- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (ACLS): Evaluating Valuation After Recent Share Price Retreat

Reviewed by Simply Wall St

Axcelis Technologies (ACLS) shares retreated over the past month, dipping by 10%. Given the company’s recent performance, investors are reviewing key fundamentals and considering whether market sentiment aligns with the company's underlying value and growth potential.

See our latest analysis for Axcelis Technologies.

After a strong run earlier in the year, Axcelis Technologies has seen momentum shift as the 1-month share price return sits at -10.3%. Despite the recent slide, the stock still boasts a 13.3% year-to-date price gain and a remarkable 228% total shareholder return over five years. This shows that long-term investors have been well rewarded even as short-term sentiment fades.

If changing momentum in the chip sector has you curious, it could be the perfect moment to broaden your search and check out See the full list for free.

The big question now is whether Axcelis Technologies is trading below its true value or if its impressive long-term gains mean that future growth is already reflected in the current price. Is there still room for investors to profit, or has the market already taken into account what lies ahead?

Most Popular Narrative: 18% Undervalued

With a fair value estimate of $97 versus a last close of $79.56, the prevailing narrative points toward further upside built on ambitious financial expectations.

Ongoing R&D investments and next-generation Purion platform enhancements are driving increased customer engagement, particularly around advanced node processes (trench and super junction devices). These developments are enabling Axcelis to win share in premium market segments and are supporting future gross margin improvement.

Curious what powers this compelling valuation? The excitement centers on not just growth, but big margin shifts and bold long-term profit projections. The full narrative unpacks the surprise assumptions analysts are baking into their models, and the numbers may catch you off guard.

Result: Fair Value of $97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant dependence on Chinese customers and a slowdown in advanced product adoption could quickly change the outlook for Axcelis Technologies.

Find out about the key risks to this Axcelis Technologies narrative.

Another View: DCF Analysis Raises Questions

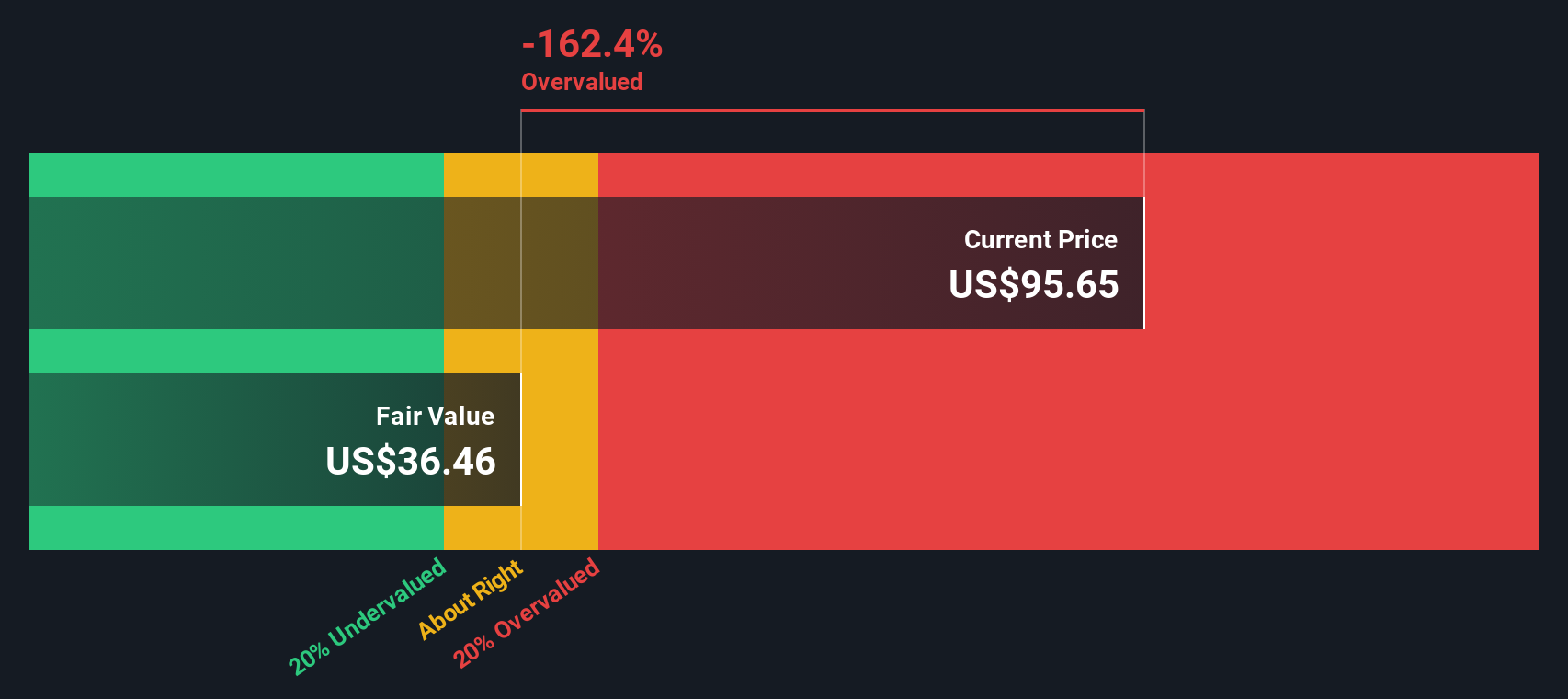

While analyst price targets hint at upside, the SWS DCF model tells a different story. According to this model, Axcelis Technologies is trading well above its fair value estimate of $36.16. This suggests the market may be too optimistic. Could this signal a valuation risk that is being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Axcelis Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Axcelis Technologies Narrative

If you see things differently or want to dig into the data yourself, you can craft your own take on Axcelis Technologies in just a few minutes with Do it your way.

A great starting point for your Axcelis Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let a single opportunity slip by. Tap into unique market trends and seize the advantage with these tailored stock ideas from Simply Wall Street’s powerful screener tools.

- Capture breakthrough potential with these 26 AI penny stocks, which are at the forefront of artificial intelligence innovation across multiple industries.

- Boost your portfolio’s stability by zeroing in on these 22 dividend stocks with yields > 3%, offering consistent yields and reliable income streams above 3%.

- Step ahead of the crowd and pinpoint hidden gems through these 840 undervalued stocks based on cash flows, based on strong cash flow signals and financial fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026