- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

A Look at Broadcom (AVGO) Valuation as Wall Street Optimism Grows on AI Partnerships and Cloud Deals

Reviewed by Simply Wall St

Broadcom (AVGO) caught Wall Street’s attention this week as several analysts pointed to its deepening partnerships in AI hardware. Recent updates include Google’s use of Broadcom-designed TPUs for its Gemini 3 AI model and new strategic cloud deployments.

See our latest analysis for Broadcom.

Building on these high-profile partnerships and product launches, Broadcom’s latest share price sits at $386.08. While the stock experienced a sharp pullback after recent highs, its momentum remains impressive, highlighted by a 27.7% 90-day share price return and a 131.9% total shareholder return over the past year. Both Wall Street and institutional investors are keeping a close watch for ongoing growth, especially as Broadcom expands its footprint across the AI and cloud computing landscape.

If Broadcom’s rapid ascent has you considering where opportunity might strike next, it’s a great time to explore other leaders in tech and AI using our See the full list for free.

With Broadcom’s shares surging on excitement around AI and cloud partnerships, the key question is whether the current price reflects these future growth drivers or if there is still room for investors to benefit from further upside.

Most Popular Narrative: 4.4% Undervalued

Broadcom's latest fair value, as calculated in the most followed narrative, sits slightly above its last close price. This setup reflects analyst conviction that recent AI-driven momentum is still not fully captured in the market price.

Broadcom is experiencing accelerating demand for custom AI accelerators (XPUs) from hyperscale and large language model customers, underscored by the addition of a major fourth customer and a strengthened backlog. This indicates robust multi-year revenue growth in the AI semiconductor segment.

How high could the story reach? The key to this narrative’s bold calculation lies in game-changing growth forecasts and a powerful shift in future profit margins. Want to see which building blocks are driving the fair value above market price? Uncover the projections analysts are betting on for Broadcom’s next chapter.

Result: Fair Value of $403.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks to watch, such as increased competition and concentration among AI customers, which could impact Broadcom’s projected growth trajectory.

Find out about the key risks to this Broadcom narrative.

Another View: Multiples Tell a Different Story

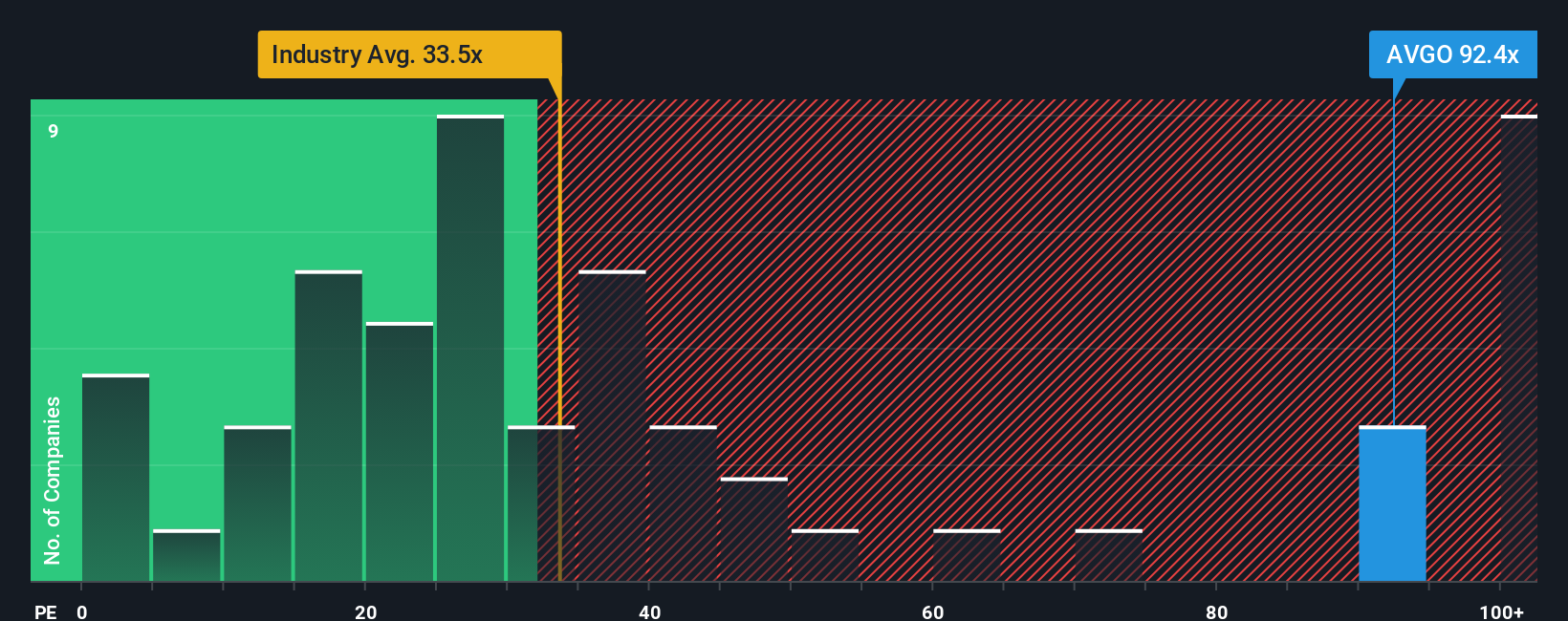

Looking through the lens of market pricing, Broadcom is currently trading at a price-to-earnings ratio of 96.9x, which is notably higher than both the US semiconductor industry average of 35.7x and the peer average of 55.6x. Even compared to its fair ratio of 66x, the stock appears pricey, suggesting investors are paying a premium for its anticipated growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If you want to challenge these perspectives or dig deeper into Broadcom’s fundamentals, it’s quick and easy to build your own outlook using our tools. Do it your way.

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Jump into exciting opportunities beyond Broadcom by using the Simply Wall Street Screener. Real investors use it to uncover tomorrow’s winners before the crowd moves in.

- Catch the momentum of next-generation technology by scanning these 25 AI penny stocks poised to transform industries with artificial intelligence breakthroughs.

- Access hidden bargains across the market and see which opportunities are being overlooked with our handpicked selection of these 929 undervalued stocks based on cash flows.

- Supercharge your portfolio’s earning power by checking out these 14 dividend stocks with yields > 3% offering consistently strong yields and proven cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026