- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Ambarella (AMBA): Revisiting Valuation After Upgraded 2026 Revenue Outlook and Narrower Quarterly Loss

Reviewed by Simply Wall St

Ambarella (AMBA) just delivered a quarter that combined faster sales growth with a slimmer loss, and then immediately raised its full year revenue outlook to a record range, which is what has investors paying attention.

See our latest analysis for Ambarella.

The latest earnings beat and upgraded guidance come after a choppy spell, with a 30 day share price return of minus 14.34% and a five year total shareholder return of minus 16.23%. This positive surprise could mark a turn in sentiment.

If Ambarella’s update has you thinking about what else could rerate on stronger growth signals, it might be a good time to explore high growth tech and AI stocks.

With revenue accelerating, losses narrowing and the share price still sitting at a steep discount to analyst targets, the big question now is simple: Is Ambarella undervalued, or is the market already pricing in that future growth?

Most Popular Narrative Narrative: 24.5% Undervalued

With Ambarella last closing at $74.10 against a narrative fair value near $98, the current gap assumes a very different future than the market does.

The company's unified architecture and software development platform enable efficient support and rapid customer onboarding across a growing array of applications, which lowers incremental operating expenses and strengthens operating leverage as revenue grows. The robust pipeline of new product launches and design wins in autonomous mobility (including automotive safety, ADAS, and telematics) are expected to realize significant long term, high volume opportunities, improving multi year revenue visibility and supporting future revenue inflection points as OEM decision cycles play out.

Curious how steady double digit revenue growth, margin expansion, and a punchy future earnings multiple all combine into that upside case? The full narrative unpacks the exact assumptions, the timing of the expected inflection, and why future profitability is treated more like a mature chip leader than a turnaround story.

Result: Fair Value of $98.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated IoT exposure and slower than hoped automotive design wins could easily derail the upbeat growth and valuation assumptions embedded in this narrative.

Find out about the key risks to this Ambarella narrative.

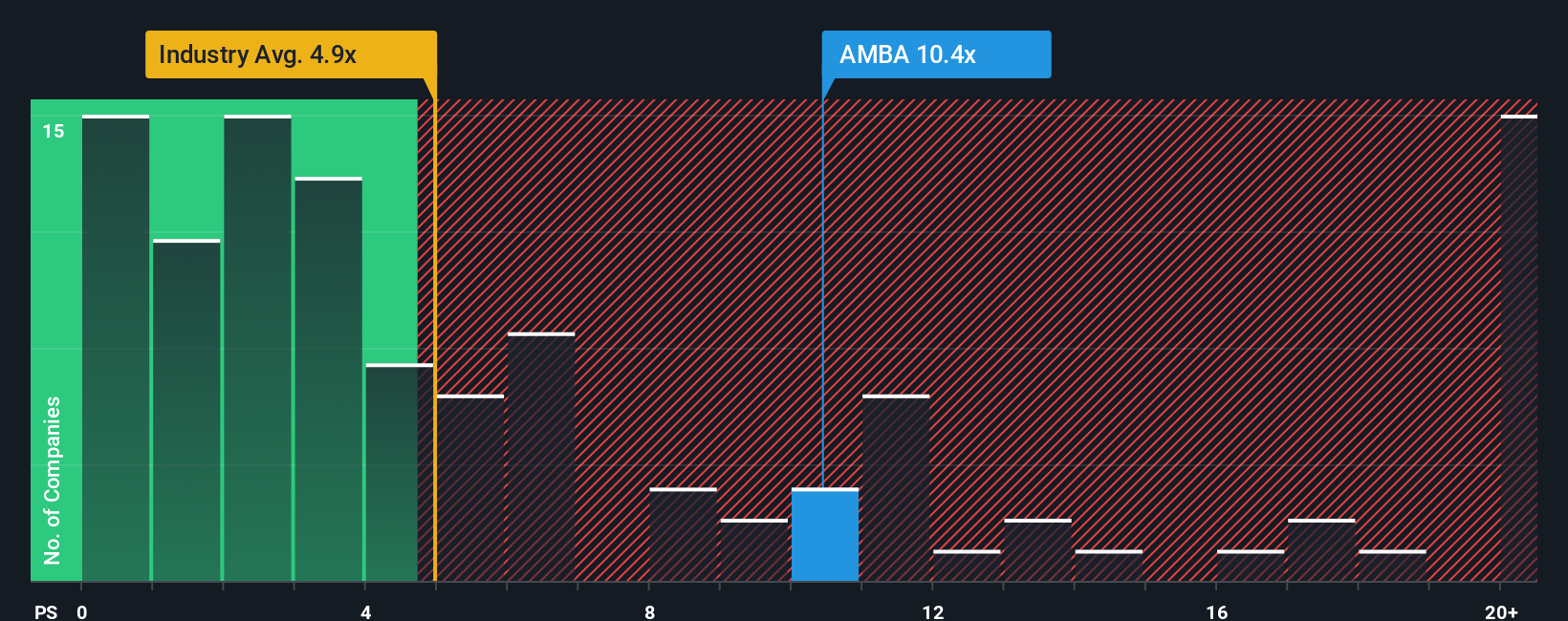

Another View: Market Ratios Flash a Caution Signal

Our price to sales lens paints a tougher picture. Ambarella trades at 8.5 times sales versus a 5.5 times industry average, 5.6 times for peers, and a 5.4 times fair ratio. This suggests the market may already be paying up for growth that still needs to arrive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ambarella Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Ambarella research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, tap into fresh opportunities on Simply Wall St's powerful screener so you are not leaving potential winners on the table.

- Capture hidden value by targeting quality businesses trading below intrinsic worth using these 911 undervalued stocks based on cash flows that highlight strong cash flow potential.

- Ride breakthrough innovation by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Strengthen your passive income stream by focusing on these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026