- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Canadian Solar (NasdaqGS:CSIQ) Valuation Spotlight After Major North America Expansion and Growth Strategy Unveiling

Reviewed by Simply Wall St

Canadian Solar (NasdaqGS:CSIQ) just laid out a sweeping strategy to expand its North American presence. The company announced new joint ventures, a major U.S. subsidiary, and the purchase of overseas assets to strengthen local manufacturing.

See our latest analysis for Canadian Solar.

Canadian Solar’s announcement arrives amid strong market momentum, as evidenced by a notable 128.82% year-to-date share price return and a 178.28% surge over the last 90 days. While the stock’s 1-year total return stands at 119%, longer-term total shareholder returns remain negative, highlighting a dramatic turnaround that has captured investor attention in recent months.

If this level of growth has you curious about what else might be on the rise, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After such a steep rally, investors may be wondering whether Canadian Solar’s shares still offer room to run or if the market has already priced in the next chapter of growth, leaving limited upside ahead.

Most Popular Narrative: 26.6% Overvalued

The narrative sees Canadian Solar’s fair value at $21.76, a significant discount to the last close of $27.55. This highlights a notable gap between investor optimism and what the mainstream narrative considers justified.

“Bullish analysts highlight Canadian Solar's strong third quarter results and improved 2026 guidance for battery energy storage systems, which are seen as key engines for future growth and margin expansion. The robust rally in Canadian Solar's stock since the second quarter is attributed to optimism around increased demand from data centers and growing momentum for battery solutions in the broader clean energy transition.”

Ever wondered which bold financial leaps and growth trends analysts are counting on to back this eye-catching valuation? One assumption could flip the script entirely. The numbers beneath the surface might surprise you, but only if you dig into the full narrative for yourself.

Result: Fair Value of $21.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing policy uncertainty in the U.S. and rising costs across the supply chain could quickly change the outlook for Canadian Solar's future growth.

Find out about the key risks to this Canadian Solar narrative.

Another View: What Does the DCF Model Say?

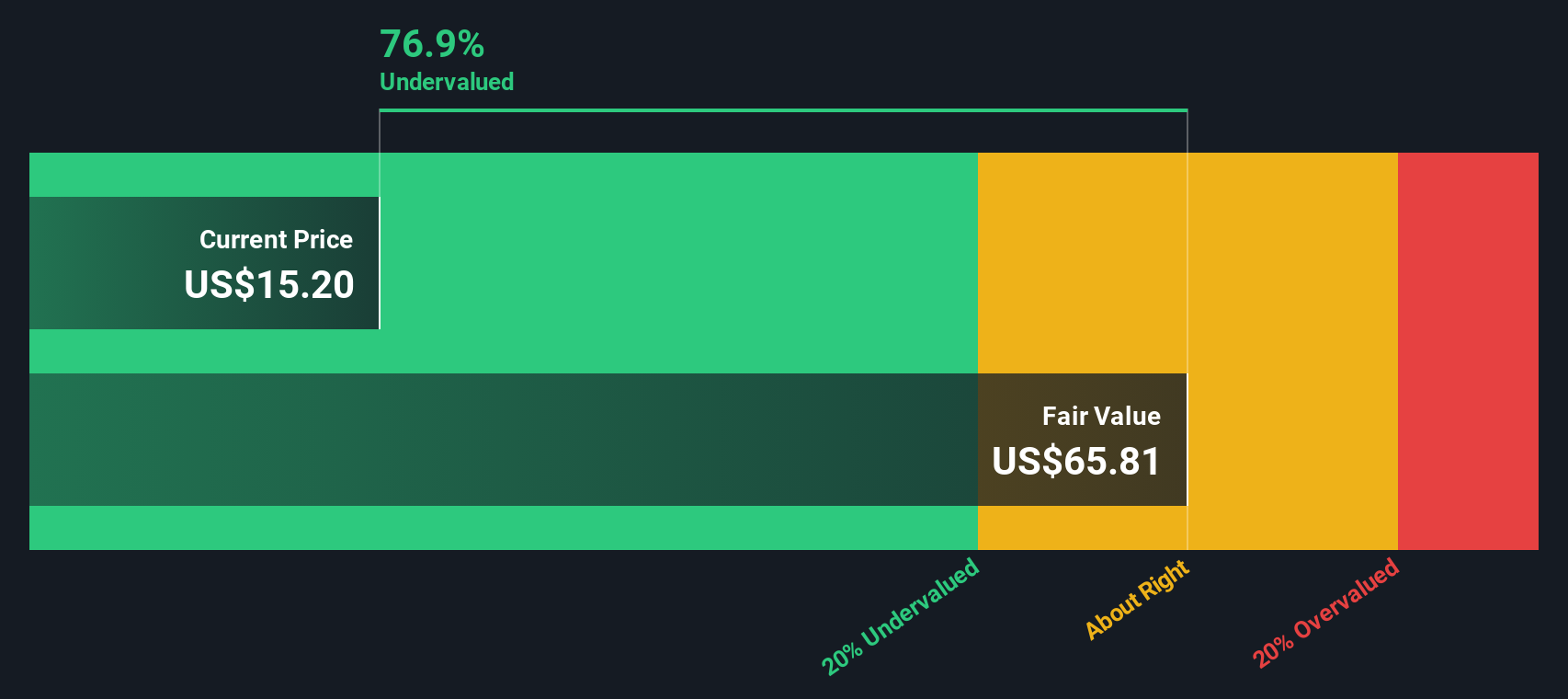

Switching perspectives, our SWS DCF model produces a very different outcome. While the multiples approach flags Canadian Solar as overvalued, the DCF model suggests the shares are actually trading nearly 53% below their intrinsic value. This points to a potential opportunity if long-term assumptions hold true.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canadian Solar Narrative

If this analysis doesn’t match your outlook or you want to dig deeper into the numbers, you can build your own view in just a few minutes. Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not limit themselves to a single stock. Uncover more opportunities using curated lists built around growth, innovation, and smart value searching.

- Tap into future-defining technologies by reviewing these 25 AI penny stocks to see which companies are set to shape tomorrow’s markets and transform how industries operate.

- Unlock potential value and strong fundamentals in overlooked companies through these 927 undervalued stocks based on cash flows if you are seeking to get ahead of the crowd.

- Maximize your passive income strategy by selecting from these 14 dividend stocks with yields > 3% with yields above 3%, allowing your portfolio to work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026