- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

How Investors Are Reacting To Axcelis Technologies (ACLS) Weaker Q3 Results and Softer Q4 Outlook

Reviewed by Sasha Jovanovic

- Axcelis Technologies announced third quarter 2025 results showing revenue of US$213.61 million and diluted earnings per share of US$0.83, both declining from the prior year, and issued new fourth quarter guidance with expected revenue of around US$215 million and US$0.76 earnings per diluted share.

- This update highlights sustained business headwinds for Axcelis, with ongoing sequential declines in both revenue and profitability through year-end as reflected in their forward outlook.

- We'll examine how Axcelis Technologies' weaker quarterly results and cautious guidance impact its long-term investment narrative in the semiconductor industry.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Axcelis Technologies Investment Narrative Recap

To be an Axcelis Technologies shareholder, you need confidence in the long-term adoption of silicon carbide power devices across electric vehicles and industrial markets, which should drive demand for Axcelis’s ion implantation tools. The recent earnings and guidance update signals continued short-term softness, highlighting that muted bookings and customer digestion of prior investments remain the biggest immediate risk, while the anticipated ramp in silicon carbide adoption is still the key catalyst; this news reinforces rather than changes that dynamic.

An announcement that stands out is Axcelis's September launch of the Purion Power Series+ and GSD Ovation ES, underscoring its ongoing investment in next-generation technology. While recent results show slowing demand, these products reflect the company's effort to position itself for the expected uptick in advanced power device adoption and to capture premium market opportunities in the future.

In contrast, market participants should be aware of Axcelis's heavy customer concentration in China, especially as regulatory and export risks continue to...

Read the full narrative on Axcelis Technologies (it's free!)

Axcelis Technologies is projected to generate $836.1 million in revenue and $66.7 million in earnings by 2028. This outlook assumes a 2.3% annual revenue decline and a $91.8 million decrease in earnings from the current level of $158.5 million.

Uncover how Axcelis Technologies' forecasts yield a $97.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

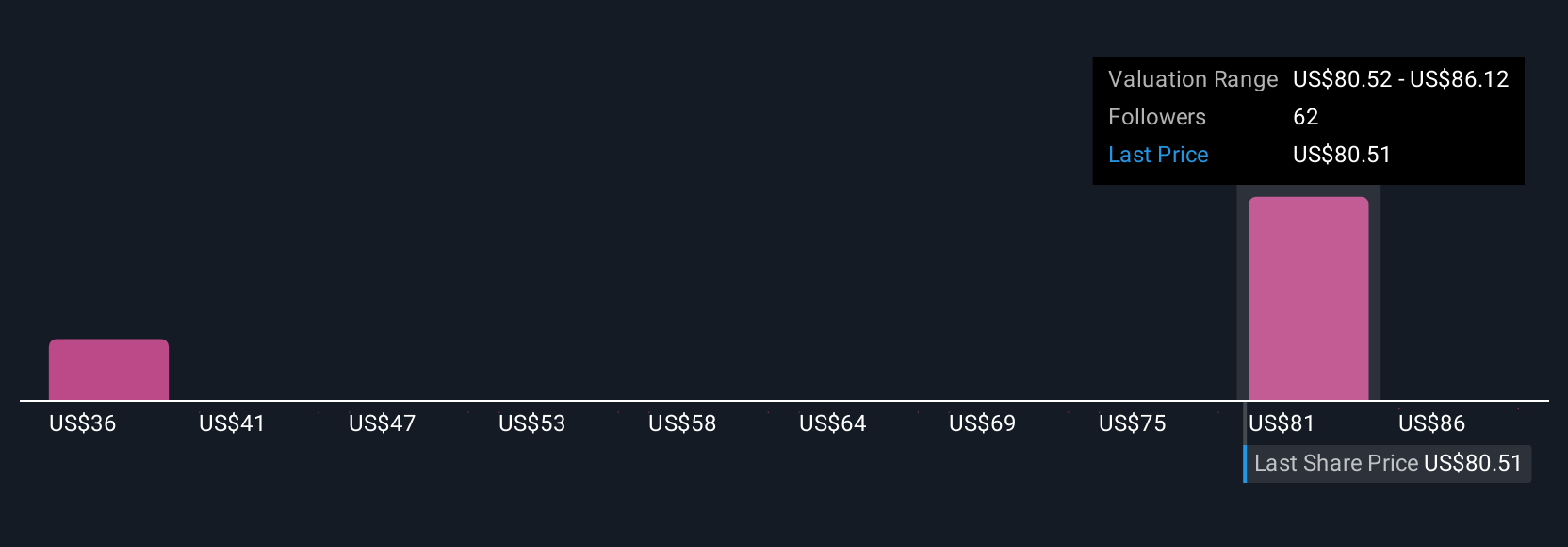

Three members of the Simply Wall St Community estimate fair value for Axcelis Technologies shares in a wide US$36 to US$97 range. Analysts caution, however, that prolonged muted bookings growth may weigh on near-term revenue, so explore multiple viewpoints before forming your own outlook.

Explore 3 other fair value estimates on Axcelis Technologies - why the stock might be worth as much as 17% more than the current price!

Build Your Own Axcelis Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Axcelis Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axcelis Technologies' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives