- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Does AMD’s Volatility After AI Partnerships Signal an Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Curious whether Advanced Micro Devices is a buy at current levels? You're not alone, as plenty of investors are asking if the recent price movements have left AMD undervalued, overhyped, or fairly valued.

- AMD’s stock has experienced notable fluctuations, gaining 6.7% in the past week, dropping 15.1% over the last month, but still up 80.3% year-to-date and 58.6% over the past year.

- Recent headlines highlighting AMD's partnerships in AI and major technology companies, along with competitive developments in the semiconductor industry, have fueled investor interest and market volatility. These stories reflect the ongoing narrative that AMD holds a prominent position in sectors that continue to drive market attention and uncertainty.

- On a value basis, AMD currently scores 2 out of 6 for undervaluation checks, suggesting that there is more to consider than just the surface-level numbers. Stay with us as we explore popular valuation methods, and look ahead for an approach that goes beyond traditional metrics.

Advanced Micro Devices scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is designed to estimate a company’s intrinsic value by projecting its future cash flows and then discounting those cash flows back to their present value. This method is widely used to gauge what a company is truly worth based on its ability to generate cash over time.

For Advanced Micro Devices, the latest reported Free Cash Flow stands at approximately $5.57 billion. According to analyst estimates and projections, AMD’s Free Cash Flow is expected to expand significantly, reaching around $30.9 billion by the end of 2029. While analyst estimates directly support the next five years, further cash flow growth beyond that point is extrapolated using typical industry assumptions.

Based on this methodology, AMD’s intrinsic value is estimated at $399.95 per share. With the DCF suggesting the stock is trading at a 45.6% discount to its fair value, the numbers indicate AMD is currently undervalued according to this cash flow-based approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Micro Devices is undervalued by 45.6%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Advanced Micro Devices Price vs Earnings

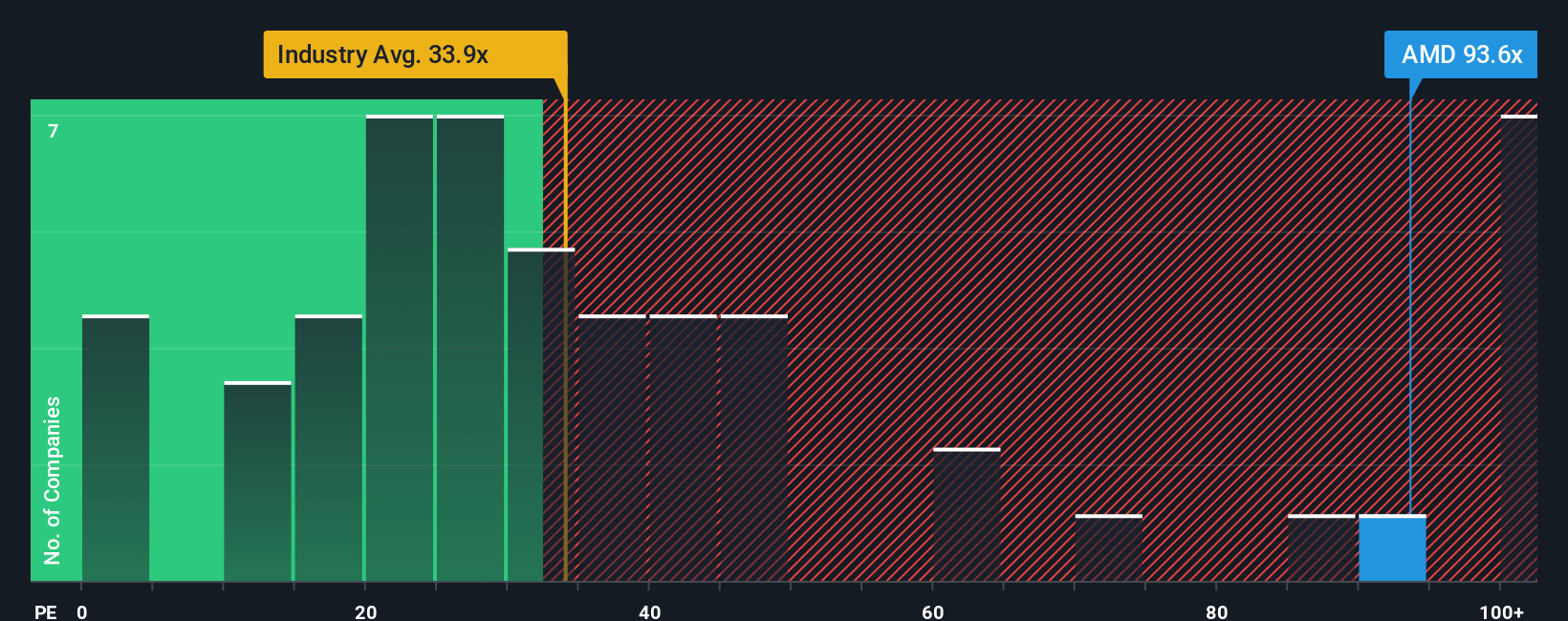

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies such as Advanced Micro Devices. It offers a straightforward way to gauge how much investors are currently willing to pay for each dollar of earnings generated by the company. Generally, a higher PE ratio reflects strong growth expectations or lower perceived risk, while a lower ratio may indicate subdued outlooks or higher risk.

At present, AMD trades at a PE ratio of 113.1x, which is notably higher than the semiconductor industry average of 36.1x and the peer average of 66.8x. This premium reflects the market's optimism about AMD's growth prospects and competitive position, especially given recent momentum in AI and high-performance computing.

Simply Wall St's “Fair Ratio” provides a more individualized benchmark, integrating factors such as AMD's earnings growth, profit margins, industry dynamics, market capitalization, and specific risk profile. This nuanced approach avoids the pitfalls of broad industry or peer comparisons and offers a fairer assessment of what an appropriate PE ratio for AMD should be given its unique circumstances.

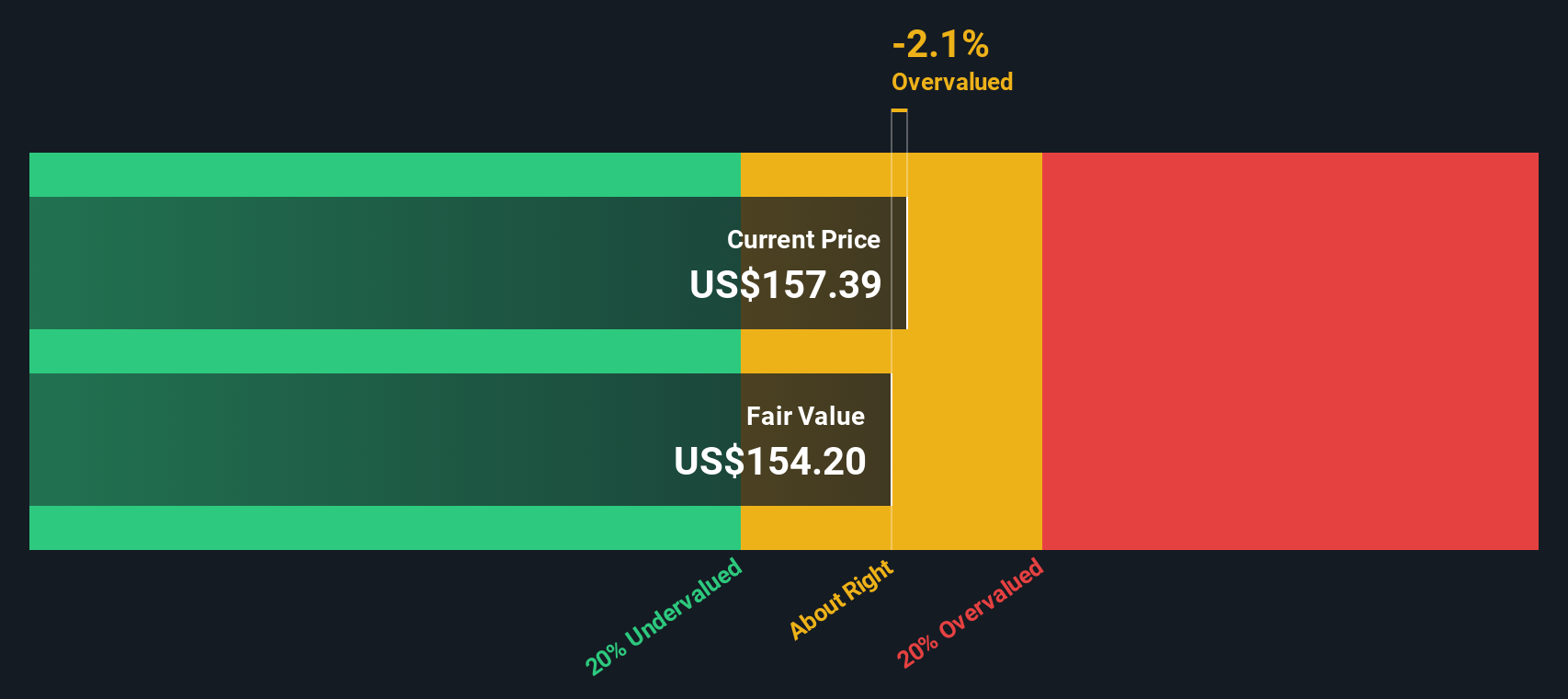

Currently, AMD's Fair Ratio is estimated at 63.7x. Comparing this with the company's actual PE ratio of 113.1x suggests that the stock is trading above what would be considered justified by these tailored fundamentals, indicating AMD is overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a user-driven story that combines your personal insight about a company, your estimates for its future growth, and your sense of fair value, all in one simple statement. Rather than relying solely on static ratios or external analyst targets, Narratives allow you to link Advanced Micro Devices’s real-world business story to concrete financial forecasts and a clear estimate of what the stock should be worth.

