- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB) Valuation Check After New NVIDIA NVLink Fusion Connectivity Strategy

Reviewed by Simply Wall St

Astera Labs (ALAB) just laid out plans for custom connectivity solutions built around NVIDIA’s NVLink Fusion and hyperscaler collaborations, a strategic move that could deepen its role inside next generation AI data centers.

See our latest analysis for Astera Labs.

The latest announcement lands after a choppy stretch, with the share price returning about 15 percent over the past month and 20 percent over the last quarter, yet total shareholder return for the year still points to solid upside momentum rather than a breakdown.

If Astera’s AI connectivity story has your attention, it is a good time to see how it stacks up against other chip names and explore high growth tech and AI stocks as potential next wave beneficiaries.

With revenue still growing near 30 percent annually and the stock trading roughly 30 percent below consensus targets despite recent volatility, is Astera Labs quietly undervalued here, or are investors already paying up for tomorrow’s AI growth?

Most Popular Narrative: 23.1% Undervalued

Against a last close of $152.51, the most followed narrative sees Astera Labs’ fair value materially higher, hinging on aggressive earnings expansion and richer margins.

Strong early engagement with hyperscalers and AI platform providers on open, interoperable standards like UALink (which are still in the early adoption phase with projected ramp in 2027 and beyond) enables Astera Labs to capture the industry's shift toward open, multi-vendor AI Infrastructure 2.0, ensuring exposure to significant long-term market expansion and incrementally larger addressable markets, positively impacting revenue growth rates and future margin potential as adoption accelerates.

Curious how this story turns into a double digit upside case? The narrative leans on compounding revenue, fatter margins, and a bold future earnings multiple. Want the full playbook behind that fair value? Read on to see which assumptions really move the needle.

Result: Fair Value of $198.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Astera’s dependence on hyperscaler AI capex and rising competition in interconnect standards could quickly challenge the long term growth assumptions behind this upside case.

Find out about the key risks to this Astera Labs narrative.

Another Angle on Valuation

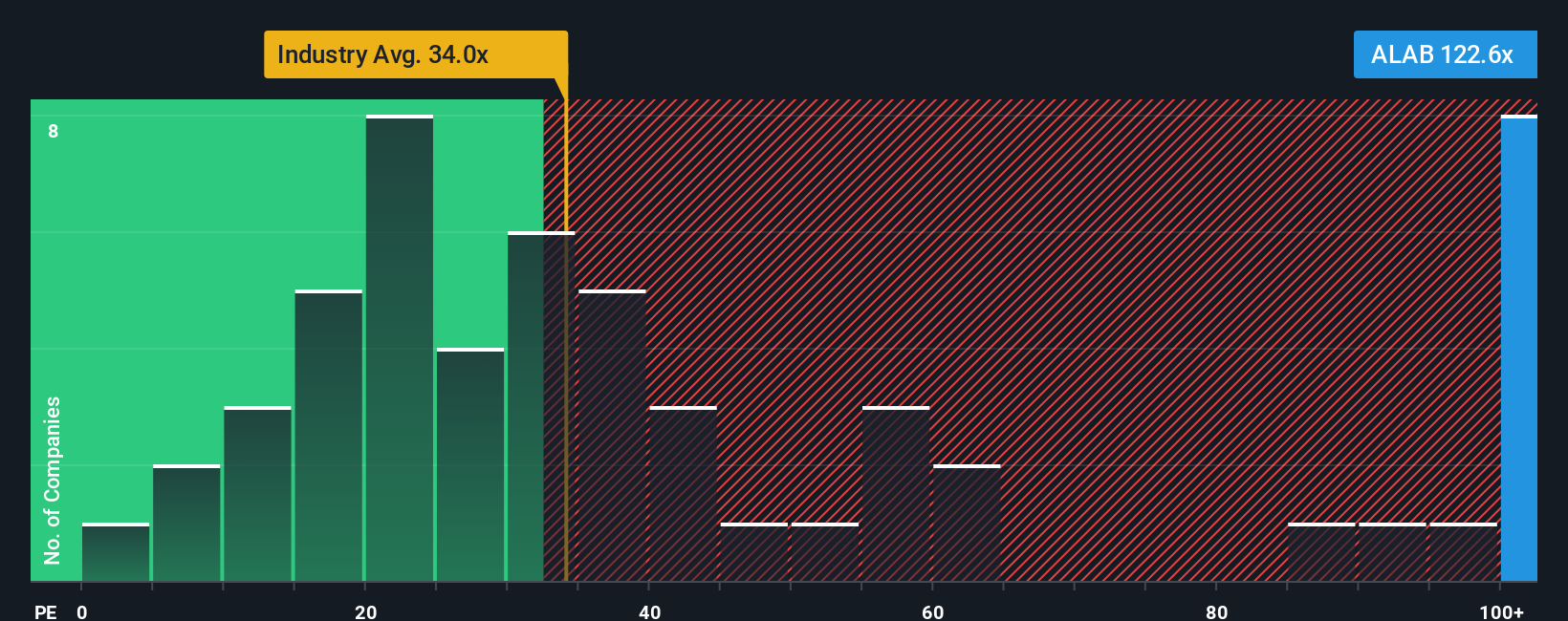

Analysts see upside to $198.32, but the current 129.5x price to earnings ratio versus a peer average near 40x and a fair ratio of 65.4x signals a rich setup. If growth or margins wobble, how quickly could the market re-rate Astera toward that lower multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astera Labs Narrative

If you see Astera’s prospects differently or want to test your own thesis against the numbers, build a personalized view in minutes, Do it your way.

A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work and use the Simply Wall St Screener to uncover focused opportunities, instead of guessing what to buy next in this fast moving market.

- Target overlooked opportunities with pricing power by reviewing these 909 undervalued stocks based on cash flows that still show room for meaningful upside based on future cash flows.

- Ride the structural shift toward automation and intelligence by scanning these 26 AI penny stocks positioned to benefit from accelerating adoption across industries.

- Strengthen your income strategy by pinpointing these 15 dividend stocks with yields > 3% that can help anchor returns when growth stories stumble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026