- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (NasdaqGS:ARM) Valuation Spotlighted After Upbeat Earnings and AI Growth Momentum

Reviewed by Simply Wall St

Arm Holdings (NasdaqGS:ARM) shares moved higher after the company reported second-quarter results that beat forecasts and offered an upbeat outlook for the next quarter. Investors are taking notice as AI-driven growth is propelling the business forward.

See our latest analysis for Arm Holdings.

Arm Holdings has had a headline-making few months, with a wave of upbeat earnings, expansion plans into AI-focused chips, and new partnerships fueling investor interest. The stock’s year-to-date share price return stands at a solid 16.8%, while the total shareholder return over the past year is 7.02%. This reflects steady gains, but also recent volatility as the market digests both growth potential and new risks.

If the AI momentum at Arm has you curious, it could be a smart time to explore See the full list for free.

But with Arm’s shares not far from analyst price targets and a strong run driven by AI enthusiasm, the key question now is whether there is still room for upside or if future growth is fully priced in.

Most Popular Narrative: 113.9% Overvalued

According to jaikhom, the fair value for Arm Holdings is far below the current share price, highlighting a significant gap between market excitement and the company's fundamentals. This sets the stage for a deeper look at how momentum and risk are shaping valuations right now.

However, recent market action suggests investor sentiment has shifted decisively beyond fundamentals. With ARM now trading in the $120, $140 range, its implied earnings yield has fallen below that of the 10-year Treasury, a classic hallmark of speculative enthusiasm. This divergence marks what we define as the "bubble wave," a phase where momentum, narrative, and liquidity begin to dominate valuation discipline.

Curious what powers the narrative's aggressive stance? Hint: it hinges on sharply different profit assumptions and a contrarian discount rate. Discover the surprising framework and the one factor that could rapidly flip this story. Are you ready to see how it all adds up?

Result: Fair Value of $70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, better-than-expected earnings delivery or a sudden shift in interest rates could quickly challenge the current narrative of overvaluation.

Find out about the key risks to this Arm Holdings narrative.

Another View: Comparing Valuation Multiples

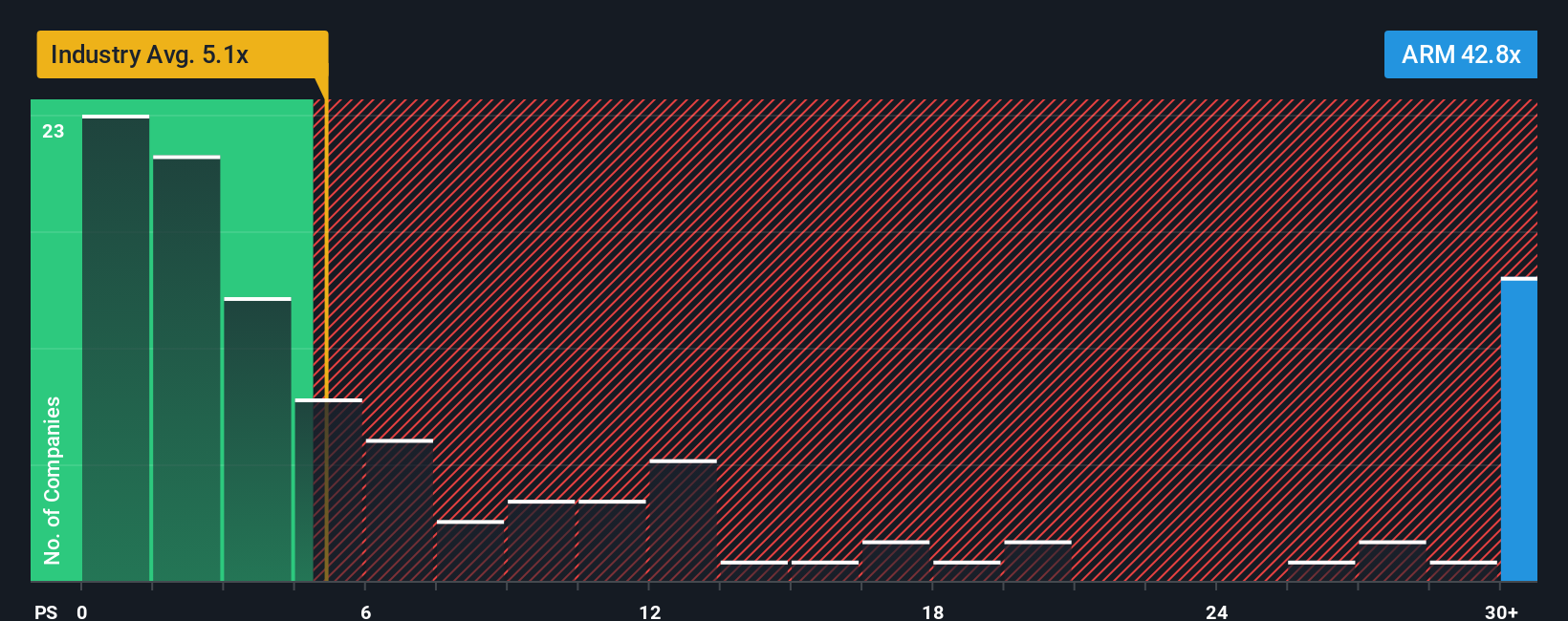

Taking a different angle, some investors compare Arm’s share price to its revenue. Currently, Arm trades at 36 times its annual revenue. This is far higher than the US semiconductor industry average of just 4.8 times, or even its peer average of 6.8 times, suggesting a premium price with little room for error.

The market’s fair ratio for Arm could settle around 44.4 times revenue. However, today’s multiple puts Arm in risky territory if growth projections fall short. Does this mean investors are leaning too far into future potential, or could new catalysts justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arm Holdings Narrative

If you have your own perspective or want to dig deeper into the numbers, it’s quick and easy to craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Arm Holdings.

Looking for More Smart Investment Ideas?

Seize your next big opportunity by scanning unique sectors and finding stocks that fit your style. If you wait, you could miss the trends everyone is talking about.

- Capture long-term wealth potential by reviewing these 15 dividend stocks with yields > 3% offering yields above 3% for steady, compounding returns.

- Tap into breakout innovators by scouting these 26 AI penny stocks powering the next surge in artificial intelligence technologies.

- Spot hidden bargains and get ahead of the crowd with these 872 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives