- United States

- /

- Insurance

- /

- NYSE:ARX

Insider-Owned Growth Leaders To Watch In December 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed performance with major indices like the Dow and S&P 500 nearing record highs, investors are closely monitoring economic indicators such as upcoming inflation data that could influence Federal Reserve decisions on interest rates. In this environment of cautious optimism, growth companies with high insider ownership stand out as intriguing opportunities, offering potential resilience and alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Credo Technology Group Holding (CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet and PCIe applications across the United States, Taiwan, Mainland China, Hong Kong, and internationally with a market cap of approximately $32.68 billion.

Operations: Credo Technology Group Holding Ltd's revenue is primarily derived from its semiconductor segment, which generated $796.13 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 28.0% p.a.

Credo Technology Group Holding, while experiencing significant insider selling recently, is poised for robust growth with revenue expected to increase by 24.2% annually and earnings projected to grow at 28% per year. The company has just turned profitable, reporting a net income of US$82.64 million in Q2 2025 compared to a loss previously. Despite high share price volatility, Credo's innovations like the Weaver memory fanout gearbox and ZeroFlap optical transceivers highlight its commitment to advancing AI infrastructure capabilities.

- Navigate through the intricacies of Credo Technology Group Holding with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Credo Technology Group Holding's shares may be trading at a premium.

Accelerant Holdings (ARX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelerant Holdings (ticker: ARX) operates a data-driven risk exchange that connects specialty insurance underwriters with risk capital partners, with a market cap of $3.14 billion.

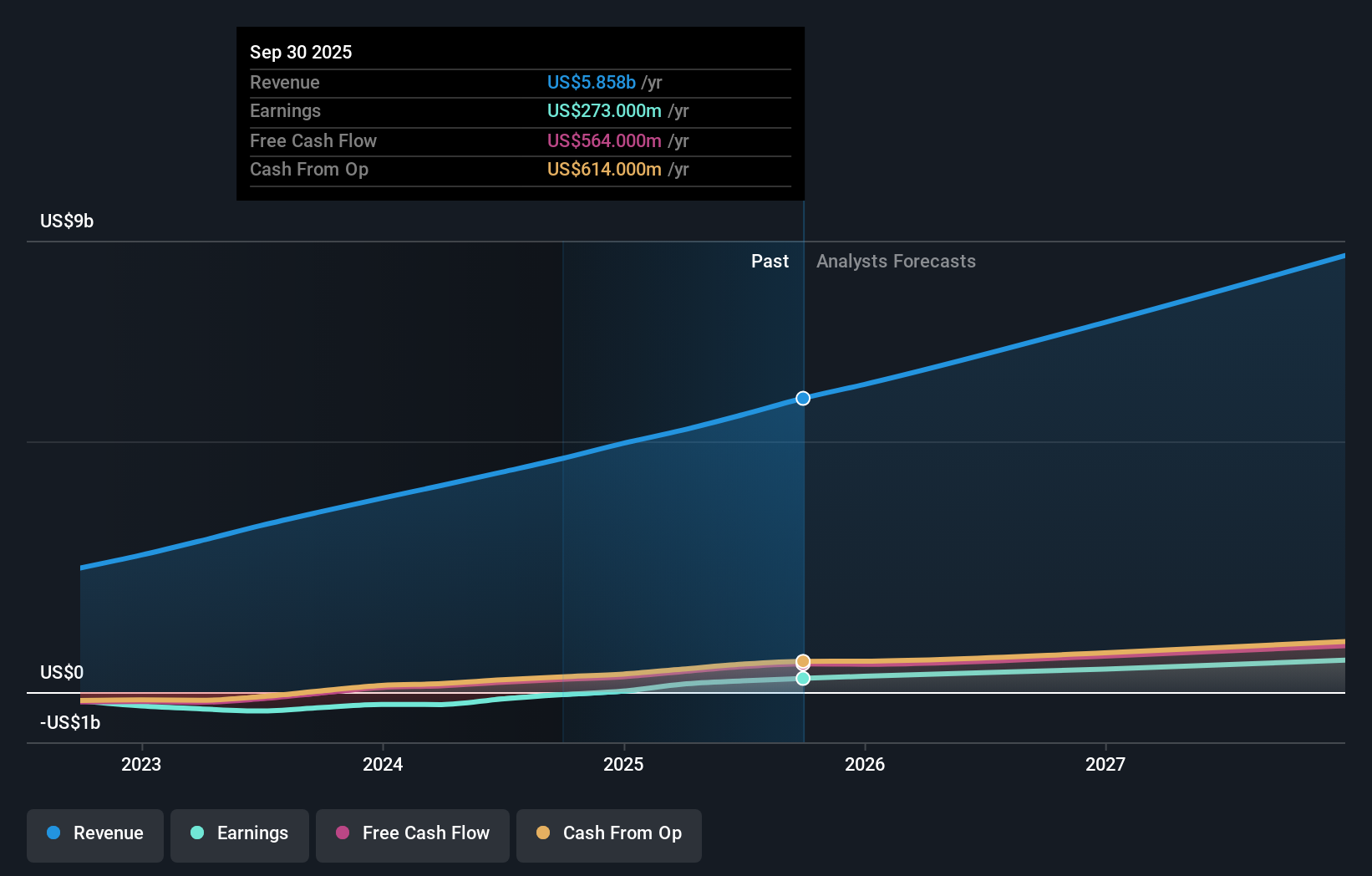

Operations: The company's revenue is derived from three primary segments: Underwriting at $380.90 million, MGA Operations at $198.60 million, and Exchange Services at $302.10 million.

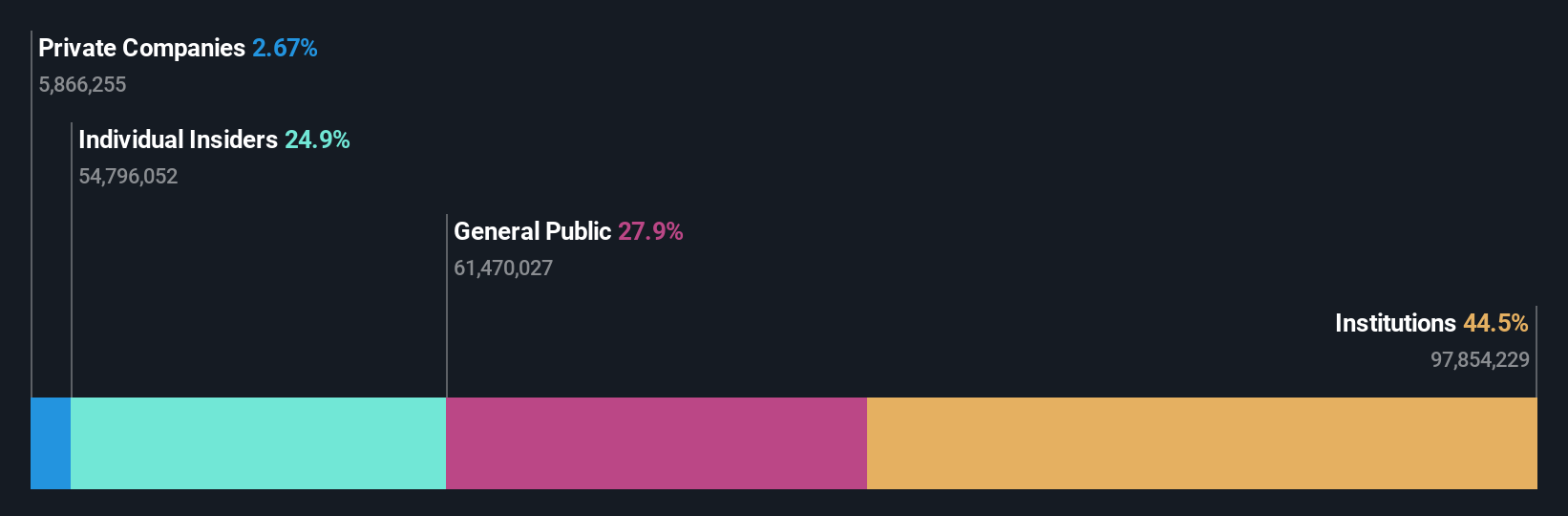

Insider Ownership: 25%

Earnings Growth Forecast: 103.4% p.a.

Accelerant Holdings is experiencing substantial revenue growth, with recent third-quarter figures reaching US$267.4 million, up from US$153.7 million the previous year. Despite a significant net loss of US$1,439.7 million, insider buying indicates confidence in future prospects. The company's strategic partnership with AF Specialty enhances its risk capital capacity and access to high-rated financial backing. While earnings are forecasted to grow significantly at 103.37% annually, profitability is expected within three years, outpacing market averages.

- Delve into the full analysis future growth report here for a deeper understanding of Accelerant Holdings.

- In light of our recent valuation report, it seems possible that Accelerant Holdings is trading beyond its estimated value.

Toast (TOST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Toast, Inc. provides a cloud-based digital technology platform for the restaurant industry across various countries and has a market cap of $20.68 billion.

Operations: Toast's revenue is primarily generated from its data processing segment, which amounts to $5.86 billion.

Insider Ownership: 17.8%

Earnings Growth Forecast: 28.9% p.a.

Toast has demonstrated strong growth potential with recent profitability and revenue of US$1.63 billion in Q3 2025, up from US$1.31 billion a year prior. Despite limited insider buying, the strategic partnerships with TGI Fridays and Uber highlight its expansion capabilities in restaurant technology. Analysts forecast significant earnings growth at 28.9% annually, surpassing market averages. The company's share buyback indicates confidence in its valuation as it continues to innovate with AI solutions like Toast IQ for operational efficiency.

- Click to explore a detailed breakdown of our findings in Toast's earnings growth report.

- Upon reviewing our latest valuation report, Toast's share price might be too optimistic.

Key Takeaways

- Get an in-depth perspective on all 201 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Interested In Other Possibilities? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARX

Accelerant Holdings

Accelerant Holdings, together with its subsidiaries, operate a data-driven risk exchange that connects selected specialty insurance underwriters with risk capital partners.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026