Narratives are easy to use and accessible on Simply Wall St’s Community page, where millions of investors share and update their views. They empower you to make buy or sell decisions by directly comparing your Narrative’s Fair Value to the current market price. This gives you a sense of whether the market is missing something or reflecting your outlook already. Because Narratives are linked to up-to-date models, new information such as earnings releases or major news automatically refreshes your fair value and risk factors.

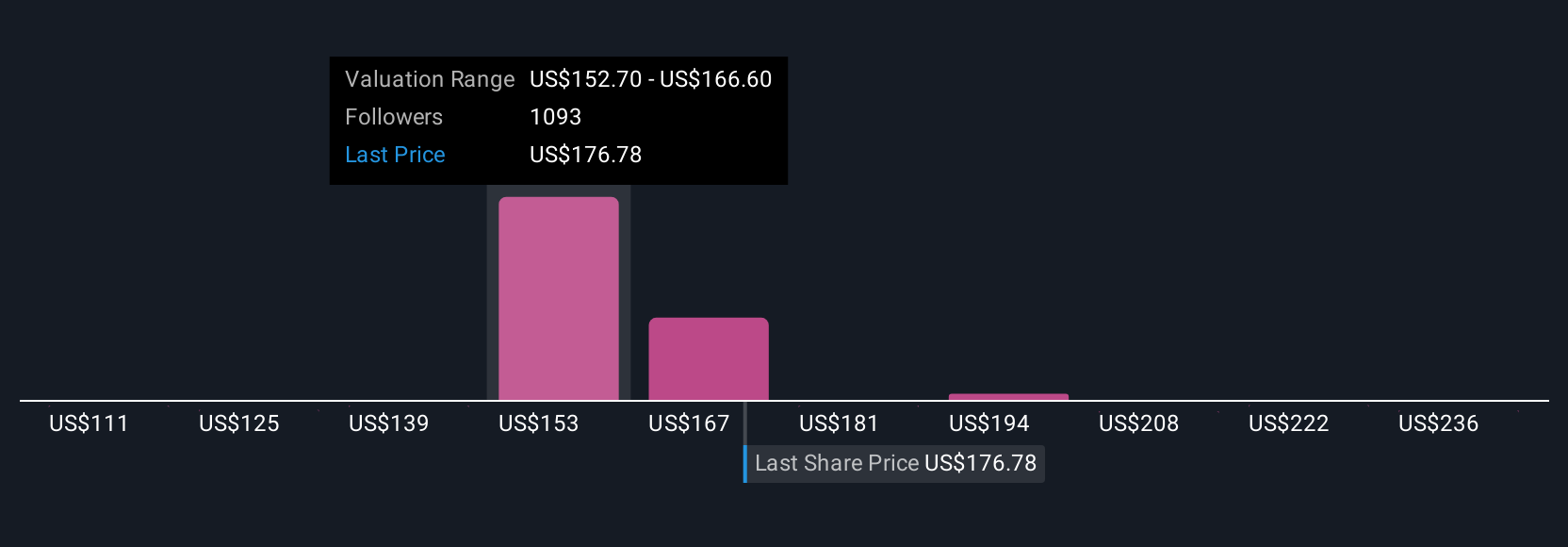

For example, one AMD investor focused on surging AI revenue may view the stock’s fair value as high as $290, while another concerned about export restrictions and competition could set it as low as $137. Different stories and different numbers are all driven by the same simple tool.

For Advanced Micro Devices, here are previews of two leading Advanced Micro Devices Narratives: 🐂 Advanced Micro Devices Bull CaseFair Value: $277

Currently 21.5% overvalued compared to this fair value

Revenue Growth: 32.9%

- Analysts expect AI and data center momentum, as well as strategic partnerships, to drive strong revenue and margin expansion for AMD.

- Forecasts anticipate robust annual revenue growth and margin improvement, but current market optimism may be embedding challenging assumptions on competitive share gains and international expansion.

- Catalysts such as new product launches and expanded AI/Cloud adoption could deliver upside. However, risks include execution headwinds, tougher competition, and regulatory changes.

Fair Value: $194

Currently 12.2% overvalued compared to this fair value

Revenue Growth: 18.8%

- AMD faces intense competition from Nvidia and Intel, especially in AI and data center markets, creating uncertainty around future market share expansion.

- Cyclicality in the semiconductor industry, global economic headwinds, and reliance on external manufacturers such as TSMC present ongoing risks to growth and supply chain stability.

- While AMD offers long-term growth prospects, conservative investors may wish to monitor the execution of AI and data center strategies before committing in a volatile market environment.

Do you think there's more to the story for Advanced Micro Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026