- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

Diodes (DIOD): Assessing Valuation After New AP61406Q Automotive Power Converter Launch

Reviewed by Simply Wall St

Diodes (DIOD) just rolled out its AP61406Q automotive DC-DC buck converter, a compact, programmable power chip aimed at infotainment, instrument clusters, telematics, and ADAS, giving investors another data point on its auto strategy.

See our latest analysis for Diodes.

The AP61406Q launch comes as Diodes’ 7 day share price return of 13.78% has injected some welcome momentum into a stock whose 1 year total shareholder return is still negative at 13.49%. This hints that sentiment may be stabilizing rather than surging.

If this kind of targeted auto exposure appeals to you, it could be worth scanning other listed auto chip and component players via our auto manufacturers and comparing how their growth stories stack up.

Yet with shares still down double digits over the past year despite solid revenue and earnings growth, investors have to ask: Is Diodes quietly undervalued here, or is the market already pricing in its next leg of automotive driven expansion?

Most Popular Narrative Narrative: 10.4% Undervalued

With Diodes last closing at $52.58 versus a most popular narrative fair value near $58.67, the valuation hinges on aggressive profit recovery and richer future multiples.

Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs). This supports higher average selling prices and future margin expansion.

Strategic focus on new product introductions, especially in high-margin analog, mixed-signal, and power management segments, positions Diodes to benefit from product mix improvement. This should translate into structurally higher gross and operating margins over time.

Curious how moderate revenue growth, sharply higher margins, and a reset earnings multiple supposedly add up to that upside target? The narrative’s projections might surprise you.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated inventory and heavy Asia exposure mean that any demand wobble or geopolitical shock could quickly challenge the upbeat, automotive-driven thesis.

Find out about the key risks to this Diodes narrative.

Another Angle on Value

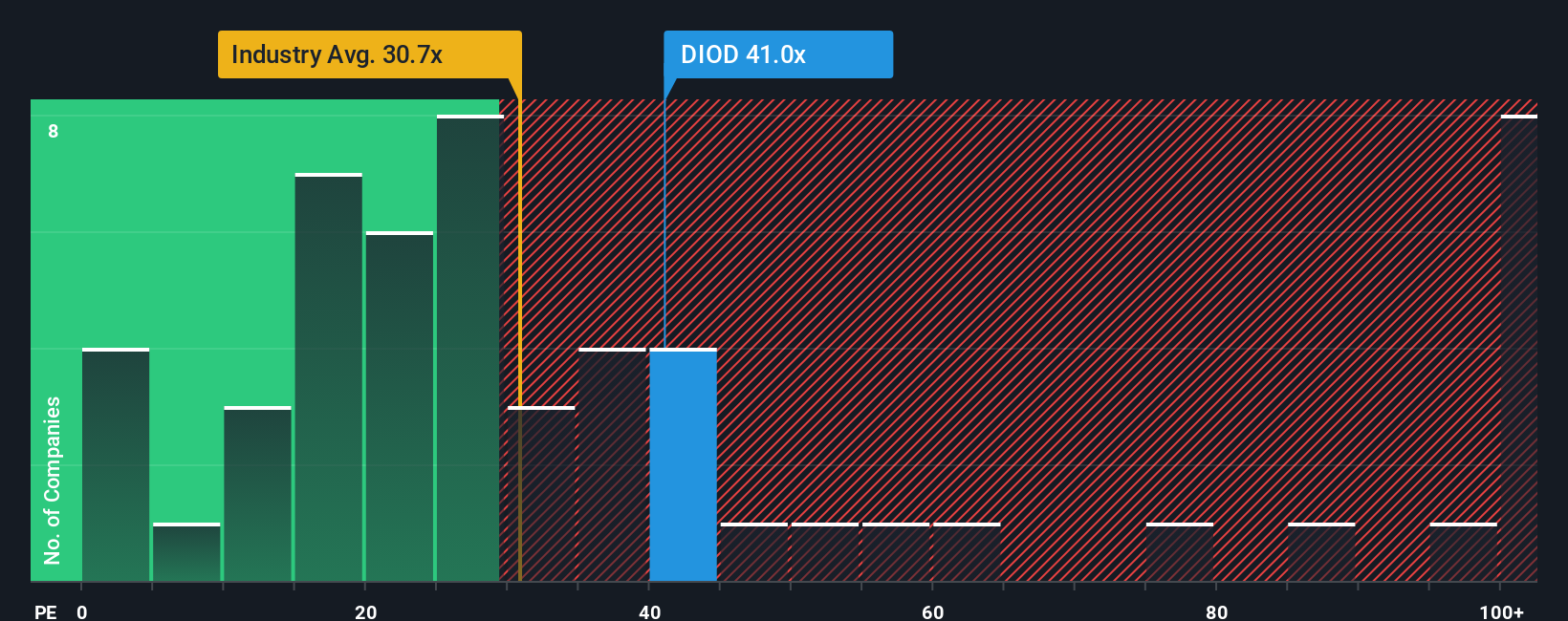

While the popular narrative leans on future earnings growth, today’s price already embeds a rich 38x earnings multiple versus the US semiconductor average of 37.5x. Even if a fair ratio of 42.9x suggests some upside, that premium leaves little room for execution slip ups, does it not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diodes Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your Diodes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to actively hunt for stocks that fit your style before the market wakes up.

- Look for potential multi-baggers early by scanning these 3576 penny stocks with strong financials that pair tiny share prices with strengthening fundamentals and improving business momentum.

- Position your portfolio for the next wave of innovation by targeting these 26 AI penny stocks shaping automation, data intelligence, and software powered disruption.

- Focus on these 15 dividend stocks with yields > 3% that combine meaningful yields with balance sheets built to sustain payouts through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026