- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (ENPH) Is Up 6.3% After Major Gas Station Solar Wins and New Incentives

Reviewed by Sasha Jovanovic

- In recent days, Enphase Energy reported widespread adoption of its IQ8 Microinverters for global gas station solar installations and its IQ Battery systems becoming eligible for San Diego Community Power’s Solar Battery Savings program, offering upfront rebates and performance incentives to residential customers.

- This expansion highlights how Enphase’s advanced safety, domestic manufacturing, and incentive-qualifying features are driving adoption across both critical commercial and residential markets.

- We'll explore how Enphase’s growing footprint in gas station solar projects impacts its investment narrative and opportunities for new incentive-driven demand.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Enphase Energy Investment Narrative Recap

To be a shareholder in Enphase Energy, you have to believe that the global adoption of distributed solar and battery technology, supported by product safety, advanced features, and eligibility for incentive programs, can outweigh structural risks such as a contracting US residential solar market and inventory headwinds. Recent news of Enphase’s IQ8 Microinverters gaining momentum in global gas station installations and its batteries qualifying for lucrative local rebates may support the company’s search for alternative growth opportunities, but these developments do not fundamentally alter the dominant risk posed by potential declines in US residential demand or oversupply as 2026 approaches.

One highly relevant announcement is that Enphase IQ Battery systems are now eligible for San Diego Community Power’s Solar Battery Savings program, adding financial incentives for residential adoption. This further emphasizes the importance of new regulatory-driven demand channels and incentive structures as near-term catalysts that can partially offset expected domestic market contraction, helping the company diversify its revenue base and maintain adoption despite core market uncertainties.

But against this more optimistic backdrop, investors should be aware that ongoing elevated microinverter inventory levels signal potential oversupply pressures that may impact earnings if...

Read the full narrative on Enphase Energy (it's free!)

Enphase Energy's outlook projects $1.6 billion in revenue and $232.0 million in earnings by 2028. This scenario requires a 3.0% annual revenue growth and an increase of $57.3 million in earnings from the current $174.7 million.

Uncover how Enphase Energy's forecasts yield a $40.38 fair value, a 31% upside to its current price.

Exploring Other Perspectives

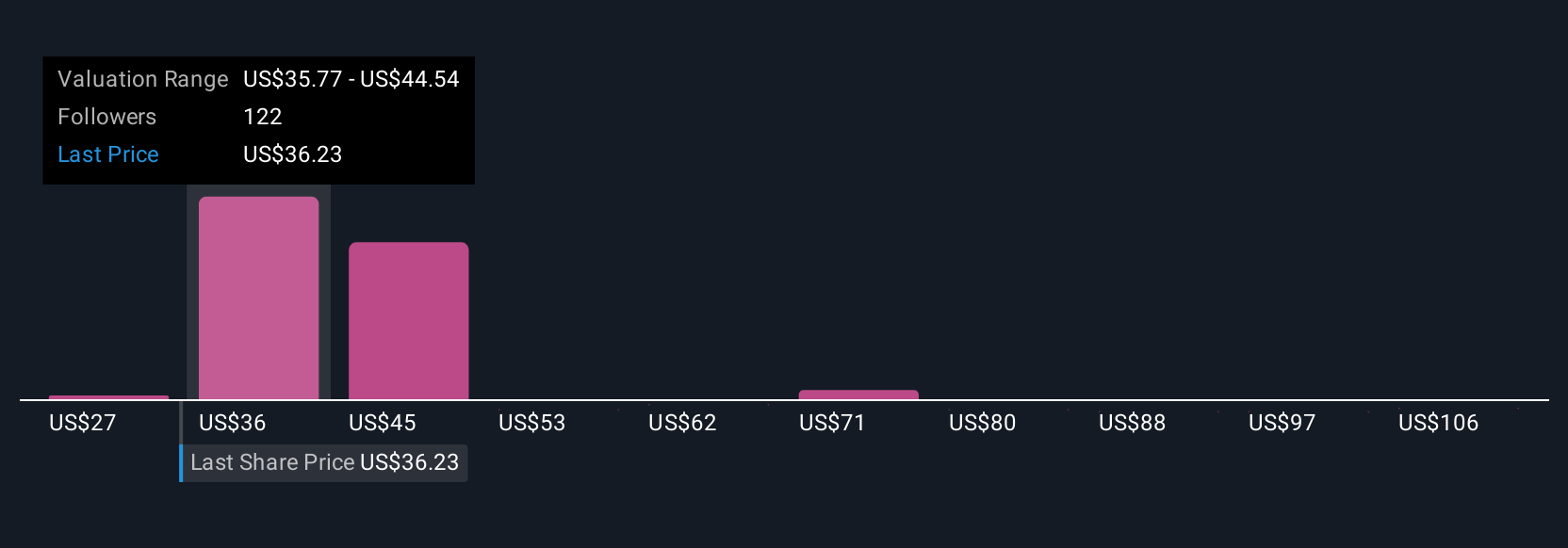

Simply Wall St Community members have published 15 fair value estimates for Enphase Energy, from US$28.32 to US$70.42 per share. Many see opportunity in subsidy-driven growth, but the risk of inventory oversupply remains front of mind as you compare these diverse outlooks.

Explore 15 other fair value estimates on Enphase Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Enphase Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enphase Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enphase Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enphase Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives