- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (AMD) Exits Russell Top 50 Index Amid Chip Stock Surge

Reviewed by Simply Wall St

Advanced Micro Devices (AMD) reported a notable 76% increase in its share price over the last quarter, coinciding with significant partnerships and strategic alliances that potentially buttressed this performance. Oracle's deployment of AMD's Instinct MI355X GPUs may have enhanced AMD's appeal amid its expanding influence in AI and cloud sectors. However, AMD's exit from the Russell Top 50 Index presented a contrast against broader rallying of chip stocks spurred by a strong tech market. While the market remained relatively flat, AMD maintained distinct growth, buoyed by extensive product innovations and collaborative ventures in AI and cloud computing.

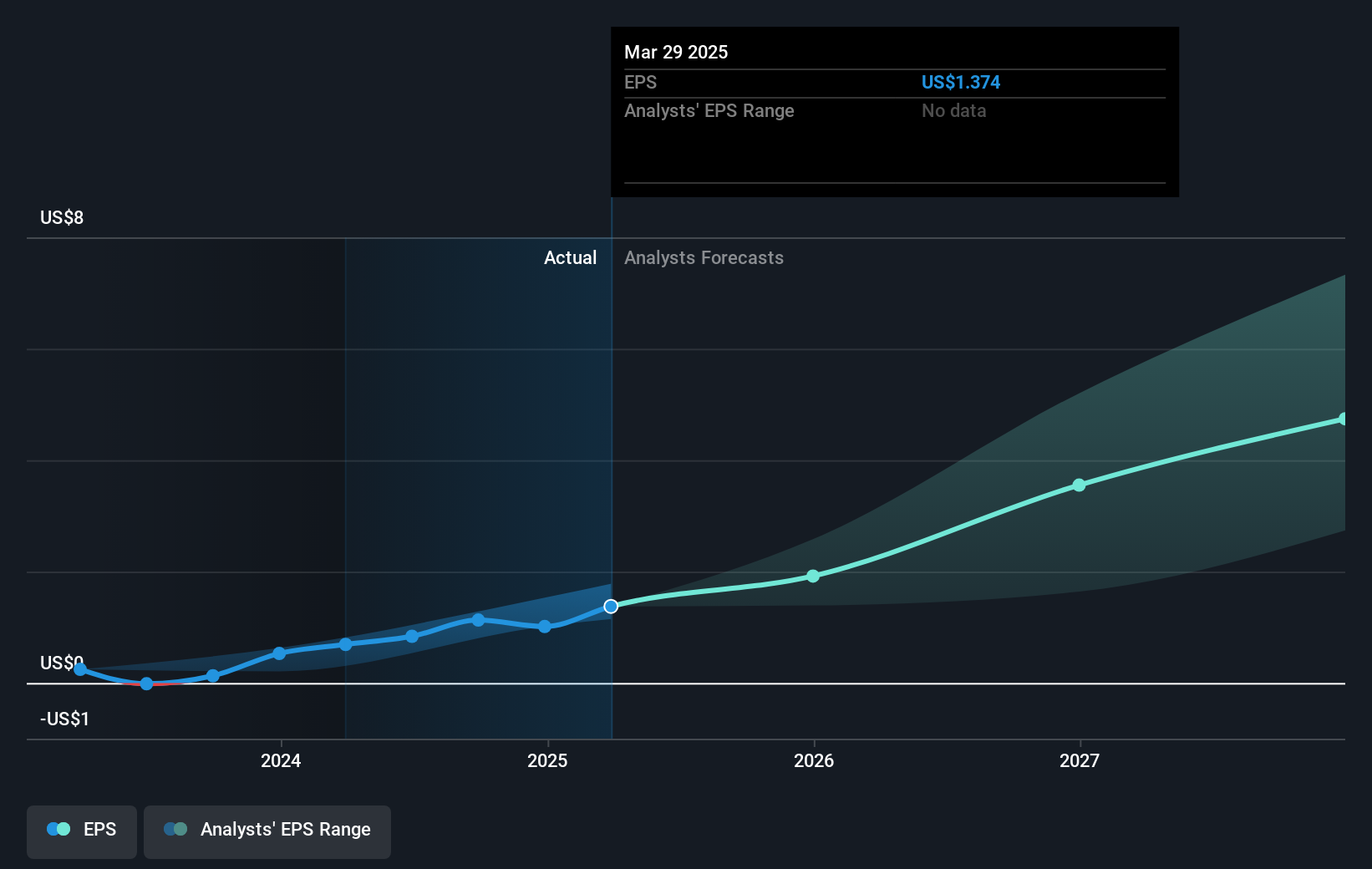

The recent partnerships and strategic alliances highlighted in the introduction could support AMD's narrative of diversified and resilient growth driven by AI and cloud sectors. These factors might bolster revenue and earnings forecasts, particularly given the expansion in AI and data center demand. However, AMD's removal from the Russell Top 50 Index and its share price's premium relative to the consensus price target suggest that the market may have high expectations, which could influence future valuation assessments. With the current share price at US$155.61, compared to a consensus price target of US$138.69, the stock is trading approximately 11% above the expected fair value. This indicates that analysts may have a cautious outlook on the stock’s future performance given its current valuation.

Over the past five years, AMD's total shareholder returns, including share price appreciation and dividends, amounted to 173%, showcasing significant growth. However, in the last year, AMD underperformed the US Semiconductor industry, which returned 20.5%, and it also fell short of the broader US market return of 10%. This performance discrepancy might be attributed to the intensified competition and regulatory challenges highlighted in the bearish narrative. The potential revenue growth may be limited by these factors, with implications for earnings volatility. AMD's assumption from bearish analysts of 10.2% annual revenue growth and earnings nearing US$4.5 billion by 2028 underscores a more conservative outlook amid these industry headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives