- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (ARM) Is Down 7.1% After Announcing AI Chip Plans and Q2 Earnings – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Arm Holdings recently reported its second quarter 2025 earnings, posting US$1.14 billion in sales and US$238 million in net income, with basic earnings per share rising to US$0.22.

- The company also revealed plans to develop its own first-party AI accelerator chips for data centers, signaling a significant expansion beyond its traditional licensing model.

- We'll examine how Arm Holdings' entry into first-party AI chip production could reshape its future growth outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Arm Holdings Investment Narrative Recap

Arm Holdings’ core appeal lies in the belief that it can sustain high earnings growth by expanding beyond mobile royalties, particularly with new products for AI data centers and the intelligent edge. The latest earnings beat and launch of first-party AI accelerator chips could strengthen this outlook and potentially accelerate the company’s most important short-term catalyst: growing AI-driven data center royalty streams. Still, the accelerated expansion into chip development increases operational complexity and heightens execution risk, which investors should keep in mind.

Among recent developments, Arm’s October 2025 collaboration with Astera Labs to simplify custom SoC design for AI infrastructure stands out. The relevance is especially high as both announcements signal Arm’s intent to capture more value from the data center opportunity, which remains a central catalyst for the stock as AI adoption continues to rise.

On the other hand, investors should also be aware of the growing risk that customers building more of their own chips could further concentrate Arm’s revenue base if...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings' forecasts point to $7.4 billion in revenue and $2.3 billion in earnings by 2028. Achieving this would require annual revenue growth of 21.5% and an increase in earnings of $1.6 billion from the current $699 million.

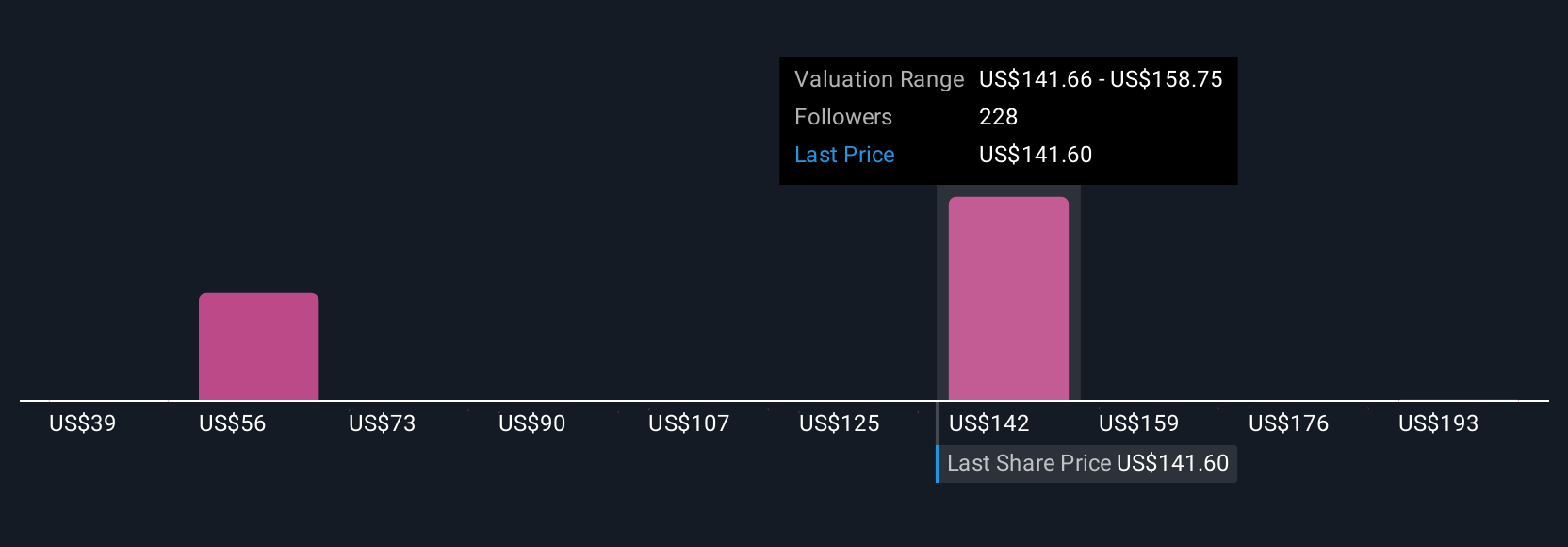

Uncover how Arm Holdings' forecasts yield a $157.52 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Some of the highest analyst estimates were expecting Arm’s revenue to hit US$8.6 billion by 2028, with earnings of US$2.8 billion, and see much greater potential for royalty and licensing growth from expanding data center share. These views are much more optimistic than the consensus and highlight just how much expectations for the business can differ depending on your assumptions. With recent events potentially changing the story, it’s worth considering a range of opinions.

Explore 17 other fair value estimates on Arm Holdings - why the stock might be worth less than half the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives