- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

A Fresh Look at ACM Research (ACMR) Valuation After Breakthrough System Deliveries and Growing Market Adoption

Reviewed by Simply Wall St

ACM Research (ACMR) is drawing attention from investors after delivering its new Ultra Lith BK system to a global display panel manufacturer. The company has also provided the first commercial panel electrochemical plating tool for advanced packaging applications.

See our latest analysis for ACM Research.

ACM Research has been on a remarkable run, fueled in part by high-profile product launches that underscore its growing role in advanced chipmaking tech. While not every headline moves the needle, recent strong momentum is hard to ignore. The stock’s 1-year total shareholder return is up 94%, and its year-to-date share price return exceeds 114%, with a three-year total return of over 270%. Short-term dips have been rapidly offset by surges, and momentum still appears firmly positive as investors respond to tangible business wins.

If ACM’s surge caught your attention, it could be the ideal moment to expand your outlook and discover fast growing stocks with high insider ownership

But after such a stunning run and with analysts still expecting upside, the question remains: is ACM Research undervalued at current levels, or is the market already anticipating its next phase of aggressive growth?

Most Popular Narrative: 18.1% Undervalued

The most widely followed valuation puts ACM Research’s fair value at $40.81 per share, a notable premium to its last close of $33.41. This signals significant upside potential in the eyes of analysts. This perceived value gap reflects market optimism about ACM’s capacity to capture demand and scale its business.

Advanced digitalization and AI adoption are driving a surge in demand for next-generation semiconductor manufacturing. ACM's differentiated cleaning and plating solutions (such as its proprietary N2 bubbling and SPM tools) are positioned to capture increased orders as foundries invest in more complex 3D NAND, DRAM, and logic nodes, supporting long-term revenue growth.

Want to know what drives this bullish price target? The secret lies in aggressive growth expectations, stable profit margins, and a future multiple that is surprisingly conservative for this sector. Which numbers are shaping analyst conviction? Discover the narrative’s quantitative engine power when you dig into the full view.

Result: Fair Value of $40.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as heightened US-China export restrictions or slower than expected international adoption could swiftly challenge ACM’s strong growth narrative.

Find out about the key risks to this ACM Research narrative.

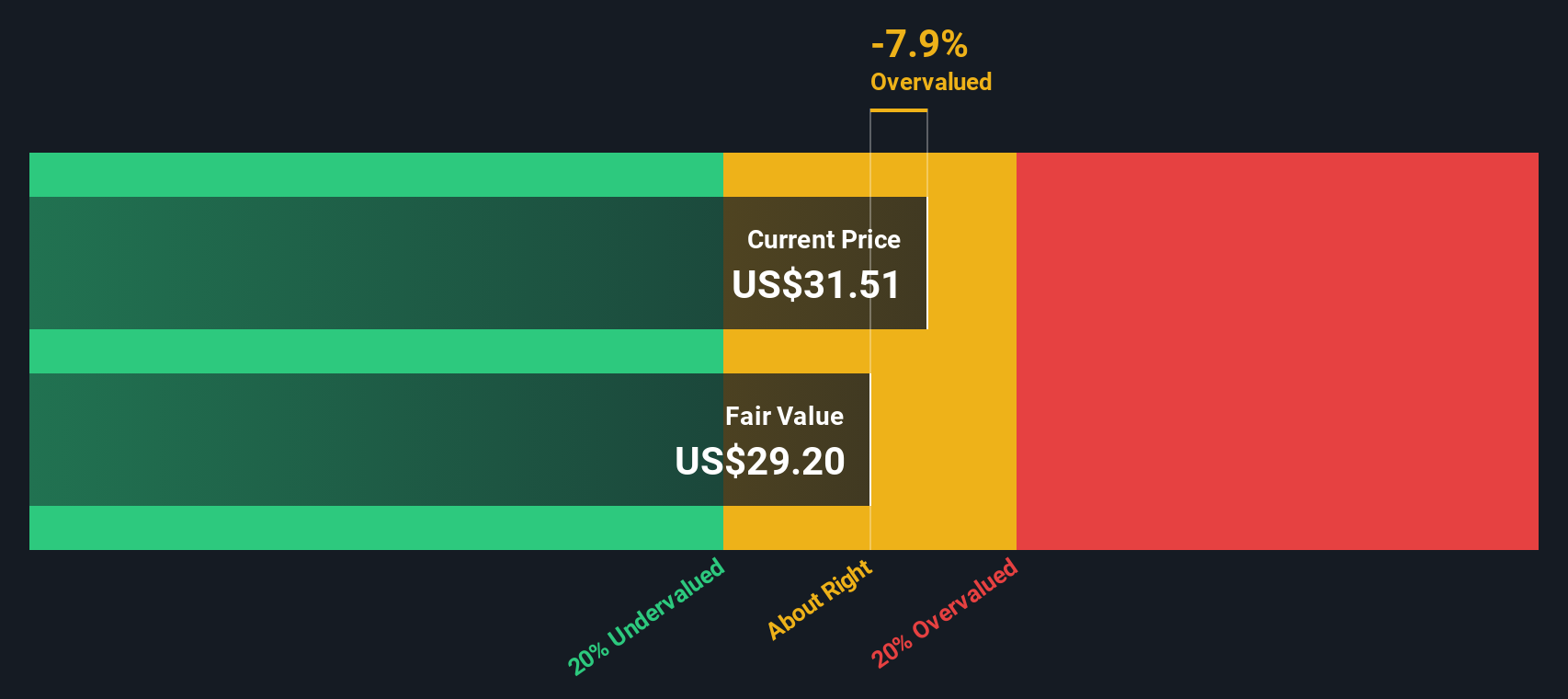

Another View: SWS DCF Model Offers a Different Take

For those looking at the numbers through a different lens, our SWS DCF model actually suggests ACM Research is trading above its estimated fair value of $29.98. This indicates a potential downside risk and challenges the idea that the market has yet to price in the company’s growth prospects. Which valuation approach do you trust to guide your next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ACM Research for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ACM Research Narrative

If you see the numbers differently or have your own view on ACM Research, you can explore the data and assemble your unique take in minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding ACM Research.

Looking for More Investment Ideas?

Give yourself an edge by tracking new trends and emerging market opportunities that others might overlook. Start here and take charge of your portfolio’s growth.

- Unlock potential by scanning for these 914 undervalued stocks based on cash flows to spot companies trading at attractive valuations and hidden gems before they break out.

- Tap into future tech gains when you connect with these 25 AI penny stocks that are fueling the next wave of artificial intelligence innovation and automation.

- Grow your income with these 15 dividend stocks with yields > 3% that reward shareholders above market average and offer steady cash flows for your investment goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026