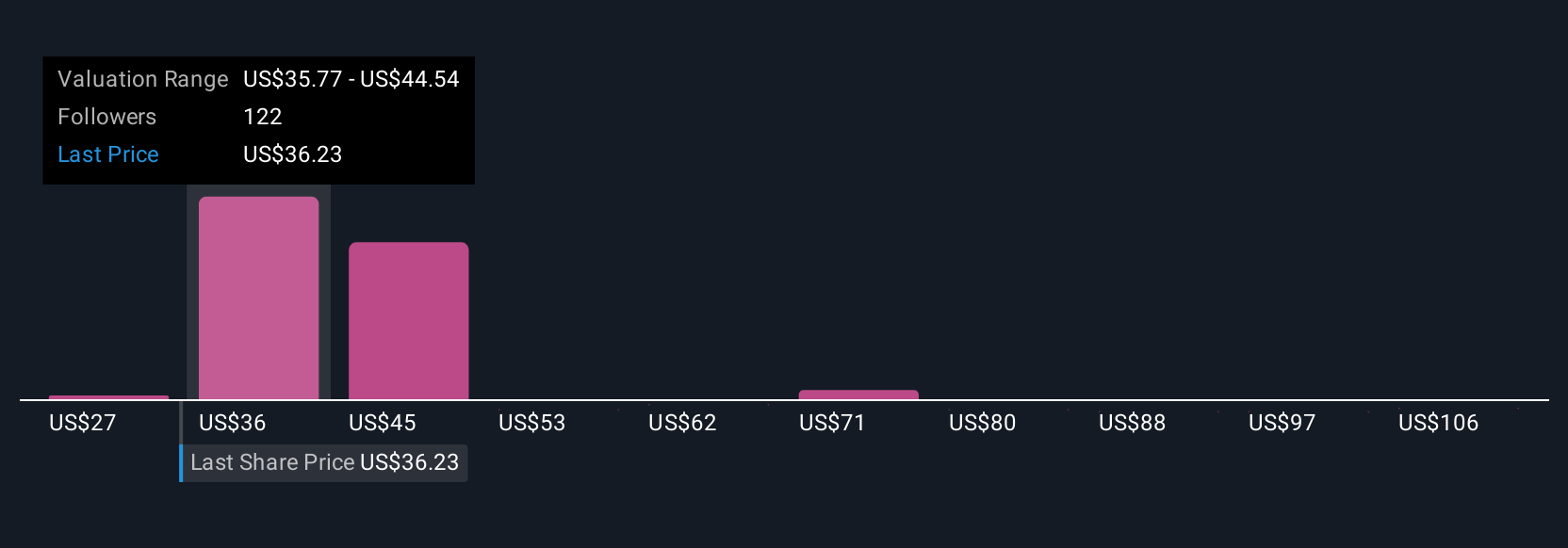

Sixteen members of the Simply Wall St Community currently value Enphase between US$28.32 and US$70.42 per share, showing wide disagreement on upside. When you set those views against policy uncertainty and execution risk around the new EV charger and PowerMatch, it becomes even more important to weigh several different outlooks before deciding how this business might perform.

Explore 16 other fair value estimates on Enphase Energy - why the stock might be worth 9% less than the current price!

Build Your Own Enphase Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enphase Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enphase Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enphase Energy's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026