- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

A Fresh Look at Diodes (DIOD) Valuation Following Launch of Automotive LED Display Controller

Reviewed by Simply Wall St

Diodes (DIOD) has just launched the AL3069Q, a high-efficiency boost controller designed for automotive LED displays. With features including a broad voltage range and advanced safety measures, this move signals Diodes' deeper push into the fast-evolving automotive electronics space.

See our latest analysis for Diodes.

Diodes’ push into automotive tech comes after a challenging stretch for shareholders, with a 1-year total return of -28.3% and a five-year total return of -34.4%. While the share price bounced 6.9% over the past week, in part on renewed optimism following product news, the broader momentum remains muted in 2024 as investors reassess the company’s growth outlook and risk profile.

If the recent innovation in auto displays caught your attention, it might be worth exploring what’s happening in the automotive tech sector more broadly. Check out See the full list for free.

With the stock trading well below its analyst target and showing only modest recent gains, investors now face a critical question: is Diodes uniquely undervalued at these levels, or is the market correctly pricing in future risks and rewards?

Most Popular Narrative: 21.4% Undervalued

With Diodes' narrative fair value pegged at $58.67, the latest close of $46.11 leaves notable upside potential and presents an optimistic outlook from analysts and consensus forecasts.

Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs). This supports higher average selling prices and future margin expansion. A strategic focus on new product introductions, especially in high-margin analog, mixed-signal, and power management segments, positions Diodes to benefit from product mix improvement. This could translate into structurally higher gross and operating margins over time.

Ever wondered what bold financial assumptions justify such a big valuation gap? The narrative hints at aggressive profit targets and future margins that could catch investors by surprise. Ready to see how these numbers play out and why the narrative's fair value defies market caution?

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on cyclical consumer demand and high exposure to Asian markets could quickly challenge the optimistic case for Diodes’ future profitability.

Find out about the key risks to this Diodes narrative.

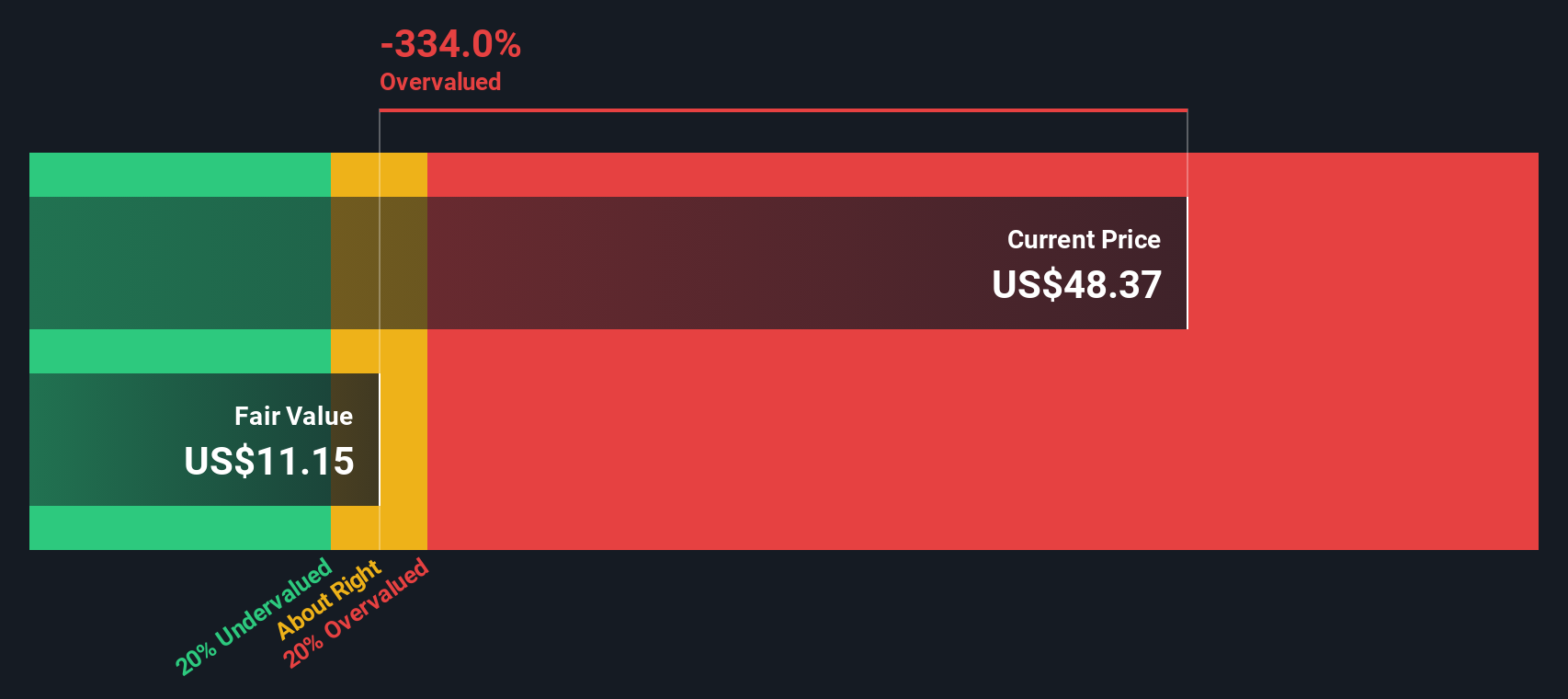

Another View: Discounted Cash Flow Says Overvalued

Looking at Diodes through the lens of the SWS DCF model, a different picture emerges. The DCF approach puts fair value at $27.69, which is below the current price of $46.11. According to this method, Diodes appears overvalued and this challenges the optimism of analyst price targets. Which model do you trust, and what does this tension signal about future returns?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diodes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 100+ undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diodes Narrative

If you’re not convinced by the current viewpoints or want to dig into the details yourself, you can quickly craft your own narrative using the available data. Do it your way.

A great starting point for your Diodes research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Fresh opportunities are waiting for you beyond Diodes. Don’t let the market move ahead without you. This is your chance to compare, analyze, and spot your next potential stock idea.

- Uncover growth trends and small-cap potential when you check out these 3578 penny stocks with strong financials, which highlights resilience in rapidly changing sectors.

- Tap into the future of healthcare by exploring these 30 healthcare AI stocks, where medical breakthroughs intersect with cutting-edge artificial intelligence.

- Maximize your income with these 15 dividend stocks with yields > 3%, featuring companies with yields above 3% and strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026