- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Is Canadian Solar’s (CSIQ) New U.S. JV a Strategic Shift in Its North American Ambitions?

Reviewed by Sasha Jovanovic

- In December 2025, Canadian Solar Inc. announced it will resume direct oversight of its U.S. operations by launching CS PowerTech, a majority-owned joint venture focused on North American manufacturing and sales of solar modules, cells, and advanced energy storage systems.

- The move to reshoring, including about US$50 million in related-party asset acquisitions and new American joint ventures, aims to deepen Canadian Solar’s North American footprint and build a more resilient, transparent domestic supply chain.

- Next, we’ll examine how this renewed U.S. manufacturing push and joint venture structure could influence Canadian Solar’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Canadian Solar Investment Narrative Recap

To own Canadian Solar, you need to believe the company can convert its global manufacturing footprint and growing storage business into durable profits despite thin margins and intense price competition. The CS PowerTech reshoring plan may support the short term catalyst of improving North American project visibility, but it also reinforces the biggest near term risk around higher capital needs and potential pressure on cash flow and margins.

Earlier in 2025, Canadian Solar opened a new global headquarters in Ontario, reinforcing its North American identity and linking local operations with its global manufacturing and storage platform. Seen together with the CS PowerTech venture, these moves tie the company more tightly to North American policy trends and may amplify both the potential benefits and uncertainties around U.S. incentives and regulatory guidance.

However, investors should be aware that rising supply chain and manufacturing costs could still...

Read the full narrative on Canadian Solar (it's free!)

Canadian Solar’s narrative projects $8.0 billion revenue and $201.9 million earnings by 2028.

Uncover how Canadian Solar's forecasts yield a $23.33 fair value, in line with its current price.

Exploring Other Perspectives

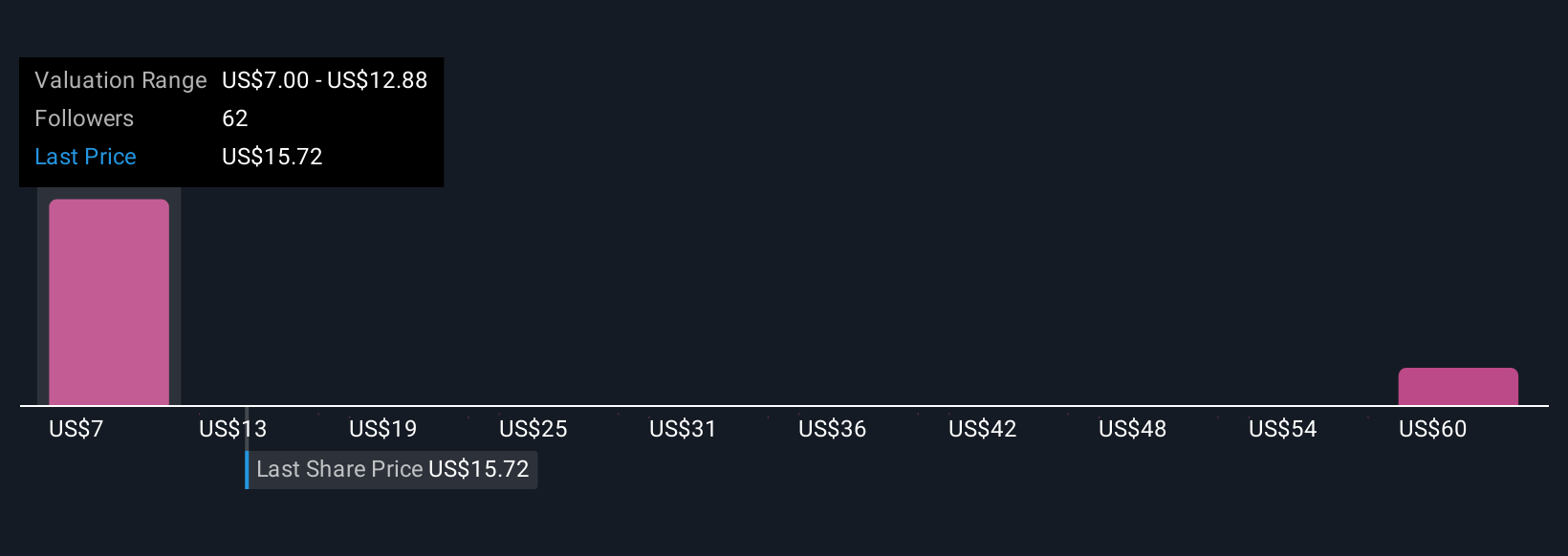

Six members of the Simply Wall St Community value Canadian Solar between US$7 and about US$57.94, highlighting how far apart individual views on fair value can be. You should weigh those opinions against the risk that heavy U.S. manufacturing investment and reshoring spend could strain free cash flow and influence how the business copes with future policy or cost shocks.

Explore 6 other fair value estimates on Canadian Solar - why the stock might be worth less than half the current price!

Build Your Own Canadian Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Canadian Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Solar's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026