- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

A Look at ACM Research (ACMR) Valuation Following Strong Q3 Results and AI Packaging Advances

Reviewed by Simply Wall St

ACM Research (ACMR) just delivered its third-quarter results, reporting higher sales and net income compared to last year. Alongside an earnings update, management highlighted gains in AI chip packaging technology and provided updated full-year revenue guidance.

See our latest analysis for ACM Research.

ACM Research’s momentum has caught the market’s attention, with a 25.94% share price return over the past 90 days and a remarkable year-to-date gain of 102.38%. This reflects growing optimism around its AI advancements and resilient fundamentals. Taking a longer view, the company’s 1-year total shareholder return stands at 71.90%, and its three-year total return is an impressive 245.88%. This confirms that recent volatility has not undercut strong underlying performance.

If ACM’s surge has you thinking more broadly about potential, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With share prices soaring and earnings on the upswing, investors now face a crucial question: is ACM Research’s recent success fully reflected in its valuation, or does today’s price leave room for further upside?

Most Popular Narrative: 22.8% Undervalued

With ACM Research’s fair value pegged at $40.81 in the most popular narrative, the last close of $31.51 leaves room for sizeable upside if the narrative holds true. This gap sets up a high-stakes debate on whether analyst forecasts can deliver.

Advanced digitalization and AI adoption are driving a surge in demand for next-generation semiconductor manufacturing, with ACM's differentiated cleaning and plating solutions (such as its proprietary N2 bubbling and SPM tools) positioned to capture increased orders as foundries invest in more complex 3D NAND, DRAM, and logic nodes, supporting long-term revenue growth.

Want to know what’s fueling these bold fair value calculations? The secret is in ambitious growth targets and a future profit multiple that challenges the industry standard. Find out which blockbuster financial forecasts are the bedrock of this price estimate. If you dare to dig beneath the headline value, more details await.

Result: Fair Value of $40.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, export restrictions and over-reliance on China remain real risks. These factors could disrupt ACM's growth trajectory if global conditions shift.

Find out about the key risks to this ACM Research narrative.

Another View: SWS DCF Model Shows a Different Story

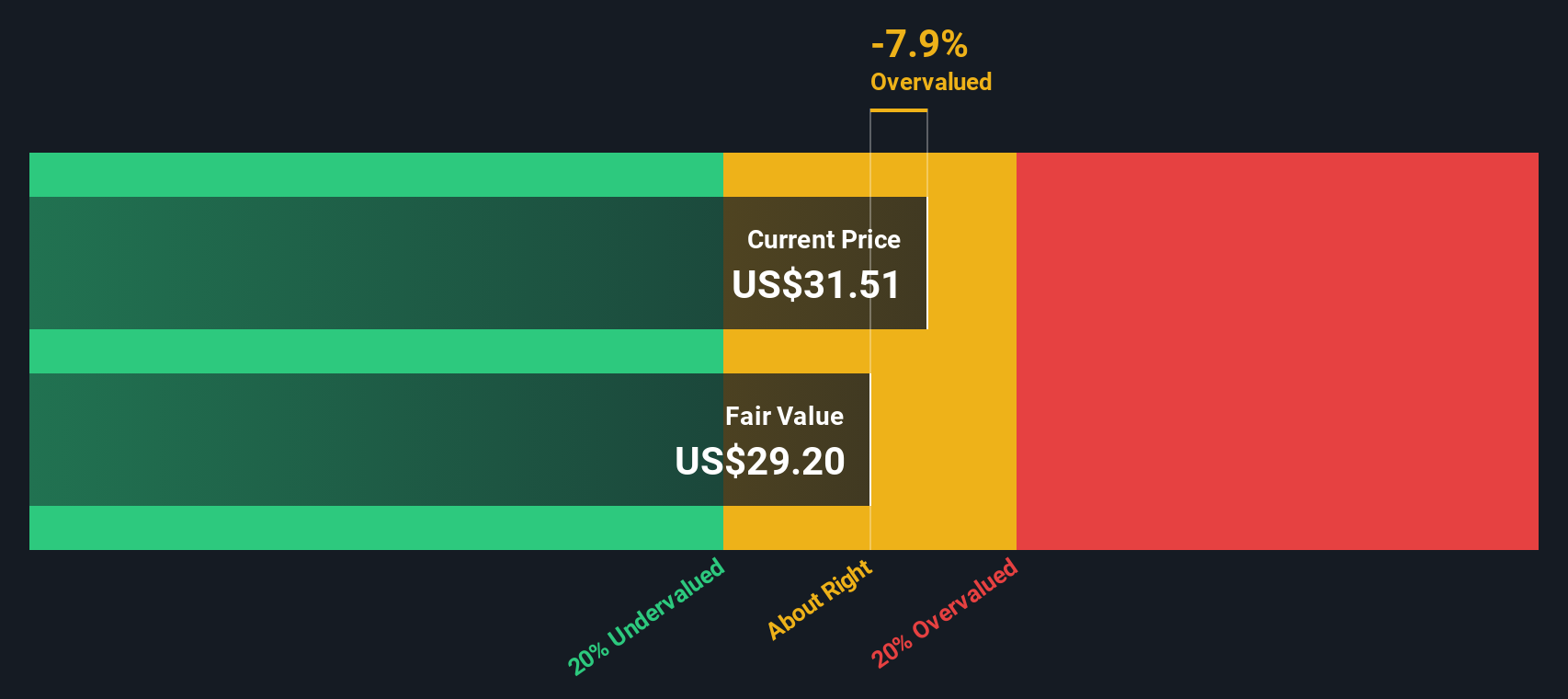

While the popular narrative values ACM Research as undervalued based on analyst targets, our SWS DCF model estimates fair value at $29.36. Since shares currently trade above this, the DCF approach suggests ACM could be overvalued and challenges the notion of easy upside. Which model best fits your outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ACM Research for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ACM Research Narrative

If the consensus view doesn’t fit your perspective or you like to follow your own path, you can dig into the numbers and craft a narrative in just minutes. Do it your way

A great starting point for your ACM Research research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock smarter opportunities and get ahead of trends by zeroing in on stocks that match your goals. Let Simply Wall Street’s tools show you where the action is.

- Tap into tomorrow’s market potential by starting with these 26 quantum computing stocks for leading innovations in computing, security, and next-generation processing breakthroughs.

- Generate passive income streams by reviewing these 16 dividend stocks with yields > 3% to find healthy returns and support your long-term financial plan.

- Take advantage of the demand for intelligent automation with these 25 AI penny stocks, which is powering advancements across every industry and reshaping the global landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives