- United States

- /

- Industrials

- /

- NYSE:MMM

3 US Stocks Trading At Estimated Discounts Of Up To 37.9%

Reviewed by Simply Wall St

The U.S. stock market has recently exhibited mixed performance, with the Dow Jones Industrial Average reaching record highs while the Nasdaq Composite and S&P 500 faced declines. Amid this volatility, discerning investors are on the lookout for undervalued stocks that could offer significant upside potential. In such a fluctuating environment, identifying stocks trading at estimated discounts can present compelling opportunities for growth and value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Afya (NasdaqGS:AFYA) | $17.30 | $33.98 | 49.1% |

| Heartland Financial USA (NasdaqGS:HTLF) | $55.34 | $109.44 | 49.4% |

| California Resources (NYSE:CRC) | $53.22 | $103.93 | 48.8% |

| Progress Software (NasdaqGS:PRGS) | $58.26 | $115.14 | 49.4% |

| Fluence Energy (NasdaqGS:FLNC) | $18.30 | $35.76 | 48.8% |

| Envela (NYSEAM:ELA) | $4.84 | $9.54 | 49.3% |

| EVERTEC (NYSE:EVTC) | $34.15 | $66.61 | 48.7% |

| WEX (NYSE:WEX) | $190.62 | $379.36 | 49.8% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $493.35 | $962.34 | 48.7% |

| Sea (NYSE:SE) | $77.52 | $151.23 | 48.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Analog Devices (NasdaqGS:ADI)

Overview: Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products globally with a market cap of $112.79 billion.

Operations: The company generates $9.70 billion from designing, developing, manufacturing, and marketing a broad range of integrated circuits.

Estimated Discount To Fair Value: 11.3%

Analog Devices is trading at US$230.89, below its estimated fair value of US$260.24, indicating potential undervaluation based on cash flows. Despite significant earnings growth forecasts of 25.7% per year, recent financial results show a decline in sales and net income compared to the previous year. The company has also engaged in strategic alliances and share buybacks, which could impact future cash flow positively but faces challenges with lower profit margins and insider selling trends.

- Upon reviewing our latest growth report, Analog Devices' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Analog Devices' balance sheet health report.

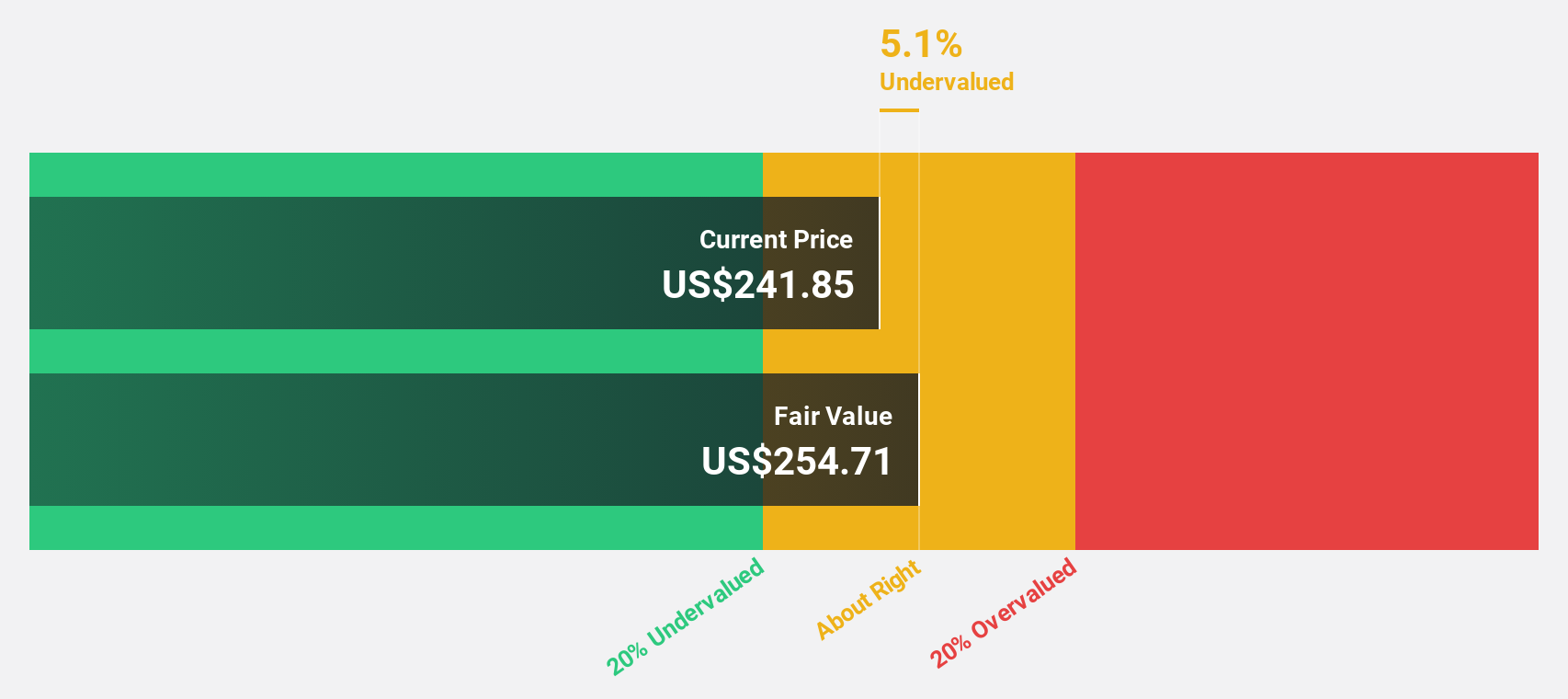

Nutanix (NasdaqGS:NTNX)

Overview: Nutanix, Inc. offers an enterprise cloud platform across multiple regions including North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa with a market cap of approximately $12.90 billion.

Operations: Nutanix generates revenue through its enterprise cloud platform across various regions, including North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

Estimated Discount To Fair Value: 20.8%

Nutanix, trading at US$62.91, is undervalued by more than 20% based on its estimated fair value of US$79.48. Despite a net loss of US$126.1 million for Q4 2024, revenue increased to US$547.95 million from the previous year’s US$494.21 million. Earnings are expected to grow 90.1% annually over the next three years, with profitability forecasted within that period, indicating strong future cash flows despite recent shareholder dilution and negative equity concerns.

- Our expertly prepared growth report on Nutanix implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Nutanix.

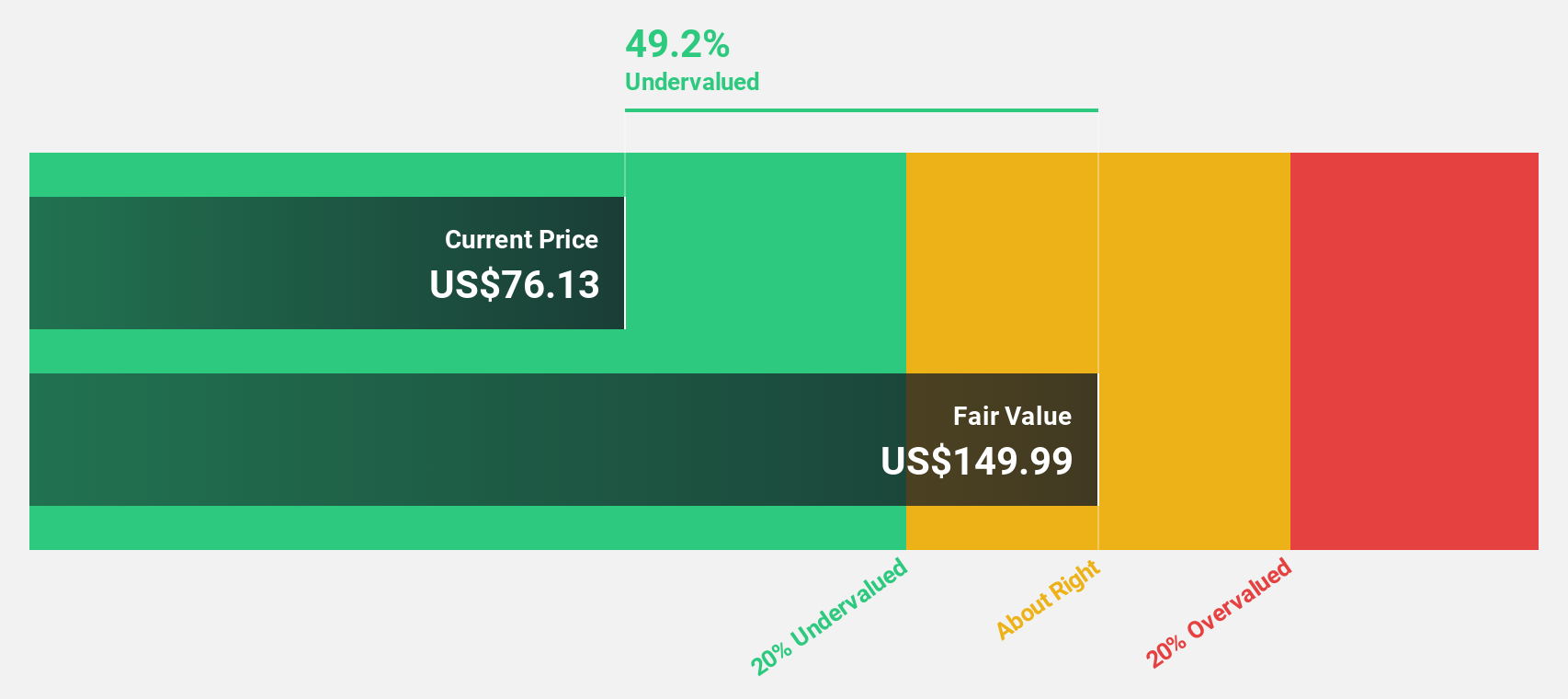

3M (NYSE:MMM)

Overview: 3M Company offers a range of diversified technology services both in the United States and internationally, with a market cap of $72.30 billion.

Operations: The company's revenue segments include Consumer at $4.94 billion, Safety and Industrial at $10.90 billion, and Transportation and Electronics at $8.51 billion.

Estimated Discount To Fair Value: 37.9%

3M, trading at US$132.91, is significantly undervalued with an estimated fair value of US$214.07. Despite high debt levels and a forecasted revenue decline of 5.4% per year over the next three years, earnings are expected to grow 22% annually, outpacing the market average of 15%. Recent profitability and a high future return on equity (71.4%) further highlight its potential for strong cash flows despite current dividend coverage concerns.

- The growth report we've compiled suggests that 3M's future prospects could be on the up.

- Take a closer look at 3M's balance sheet health here in our report.

Make It Happen

- Explore the 192 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.