- United States

- /

- Semiconductors

- /

- NasdaqGS:CRUS

Can Cirrus Logic’s (CRUS) Share Buybacks and Earnings Growth Shape Its Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- Cirrus Logic recently announced its second quarter and half-year financial results, reporting increases in both sales and net income compared to the prior year, along with updated guidance for next quarter and completion of a substantial portion of its previously announced share buyback program.

- Management's continuation of the share repurchase initiative, alongside improved operating results, may reflect confidence in future business prospects and capital allocation priorities.

- We'll examine how Cirrus Logic's robust earnings performance this quarter could influence its ongoing business diversification and investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cirrus Logic Investment Narrative Recap

To be a shareholder in Cirrus Logic, one needs to believe the company can reduce its heavy reliance on flagship smartphone customers and meaningfully grow in areas like PCs, automotive, and new mixed-signal applications. The recent strong earnings report underscored solid operating momentum and management’s consistent capital allocation, but it does not materially alter the immediate catalyst: whether diversification efforts will materially change the company’s revenue mix, or the key risk: exposure to large customer order swings, which remains high.

Of the latest announcements, the updated third quarter revenue guidance stands out as most relevant. With management forecasting US$500 million to US$560 million in sales, investor attention turns to whether Cirrus Logic can sustain recent profitability amidst market normalization and potential customer demand fluctuations, a central factor for both near-term results and longer-term investment conviction.

By contrast, what investors should also be aware of is the heightened revenue volatility if key customers scale back orders, especially since...

Read the full narrative on Cirrus Logic (it's free!)

Cirrus Logic's outlook anticipates $1.9 billion in revenue and $295.7 million in earnings by 2028. This reflects a -0.3% annual revenue decline and a $54.4 million decrease in earnings from the current level of $350.1 million.

Uncover how Cirrus Logic's forecasts yield a $130.83 fair value, a 9% upside to its current price.

Exploring Other Perspectives

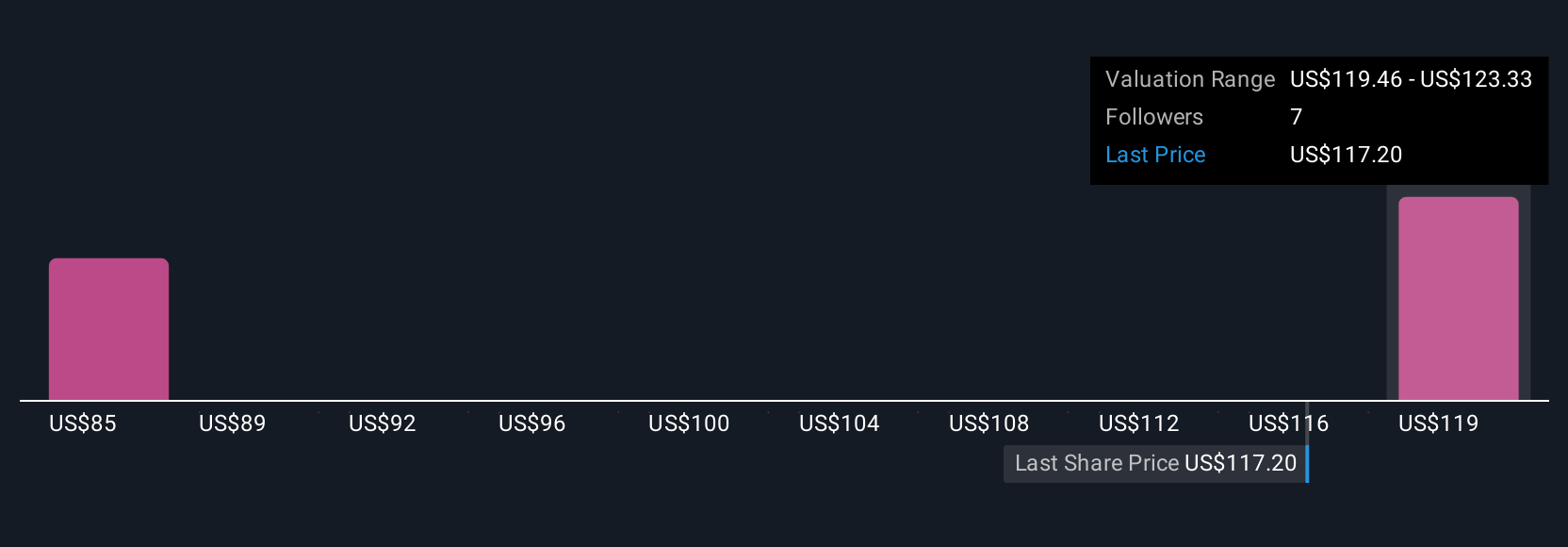

Retail investors in the Simply Wall St Community valued Cirrus Logic between US$76.27 and US$130.83 across 3 different forecasts. With broad expectations around diversification, be aware that these perspectives reflect how widely beliefs on future growth and risk can differ.

Explore 3 other fair value estimates on Cirrus Logic - why the stock might be worth 37% less than the current price!

Build Your Own Cirrus Logic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cirrus Logic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cirrus Logic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cirrus Logic's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRUS

Cirrus Logic

A fabless semiconductor company, develops mixed-signal processing solutions and audio products in China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives